Rationale

Following the recovery of the VAI peg and increased VAI activity, this VIP adjusts the baseRate and floatRate to increase VAI demand while still protecting the peg

References

Summary

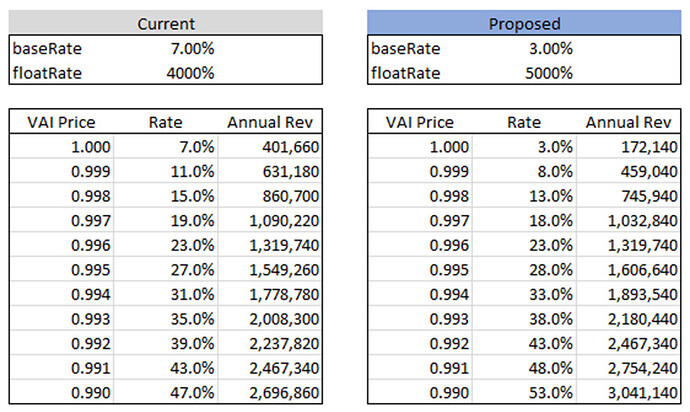

In order to make the borrow rate for VAI more competitive, while still maintaining similar structural pressure towards the peg when there are material deviations, this VIP adjusts the baseRate to 3% (from 7%) and the floatRate to 5000% (from 4000%).

Motivation

-

Harden the peg by making it expensive to borrow VAI when the VAI price is low.

-

Provide a better rate for borrowers when VAI is at or near $1.

Specification

Modification of this VIP:

-

baseRate: 3.00% (from 7.00%) -

floatRate: 5000% (from 4000%)

Please find a sensitivity analysis below reflecting both the existing and proposed rates:

Risk Analysis

-

Significant borrowings could deplete the PSM and impact the price of VAI

-

Reduction of earnings if VAI stays at $1