Summary

A proposal to adjust stablecoin Interest Rate (IR) parameters across all Venus stablecoin markets, incorporating a two-kink IR curve model for USDC and USDT.

Motivation

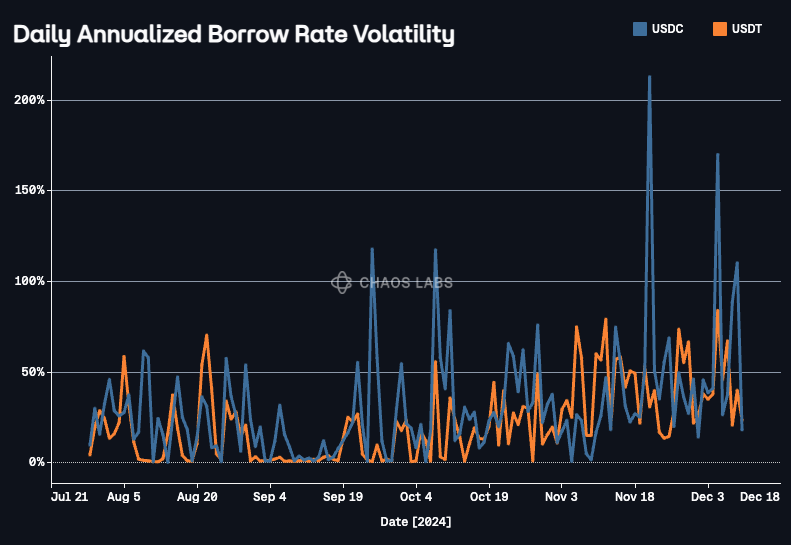

Following the recent change to SKY’s SSR to 12.5% (details here), we reviewed Venus’ stablecoin rates to optimize them in alignment with broader market conditions. Surging borrowing demand for stablecoins has caused interest rates to rise significantly, frequently pushing markets into the JumpMultiplier zone. This has led to increased rate volatility and inefficiency in rate discovery.

To address these challenges, we propose utilizing a two-kink IR curve model for USDC and USDT across all Core Pools. Originally conceptualized by Venus Labs, this innovative model provides greater granularity, reduces volatility, and ensures market sustainability under varying demand conditions.

Interest Rate Analysis

BNB

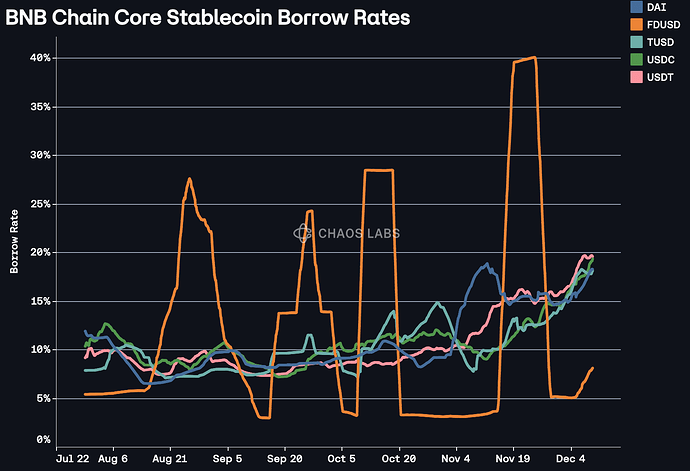

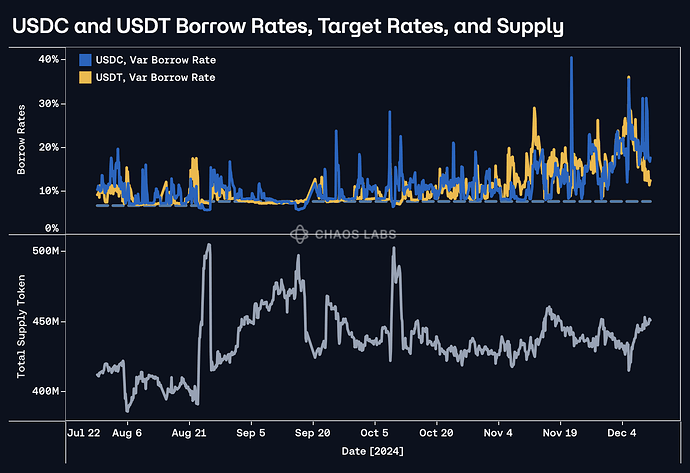

Borrow rates for major stablecoins (USDC, USDT, DAI, and TUSD) on BNB have shown significant growth over the last 30 days and are strongly correlated across instances.

A significant discrepancy can be observed in the borrow rates of FDUSD and USDD, where FDUSD shows occasional spikes in borrow rates during the Binance Launchpools while USDD shows little borrow demand across all instances. As such, we do not recommend adjusting the Multiplier of these two assets. Chaos Labs will provide further recommendations in the future to introduce a two-kink interest rate model to better optimize the FDUSD interest rate curve given by the unique observed dynamics.

Interestingly, this has not led to a surge in supply, as may be expected; supply in the USDC and USDT Core markets has ranged between 425M and 450M for most of the past two months, saving a brief spike to 500M in October. This indicates that rate increases are being driven by increased borrowing demand.

We recommend increasing the multiplier for these assets to align with the new two-kink IR curve model. For higher-risk instances such as DeFi, GameFi, Meme, and Tron, we recommend setting the multiplier at 0.2 to reach an interest rate at Kink 1 of 16%, mitigating risk exposure to stablecoin suppliers. Given the low utilization, which leads to low borrow rates within the Stablecoin pool, we also recommend leaving the parameters unchanged.

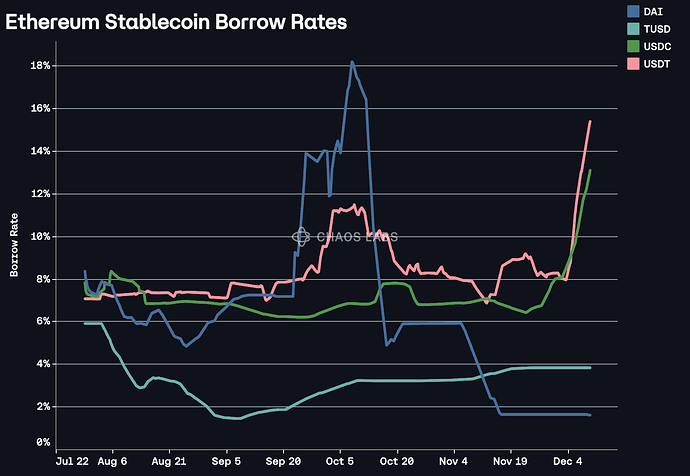

Ethereum

Borrow rates for USDC and USDT on Ethereum have surged, while DAI’s rate has dropped significantly, and TUSD remains stable. We recommend adjusting the IR parameters for all these assets, including increasing crvUSD’s multiplier to 0.20 for better optimization.

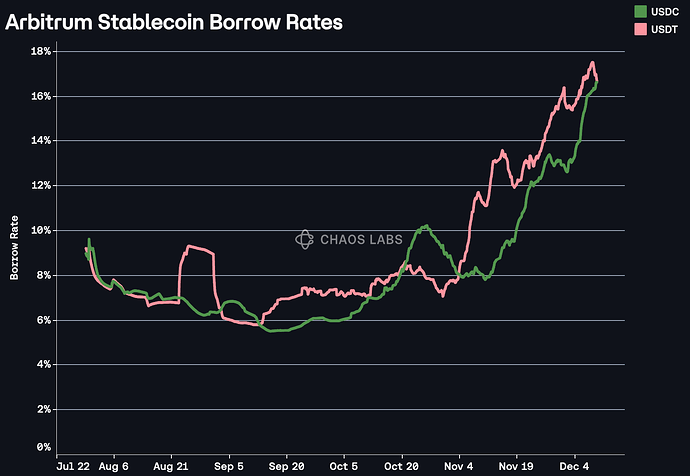

Arbitrum

USDC and USDT borrow rates have risen sharply on Arbitrum, from 8% to over 16% since November 4. To reduce volatility and optimize the IR curve, we propose aligning these assets with the two-kink model.

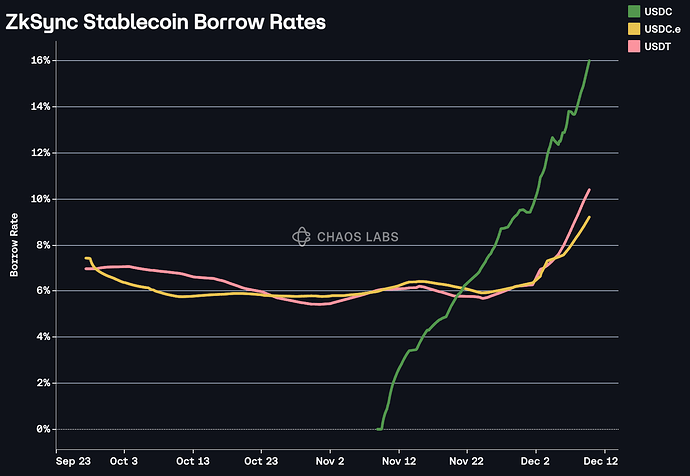

ZkSync

Stablecoin borrow rates on ZkSync have increased, with USDC reaching 16%, and USDC.e and USDT nearing or exceeding 10%. We recommend aligning their multipliers with those on other chains under the proposed two-kink model.

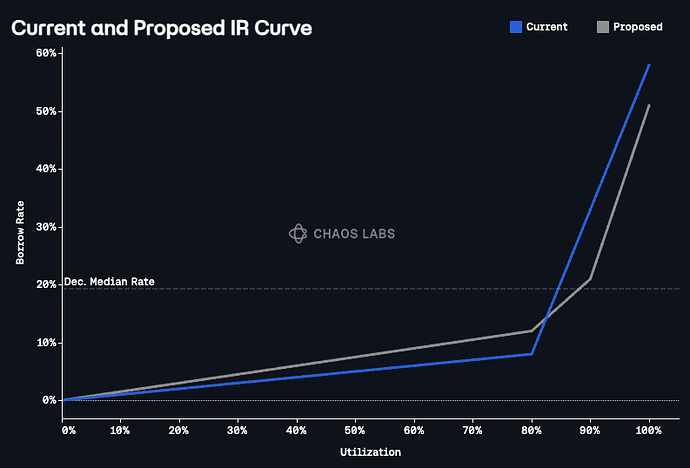

Proposed Two-Kink IR Curve

The proposed two-kink IR curve introduces more flexibility, enabling rate discovery during high utilization while discouraging excessive usage. The key features of the model are as follows:

Structure of the Two-Kink Model

- Kink 1: This kink represents the first inflection point on the interest rate curve. It is designed to target a minimum bound on the borrowing rate during normal demand periods. This level ensures competitive rates while aligning with market benchmarks, such as the Sky Savings Rate.

- Kink 2: This is the second inflection point, serving as the boundary for high utilization scenarios. The borrowing rate at Kink 2 is set to reflect the maximum rate users are generally willing to pay for extended periods. This range provides a cushion for rate discovery without pushing users into unsustainable borrowing costs.

- JumpMultiplier: Beyond Kink 2, the borrowing rate enters the JumpMultiplier zone, where rates rise steeply to discourage over-utilization. A significant JumpMultiplier ensures market sustainability by creating a strong disincentive for utilization above Kink 2.

Advantages of the Two-Kink Model

- Reduced Volatility: By introducing a gentler slope between Kink 1 and Kink 2, the model prevents large rate spikes during moderate increases in utilization, creating a more stable borrowing environment. The chart below shows how the volatility of borrow rates has surged as the markets have frequently been utilized beyond the Kink, causing them to move into the JumpMultiplier zone.

- Improved Rate Discovery: The space between Kink 1 and Kink 2 allows for more granular adjustments to borrowing demand, helping markets find equilibrium without sudden jumps.

- Encourages Healthy Utilization: The gradual increase in rates ensures borrowers stay within sustainable utilization levels, while the sharp rise beyond Kink 2 discourages excessive borrowing.

- Flexibility Across Market Conditions: The dual-kink structure allows for differentiated responses to varying levels of market demand, making it adaptable to both high and low-utilization scenarios.

Implementation Parameters

The following table outlines the parameters for the proposed two-kink IR curve for USDC, USDC.e, and USDT across all Core Pools:

| Asset | Chain | Pool | Multiplier1 | Multiplier 2 | Kink1 | Kink 2 | JumpMultiplier |

|---|---|---|---|---|---|---|---|

| USDC | Arbitrum | Core | 0.15 | 0.9 | 0.8 | 0.9 | 3.0 |

| USDC | BNB | Core | 0.15 | 0.9 | 0.8 | 0.9 | 3.0 |

| USDC | ZKSync | Core | 0.15 | 0.9 | 0.8 | 0.9 | 3.0 |

| USDC | Ethereum | Core | 0.15 | 0.9 | 0.8 | 0.9 | 3.0 |

| USDC.e | ZKSync | Core | 0.15 | 0.9 | 0.8 | 0.9 | 3.0 |

| USDT | Arbitrum | Core | 0.15 | 0.9 | 0.8 | 0.9 | 3.0 |

| USDT | BNB | Core | 0.15 | 0.9 | 0.8 | 0.9 | 3.0 |

| USDT | ZKSync | Core | 0.15 | 0.9 | 0.8 | 0.9 | 3.0 |

| USDT | Ethereum | Core | 0.15 | 0.9 | 0.8 | 0.9 | 3.0 |

The chart below illustrates the current IR curve for USDC and USDT on BNB Core and the proposed two-kink IR curve:

| Asset | Chain | Pool | Current Multiplier (Annualized) | Recommended Multiplier (Annualized) | Current Base | Recommended Base |

|---|---|---|---|---|---|---|

| DAI | Ethereum | Core | 0.0875 | 0.175 | 0 | 0 |

| DAI | BNB | Core | 0.10 | 0.175 | 0 | 0 |

| crvUSD | Ethereum | Core | 0.15 | 0.2 | 0 | 0 |

| crvUSD | Ethereum | Curve | 0.125 | 0.2 | 0 | 0 |

| TUSD | BNB | Core | 0.10 | 0.175 | 0 | 0 |

| TUSD | Ethereum | Core | 0.0875 | 0.175 | 0 | 0 |

| FRAX | Ethereum | Core | 0.15 | 0.175 | 0 | 0 |

| USDT | BNB | DeFi | 0.135 | 0.2 | 0 | 0 |

| USDT | BNB | GameFi | 0.135 | 0.2 | 0 | 0 |

| USDT | BNB | Meme | 0.175 | 0.2 | 0 | 0 |

| USDT | BNB | Tron | 0.10 | 0.2 | 0 | 0 |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0