Rationale

This VIP proposes a new set of parameters for VAI based on this discussion.

References

- Operation Fix the Peg

- [VRC] Setting the PSM fees and reenabling VAI borrowings

- PROPOSAL: Deploy the VAI PEG Stability module and Supply Liquidity to PancakeSwap for the VAI/USDT Pair

- RWA Strategy - A first Proposal

- Proposal: Real-World Asset initiative

- The solution to re-peg VAI is coming

Summary

Increase the steepness of the interest rate curve of VAI to incentivize VAI close to $1.

Motivation

- Harden the peg by making it expensive to borrow VAI when the VAI price is low.

- Provide a better rate for borrowers when VAI is at $1.

Specification

Modification of this VIP:

-

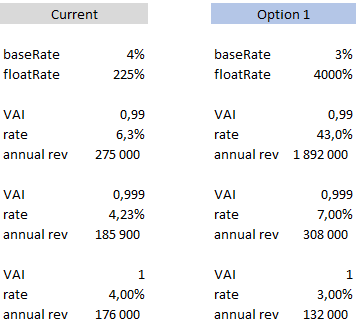

baseRate: 3% (from 4%) -

floatRate: 4000% (from 225%)

We provide below an exemple of the implication of the changes:

This VIP doesn’t enable VAI borrowings, this will be enabled in a following VIP contingent to having a significant healthy buffer in the VAI USDT PSM.

Risk Analysis

- Reduction of earnings if VAI stays at $1

- Increasing the VAI borrow rate might reduce VAI borrowings and TVL