Dear Venus community,

As mentioned before, we have long noticed Vai’s off-peg problem and designed a solution to solve it, and we have solicited the opinions of professional teams and some community members.

This solution needs to meet multiple conditions: the best practices of real products, the amount and difficulty of code development, the predictability of the mechanism, the security and audit workload, and the difficulty of actual implementation, etc., so we spent a long time designing, discussing and modifying the plan.

At present, the plan has taken shape and will be released in the second half of this week.

Like other assets, the price of Vai is determined by supply and demand. When the supply of Vai in the market is too high and the demand is insufficient, the price of Vai will deviate from its target of $1, even though Vai is minted based on the over-collateralization mechanism, and that there is sufficient collateral behind it.

Therefore, our plan will also be adjusted according to the supply and demand level of Vai. When supply exceeds demand, the model will control the issuance of Vai; when demand exceeds supply, the model will encourage the issuance of Vai.

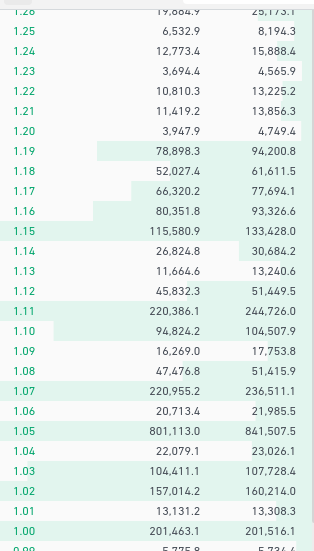

At present, the ratio of USD to VAI has exceeded 1.3:1, and Vai is in a state of serious oversupply.

Therefore, we will first initiate a VIP to temporarily stop the minting of Vai to control the total amount of it.

This is just the beginning, we already have a complete solution to keep Vai stable.

The stability of Vai is also a beginning. After Venus’ basic lending business is back on track, we will start to work hard on the expansion of the VAI scene and strive to improve its use cases.

Decentralized stablecoin has always been the most important product in the crypto world. We look forward to the growth of this business, and this will start with the re-peg of Vai.

Venus Team

2021.9.8