Proposal: Real-World Asset initiative

Summary

A proposal to engage Steakhouse Financial to support Venus in its pursuit of Real-World Assets (RWAs), built in a considered fashion that prioritizes compliance.

Background

Real-world assets represent a significant opportunity for DeFi platforms to expand their reach and scale their operations. As noted in a recent Binance research report, the integration of RWAs has the potential to transform the DeFi landscape and attract new segments of customers. As a key player on the Binance Smart Chain (BSC), it is vital for Venus to spearhead RWA initiatives and engage the community in shaping a RWA program that addresses the protocol’s objectives.

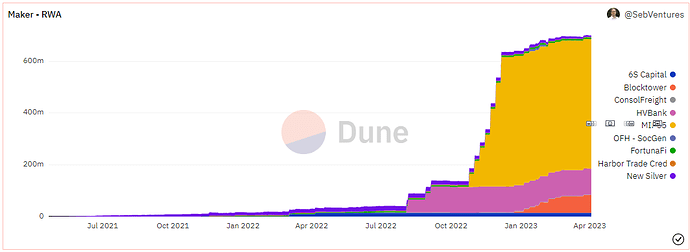

Steakhouse Financial is a leading crypto-native advisory firm providing financial reporting, strategic advisory and RWA expertise. We work for leading projects that include MakerDAO, Lido and ENS. Founders of Steakhouse have led RWA efforts at MakerDAO and worked on over 10 RWA deals worth an aggregate of over$3B. This encompasses private credit deals (such as BlockTower, a publicly listed bank HVB and New Silver), public credit (like $1.25B treasuries under Monetalis deal) and negotiating rewards deals with stablecoin issuers (such as Gemini, Paxos and Coinbase).

Proposal

The primary goal of this proposal is to comprehensively support Venus in its RWA initiatives through the following strategic measures:

- Establishing a tailored legal structure in alignment with Venus’s objectives:

Our expertise enables us to set up legal entities in jurisdictions that include the Cayman Islands and the British Virgin Islands, if required. Such entities would serve as Venus’ liaison with the real-world, functioning as a legal counterparty for most RWA projects. Highly reputable firms with experience managing similar entities for hedge funds and other financial institutions would oversee the day-to-day operations of these entities, closely adhering to guidance provided by Venus. - Providing expert advice on RWA selection and assessment for up to four deals per year:

Embarking on a journey to incorporate RWAs requires comprehensive understanding of the potential risks and legal implications. Our team of internal Steakhouse experts will conduct thorough risk and legal assessments, guiding Venus in the selection and evaluation of RWA projects. - Facilitating community engagement and strategic discussions:

Securing community support is vital for the success of RWA initiatives. We propose to actively involve the Venus community in the decision-making process by providing educational resources and facilitating discussions on potential RWA projects and strategies. - Delivering ongoing monitoring and supervision of RWA investments for Venus:

Given the dynamic nature of RWA investments, continuous oversight is essential. Steakhouse’s monitoring services have a proven track record with clients such as MakerDAO RWA. - Offering comprehensive on-chain and off-chain reporting:

To ensure transparency and accountability, Steakhouse Financial will provide extensive reporting services for both on-chain and off-chain activities related to RWA investments. For instance, our on-chain reporting capabilities can be observed in MIP65, while a more holistic report encompassing off-chain components is available here. These reports will keep the Venus community informed and support data-driven decision-making.

By addressing these key aspects, our proposal aims to create a robust foundation for Venus’ RWA initiatives, enabling the platform to expand its reach, attract new users, and drive value for its community.

Expectation

The collaboration between Steakhouse Financial and Venus is expected to follow a phased approach, with the ultimate goal of successfully incorporating RWAs into the Venus ecosystem:

- Education and awareness: The first step will involve engaging with the Venus community to raise awareness about the benefits of incorporating RWAs, the risks and challenges involved, and the potential impact on the DeFi ecosystem.

- Proposal evaluation and selection: Based on community discussions and feedback, Steakhouse Financial will present a curated selection of RWA deals that align with Venus’s objectives and risk appetite. The community will then evaluate the proposals and decide on which RWA projects to pursue.

- Implementation and integration: Once an RWA project has been selected, Steakhouse Financial will work closely with the Venus community to onboard the chosen RWA deal onto the Venus protocol. This will involve establishing the necessary legal structures, assessing risks and creating monitoring processes. Additionally, Steakhouse Financial will provide ongoing support to facilitate seamless integration with the Venus ecosystem.

- Expansion and growth: As the RWA initiative gains traction, Steakhouse Financial will continue to support Venus in identifying new RWA opportunities, evolving the strategy, driving value for the platform, and attracting new users. This ongoing partnership aims to foster the sustained growth of Venus and maintain its position as a leader in the BSC DeFi space.

- Monitoring, reporting, and optimization: Throughout the partnership, Steakhouse Financial will provide ongoing monitoring and reporting services to ensure transparency and accountability for the RWA investments. This will include tracking performance, analyzing risks, and identifying areas for optimization or improvement.

By following this structured approach, the partnership between Steakhouse Financial and Venus is expected to yield substantial benefits, including expanded access to new customer segments, enhanced stability, and greater revenue generation for the platform and its users.

Structure

Steakhouse Financial will charge a minimum fee of $200,000 per year for its services. To the extent the total assets deployed with the assistance of Steakhouse Financial exceed $100 million, Steakhouse Financial’s entire fee will be 20 basis points (bps) per year on the assets deployed. If total assets deployed exceed $500 million, the Steakhouse Financial fee will scale down to 15 bps per year on the share of assets above this amount. Such fees, which are to be paid on a monthly basis, are designed to align our interests with those of the Venus community.

Please note that Steakhouse Financial is not an asset manager nor does it provide such services in connection with this proposal. Our role is to follow guidance from the Venus community and assist with the implementation of the community’s goals.

Although we have in-house legal support, we also have relationships with specialized lawyers around the world that we can call on depending on the need. The fees for external counsel and other professional service providers that we may rely on in the design of institutional-grade legal structures are not included in the proposed fees.

Join our RWA AMA Series on Friday, March 31, 15:00 GMT where we will chat with Steakhouse Financial about their recent proposal to the Venus Community!

Join our RWA AMA Series on Friday, March 31, 15:00 GMT where we will chat with Steakhouse Financial about their recent proposal to the Venus Community!

March 31, 2023

March 31, 2023 15:00 GMT

15:00 GMT