Overview

Chaos Labs provides modifications to the proposed IR curve parameters and reviews the addition of slisBNB to the Core pool.

slisBNB

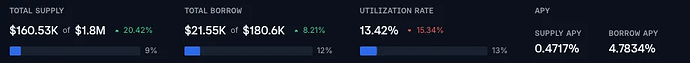

slisBNB is already listed in the Liquid Staked BNB market, where it has failed to generate much demand, some of which stems from the lack of borrowable BNB liquidity in the isolated pool.

slisBNB

BNB

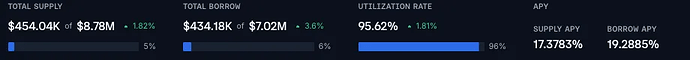

As discussed in other recommendations, we are generally supportive of listing more popular LST/LRTs in the appropriate Core instances, provided they have sufficient on-chain liquidity to support liquidations, given that a listing in Core comes with access to uncorrelated debt assets. slisBNB meets this standard, as its liquidity has been relatively stable since the start of this year.

However, this listing strategy has a drawback: assets cannot be listed with as aggressive collateral parameters as they can when listed in a pool with only correlated assets.

Recommendation

slisBNB currently carries a 90% CF and 93% LT on the isolated pool; in the Core pool, we recommend that its CF be set to 75%, just below BNB’s at 78% to account for potential additional volatility. Beyond this change, we recommend aligning all parameters with those in its isolated pool.

Specification

| Parameter |

Value |

| Asset |

slisBNB |

| Chain |

BNB Chain |

| Pool |

Core |

| Collateral Factor |

75.00% |

| Liquidation Penalty |

10.00% |

| Supply Cap |

3,000 |

| Borrow Cap |

300 |

| Kink |

50% |

| Base |

0.02 |

| Multiplier |

0.2 |

| Jump Multiplier |

3.0 |

| Reserve Factor |

25% |

BNB IR Curve

As Risk Managers, we are receptive to community proposals that may be founded in rationales other than pure optimization. In this case, the Venus community has expressed an interest in temporarily deprioritizing revenue in the BNB market, instead opting to provide a market that is highly favorable to borrowers in light of new competition. Below, we examine some of the considerations in this market and provide our recommendations.

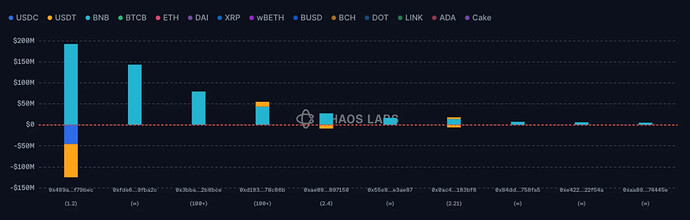

BNB Exploiter Burn

It is likely that the account 0x48…9BEC — the largest supplier in the market — will soon be force closed, removing 328K BNB from the current total supply of 1.07M and leaving roughly 740K BNB supplied in the market. As described in our previous recommendation regarding BNB’s IR curve, this user has long been the largest supplier in the market, meaning that this will be a fundamental change in the amount of liquidity available to borrow.

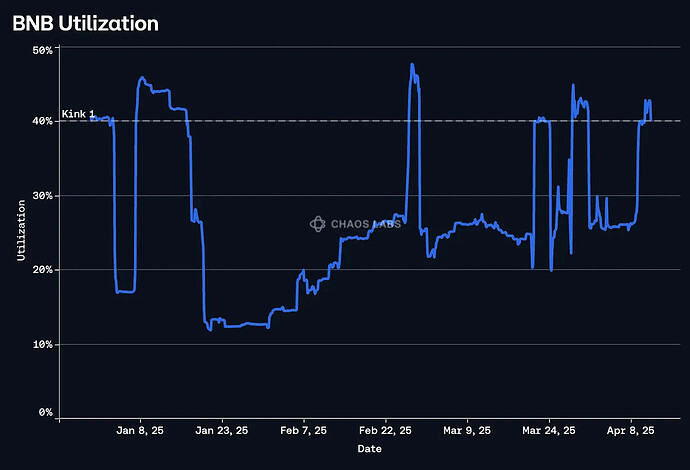

The most BNB that has been borrowed during a Launchpool in the last six months was 750K in December 2024, indicating that there is some possibility that the market could become fully utilized if the IR curve is not set appropriately.

Takeaway: A forthcoming drop in liquidity supplied makes it more likely that the market could become fully utilized during Launchpools.

Solution: Ensure that the rates at high utilization (>90%) are high enough to encourage new supply to enter the market and/or users to repay their BNB debt.

BNB Usage

Unlike on Lista DAO, BNB depositors on Venus can access deep stablecoin liquidity. As a result, there is significant utilization of BNB as a collateral asset; this has increased gradually over the last year.

However, 77% of this borrowing activity is accounted for in the account mentioned above, indicating that the vast majority of BNB supplied is not being utilized as collateral.

Of the top ten suppliers, seven are supply-only positions, indicating that these users may be sensitive to a drop in supply yield.

Takeaway: Users, especially and most importantly supply-only whales, may be sensitive to a significant drop in supply yield, as is being proposed.

Solution: While not a perfect remedy, Venus should incentivize the market to reduce the drop in supply yield.

Supply APY

The proposal does not adequately describe or consider that the existing IR curve on Venus does not create a zero-sum game. The proposal exclusively considers the perspective of the borrowers, who are inherently transient, and fails to note that the benefits of Launchpools have been passed on to Venus and its users: the former from BNB’s reserve factor, and the latter from the supply APY generated during Launchpools.

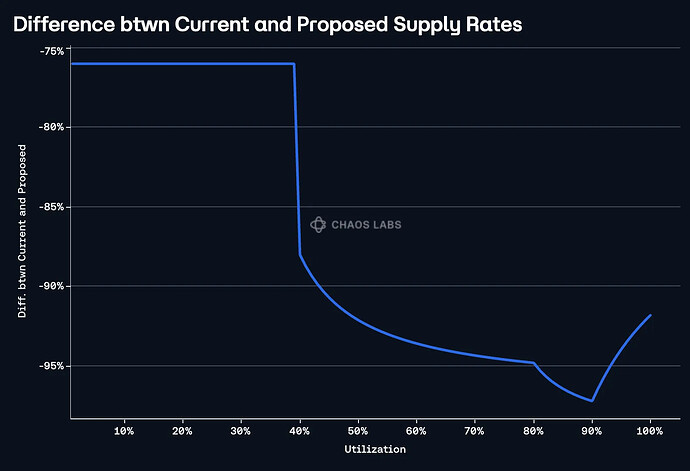

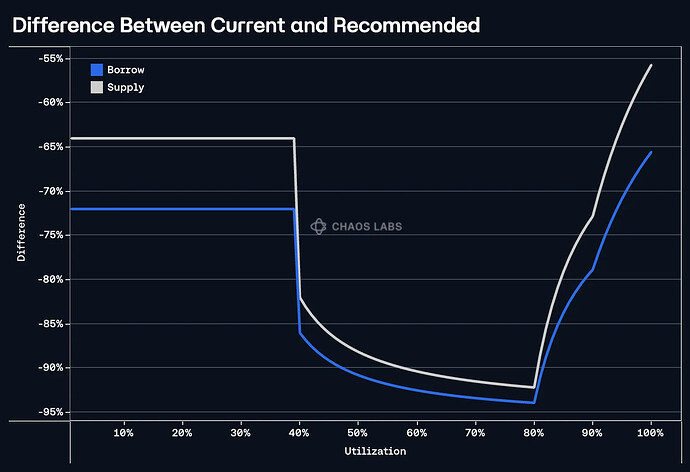

As proposed, the new IR curve would generate 76% less interest for suppliers up to 40% utilization, rapidly falling to more than a 90% difference after the current Kink 1, which would be removed under this proposal.

Additionally, we note that our recommendation from last week found that, in all but one of the Launchpools in 2025, utilization was above Kink 1 for the majority of the time.

In this 40-50% utilization zone, suppliers would accrue interest at a rate 88% to 92.5% slower than they are currently.

Takeaway: The proposed curve would minimize the reasons for a user to deposit BNB on Venus other than to use it as collateral and substantially reduce the protocol’s revenue.

Solution: Lower the Reserve Factor from 30% to 10% to reduce the impact on suppliers.

Recommendation

From an economic perspective, Chaos Labs does not endorse the original proposal, finding that it could lead to supply-only users withdrawing from the protocol unless incentives are provided.

However, considering the community’s feedback, we propose a slightly modified version that still prioritizes borrowing competitiveness while not artificially suppressing rates.

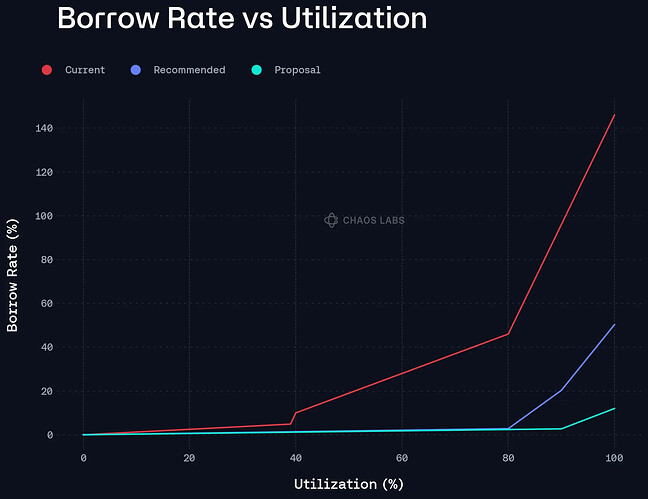

Specifically, our recommendation builds off the stablecoin IR methodology, in which we recommended the creation of a “rate discovery zone” between Kinks 1 and 2, with utilization intended to fall between the two during periods of high demand. Relative to a single-slope curve with a rate of 2.7% at the Kink and a high JumpMultiplier, the two-kink model provides greater rate stability while ensuring the market does not become too highly utilized. This is particularly critical, as demand stemming from Launchpool events consistently surpasses aggregate BNB borrowing across DeFi. The proposed framework seeks to establish bespoke inflection points for borrowing by offering minimized rates and significantly enhanced liquidity, all while preserving robust demand discovery and ensuring adequate compensation for suppliers.

Specifically, we recommend Kink 1 and Kink 2 at 80% and 90%, respectively, with Multiplier 1 set to 0.035, Multiplier 2 set to 1.75, the JumpMultiplier set to 5.0, and the Reserve Factor lowered to 10%. This curve targets a rate of 2.8% at Kink 1 and 20.3% at Kink 2.

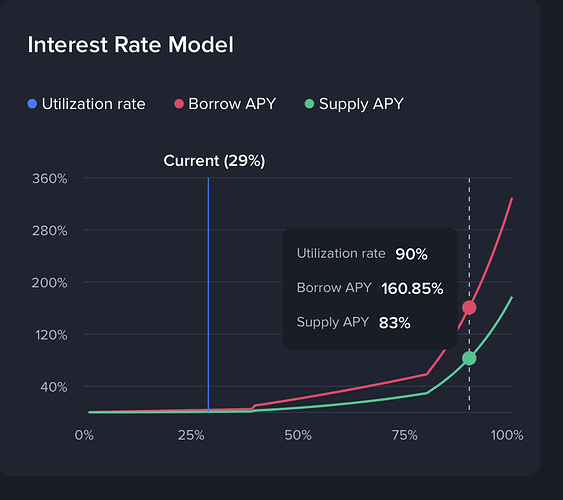

Below, we present the current, proposed, and our recommended borrow curves.

Our recommendation appropriately balances the community’s desire for lower borrow rates while also ensuring rate stability between 80% and 90%, targeting 2.8% at 80% utilization and 20.3% at 90% utilization.

The chart below shows the difference in the supply and borrow curves between the current model and our recommended model. By lowering the Reserve Factor, we are able to reduce the impact on suppliers, though they will receive lower yield, especially between 40% and 80% utilization.

Additionally, while the proposal does not include sufficient details on the incentives, providing incentives is highly recommended, given the potential drop in supplier yield.

We will continue to closely monitor borrowing activity amd BNB supply in this market during Launchpools and may recommend further optimizations in the market.

Specification

| Parameter |

Current |

Proposed |

Recommended |

| Kink 1 |

0.4 |

- |

0.8 |

| Base Rate 1 |

0 |

- |

0 |

| Multiplier 1 |

0.125 |

- |

0.035 |

| Kink 2 |

0.8 |

0.9 |

0.9 |

| Base Rate 2 |

0.05 |

0.0 |

0.0 |

| Multiplier 2 |

0.9 |

0.03 |

1.75 |

| JumpMultiplier |

5.0 |

0.93 |

3.0 |

| Reserve Factor |

30% |

30% |

10% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0