Summary

Following observations and analysis, Chaos Labs provides a recommendation to adjust BNB’s IR curve in the Core pool.

Analysis

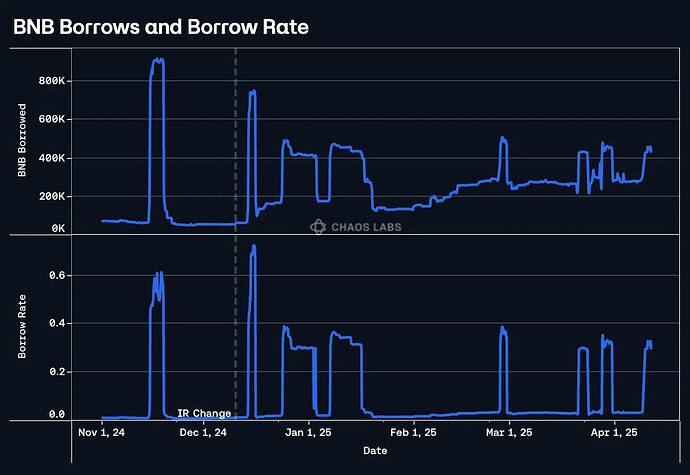

We have observed that there has been relatively little correlation between changes in the IR curve and borrows; users were willing to pay a higher rate with less notional borrows shortly after the last change. During times of increased speculation, there was significantly more notional demand for BNB borrowing.

However, we have now reached a market regime where there is consistently between 400-450K BNB borrowed during each Launchpool.

The drop in amount borrowed relative to last year can largely be attributed to tightening market conditions as well as decreased appeal of Launchpools; again, there were more than 700K borrowed after the change in IR curve.

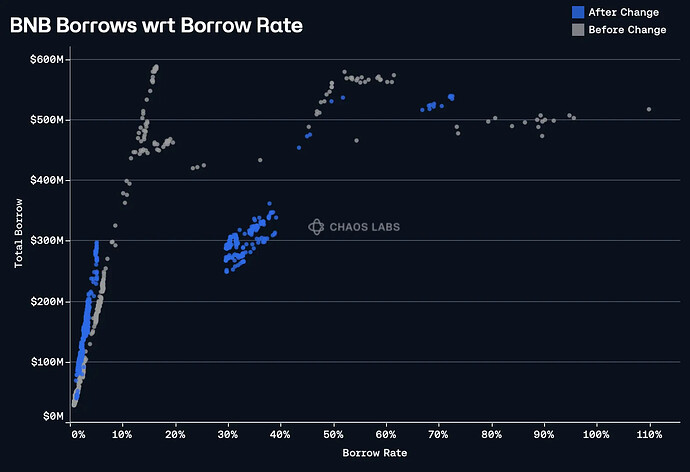

Plotting each observation as its own point, we can conclude that the new IR curve has provided users a more consistent borrowing rate, with strong clustering and only a few surges into very high borrow rates.

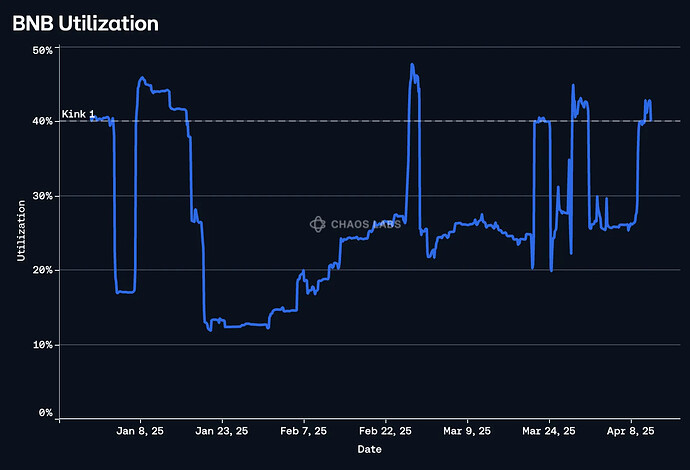

Additionally, we observe that utilization has rarely gone significantly above Kink 1, peaking at 48% in late February during the RED Launchpool. Not coincidentally, this was the first Launchpool with more than 19M BNB deposited since OMNI in April 2024.

Additionally, we note that there is new competition in this market, with Lista opening a new lending market that caps borrow rates at 12.7%. As demonstrated above, this is a significant underpricing of BNB borrow demand, leading to the market rapidly hitting its borrow cap. However, this underpricing will result in too little yield flowing to suppliers, meaning that this can only be maintained by providing token incentives to suppliers. Venus has a distinct advantage in that many BNB suppliers are using the asset as collateral to access deep stablecoin liquidity and should prove sticky, as continued incentives will put downward pressure on the incentive token, with users selling to bridge the gap between the “true” supply rewards (as dictated by borrow demand) and artificially low real supply yield.

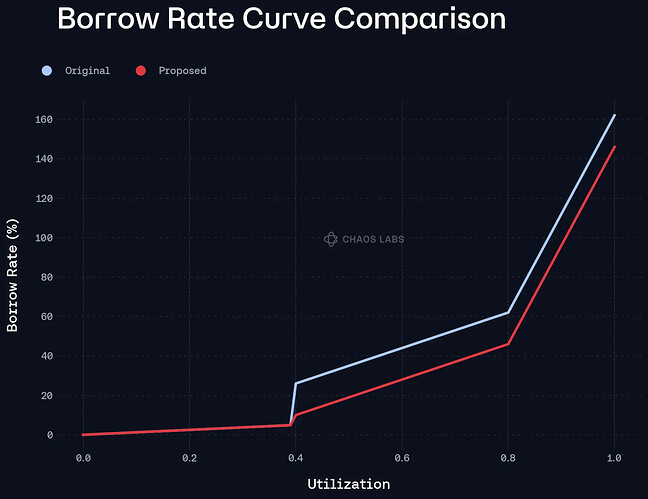

As a result of these factors, it is prudent to adjust the IR curve to create an environment that is more conducive to borrowing. The plot below shows our proposed IR curve, which reduces the Second Base from 0.21 to 0.1, reducing the jump after Kink 1. Otherwise, it maintains the same parameters after Kink 1, ensuring a gradual upwards slope in borrowing rates.

Specification

| Slope | Kink | Base Rate | Multiplier | Jump Multiplier |

|---|---|---|---|---|

| First Slope | 0.4 | 0 | 0.125 | - |

| Second Slope | 0.8 | 0.21 → 0.05 | 0.9 | 5.0 |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0