Overview

Chaos Labs supports the intent of optimizing Venus’ interest rate (IR) curve to enhance borrowing activity, especially during Launchpool events. To this end, we propose refinements designed to address under-utilization outside of Launchpool events while maximizing borrowing efficiency during these peak periods.

Analysis

Borrowing Trends and Constraints

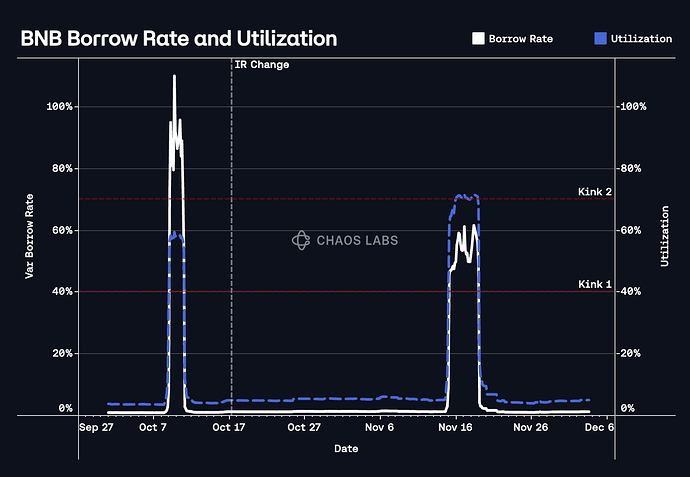

Recent observations suggest that borrowing activity has been constrained by high APYs, effectively capping utilization. Historical data indicates that 60% has often acted as a threshold for borrower tolerance, as utilization typically stabilizes below this rate during highly active periods. While various factors such as event length, asset desirability, and broader market conditions influence this dynamic, refining the IR model to align with borrower sensitivity can boost activity.

Second Slope Adjustments

Analysis of the last two Launchpool events highlights utilization behaviors that warrant adjustments to the IR curve. Since the October 17 change in the curve, utilization has exceeded the second kink (set at 70%) for 65% of the Launchpool duration, peaking at 72%. This data suggests that borrowers remain rate-sensitive, with brief surges to 60% APR signaling a practical borrowing limit.

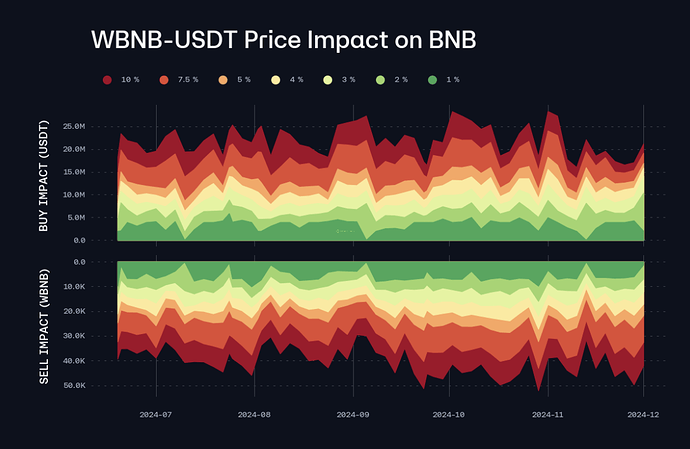

To better support liquidity and borrower behavior, we recommend increasing the second kink to 80% and setting the corresponding borrow rate to 60%. WBNB’s high liquidity—demonstrated by the ability to execute $28M swaps with minimal slippage—supports a reduced buffer for liquidations during high-utilization periods. Given that liquidity remains robust even during Launchpool events, this adjustment should maintain market safety while enhancing borrowing potential.

First Slope Refinements

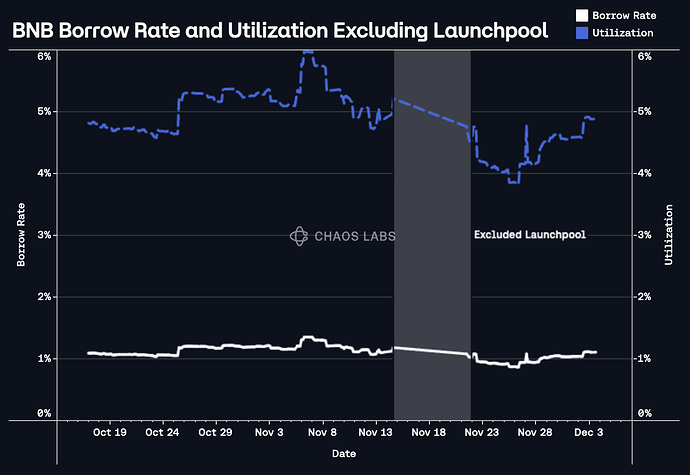

Outside of Launchpool events, borrowing activity has remained underwhelming, with a maximum non-Launchpool borrow rate of 1.35% at a utilization rate of just 6%. This demonstrates significant under-utilization, underscoring the need for a more borrower-friendly IR curve at lower utilization levels. By reducing the slope multiplier for the first segment of the curve, the borrow rate at Kink 1 can be optimized to encourage greater activity during these periods of low demand.

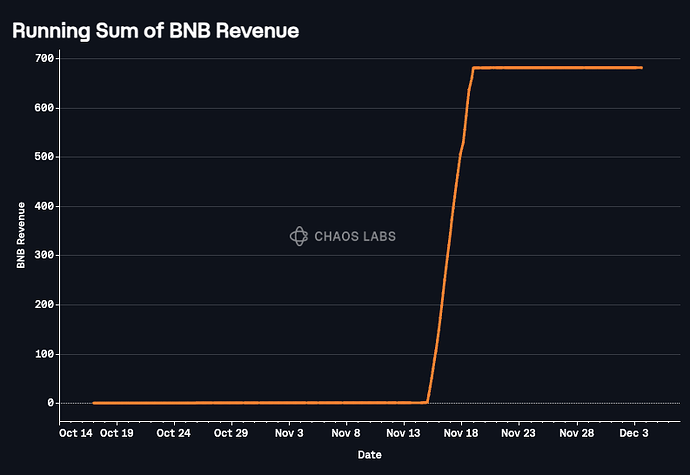

Additionally, revenue generation outside Launchpool events is negligible, with only 1.7 WBNB generated in the month preceding the most recent event. Thus, a reduction in the First Slope Multiplier is unlikely to meaningfully impact revenue but could enhance overall borrowing.

To address these findings, we propose the following changes to the IR curve:

- Decrease the First Slope Multiplier, leading to a borrow rate of 5% at Kink 1.

- Increase the Second Kink to 80% and adjust the Multiplier, resulting in a borrow rate of 62% at Kink 2.

Reserve Factor Adjustments

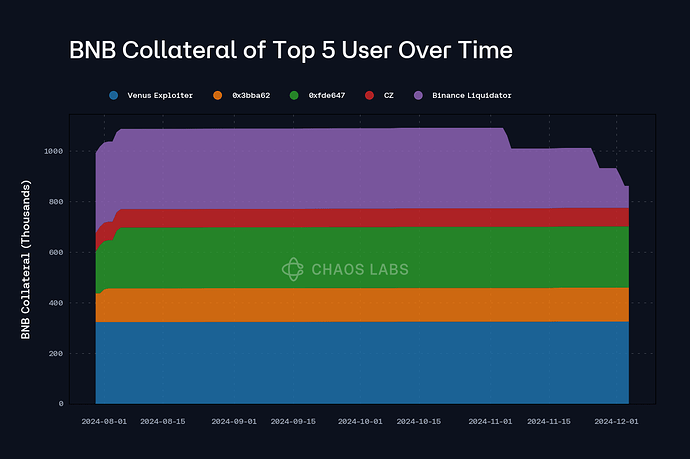

An analysis of supply data shows that the majority of WBNB supply remains stable despite multiple IR curve changes. The top five suppliers account for 76% of the total supply, with minimal reductions observed even during periods of market adjustment; the Binance Liquidator is the only account to have reduced their supply at this time. Given this stability, we propose increasing the Reserve Factor from 25% to 30%, which would boost protocol revenue by 25%.

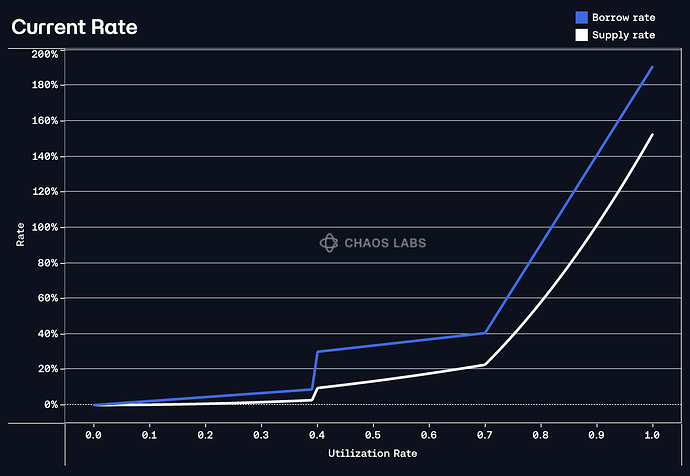

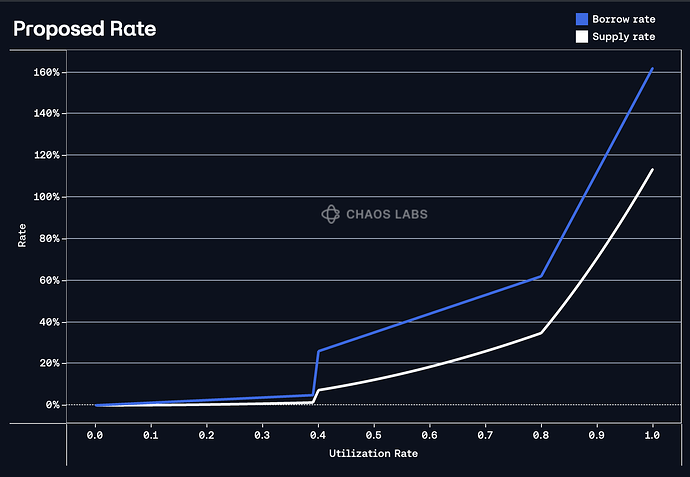

Current vs. Proposed Specification Analysis

Below, we chart the current model and our proposed model, noting that even with the RF adjustment, the supply rate at Kink 2 in the proposed model is 34.72%, compared to 22.68% in the current model. This indicates that users who supply for yield will still be appropriately compensated.

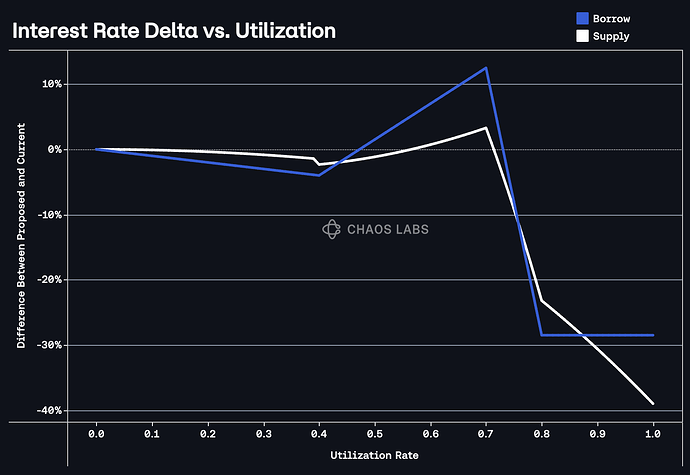

The difference between the proposed rate and the current rate is plotted below. The sharp decline in rates after 70% utilization reflects the adjusted Kink 2, encouraging efficient borrowing during high-demand periods while safeguarding liquidity.

Conclusion

It is appropriate for Venus to optimize its BNB IR curve according to utilization while taking note of what rate borrowers are willing to pay, though this may change over time due to confounding factors listed in the analysis. Additionally, based on our observations, it is unlikely that an increase in RF will have a detrimental effect on the protocol, and instead will generate significant added revenue. Our proposed model attempts to optimize the First Slope while adjusting the Second Slope to ensure that we encourage as much notional borrowing as is safe while setting the borrow rate at Kink 2 to an optimal level.

Specification

| Slope | Kink | Base Rate | Multiplier | Jump Multiplier |

|---|---|---|---|---|

| First Slope | 0.4 | 0 | 0.225 → 0.125 | - |

| Second Slope | 0.7 → 0.8 | 0.21 | 0.35 → 0.9 | 5.0 |

| Reserve Factor |

|---|

| 25% → 30% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0