Summary

A proposal to increase stablecoin Interest Rate parameters across all Venus stablecoin markets.

Analysis

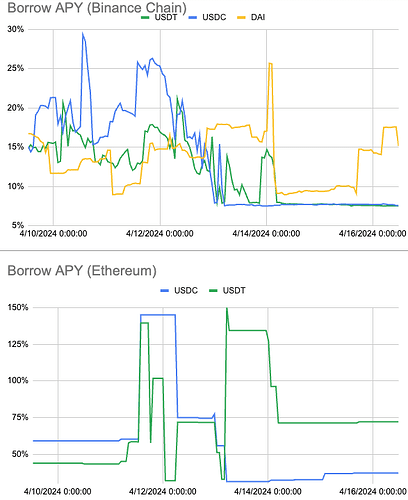

Amid our routine monitoring of the interest rates on Venus, we continue to observe persistent volatility in borrow rates. This volatility is largely driven by the upward trend in the market and various speculative investment strategies. The increased market activity has led to a substantial demand for external leverage, resulting in significant inflows of supplied capital and a convergence of rates at considerably higher levels.

To address this ongoing challenge, we propose a more assertive increase in the multiplier parameter. This adjustment is intended to stabilize borrows below the kink point, operating under the assumption that rates will eventually revert to a longer-term mean.

Stablecoin Total Supply and Borrow:

From January 3 to April 3, we observed the following increases in supply and borrowing across USDC, USDT, and DAI:

| Asset | Total Supply (M) - Jan 3 | Total Supply (M) - Apr 3 | Supply Change (M) | Supply Change (%) | Total Borrow (M) - Jan 3 | Total Borrow (M) - Apr 3 | Borrow Change (M) | Borrow Change (%) |

|---|---|---|---|---|---|---|---|---|

| USDT | 221.7 | 283.0 | 61.3 | 27.64% | 179.2 | 237.8 | 58.6 | 32.68% |

| USDC | 111.8 | 120.6 | 8.8 | 7.88% | 87.2 | 104.1 | 16.9 | 19.39% |

| DAI | 3.7 | 3.9 | 0.2 | 5.41% | 3.0 | 3.4 | 0.4 | 13.33% |

| Total | 337.2 | 407.5 | 70.3 | 20.82% | 269.4 | 345.3 | 75.9 | 28.17% |

This represents an overall $70.3M increase (20.82%) in supply across USDC, USDT, and DAI on Venus, and a $75.9M increase (28.17%) in borrows. This points to substantial demand for leverage and appealing supply rates.

Interest Rate Analysis

Over the past few months, borrow rates for stablecoins have consistently remained above the kink rate. This trend has been fueled by an upward market trajectory driven by various speculative investment strategies. As a result, the market-priced rates for stablecoins have soared to unprecedented levels, accompanied by substantial deposit inflows.

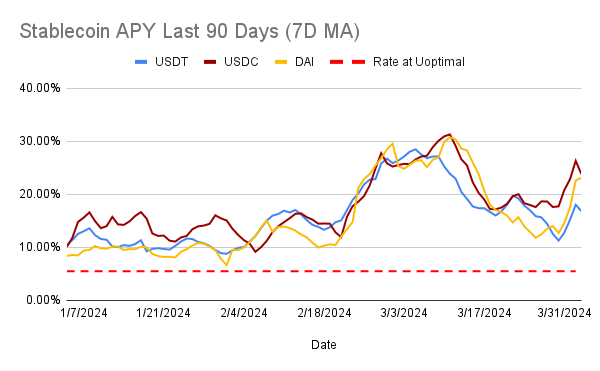

The graph below depicts the borrow rates observed over the last three months, along with the calculated 7-day Moving Average. Analysis of the data reveals that rates rarely aligned with the parameterized rate at the kink. This lack of alignment has contributed to increased rate volatility, failing to stabilize rates around the kink for several weeks.

This discrepancy indicates a pressing need to adjust rates upwards. Throughout the period, borrow rates consistently exceeded optimal levels, underscoring the necessity to recalibrate rates to reflect market conditions better and align them more closely with the kink benchmark.

Computing the arithmetic mean over varying timeframes for the stablecoins mentioned above, we observe a significant recent uptick, accompanied by sustained rates priced well above the kink rate.

| Arithmetic Mean | USDC | USDT | DAI |

|---|---|---|---|

| Last 90 Days | 17.30% | 15.68% | 15.09% |

| Last 60 Days | 19.28% | 18.19% | 17.85% |

| Last 30 Days | 23.03% | 20.81% | 21.43% |

| Last 14 Days | 18.44% | 16.24% | 14.75% |

Time Above Kink

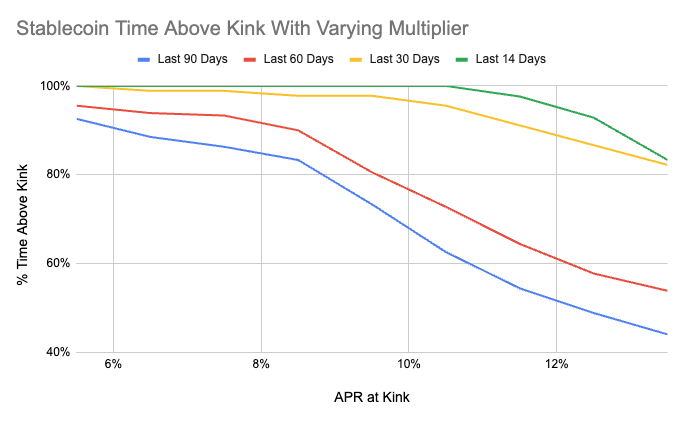

Upon thorough analysis of the percentage of time when utilization exceeded the kink and considering the aggregate utilization rate across different timeframes, it becomes evident that the current multiplier value has not effectively stabilized utilization at or below the kink. This outcome can be attributed to evolving market dynamics, particularly the recent surge in crypto asset prices.

By plotting various theoretically higher annualized multiplier values as scalar factors to account for historical “Time Above Kink” relative to the rolling interest rate, we can assess how “Time Above Kink” diminishes with increasing multiplier based on the market-priced interest rate. The surge in current interest rates over the last 7-14 days is noticeable, indicating minimal decay as the multiplier increases with recent rates. This is in contrast to a more pronounced decay observed over longer timeframes.

Specification:

We recommend adjusting the multiplier in the BNB Chain Core Pool and Stablecoins Pool from 6.875% annualized (5.5% APR at the kink) to 15% (12% APR at the kink). Additionally, we propose aligning the stablecoin market parameters on the Ethereum deployment with those on the BNB Chain and opBNB markets. Concurrently, we also suggest increasing the interest rate for stablecoins supplied in more risk-averse pools, including the GameFi and DeFi Pools, from 12.5% annualized multiplier (10% at the kink) to 18.125% (14.5% at the kink). This increase aims to achieve a more predictable and stable borrowing rate with an equilibrium utilization below the kink point.

Despite the recent trend of rates rising and oscillating above the kink point, this adjustment assumes that current rates will regress to a longer-term mean, as seen through the hovering borrow rate a few months ago and a significant reduction in “Time Above Kink”. This approach allows for a more gradual adjustment, enabling us to thoroughly assess the situation going forward and make informed decisions based on supplier and borrower activity.

We recommend that these increases be implemented in three tranches — with weekly increases over three weeks. Throughout this process, Chaos Labs will monitor activity and adjust recommendations accordingly.

| Asset | Chain | Pool | Multiplier (Annualized) | 1st Tranch - Recommended Multiplier (Annualized) | 2nd Tranch - Recommended Multiplier (Annualized) | 3rd Tranch - Recommended Multiplier (Annualized) | Jump Multiplier (Annualized) | Recommended Jump Multiplier (Annualized) |

|---|---|---|---|---|---|---|---|---|

| USDT | Binance | Core Pool | .06875 (5.5% APR at kink) | .1 (8% APR at kink) | .125 (10% APR at kink) | .15 (12% APR at kink) | No Change | |

| USDC | Binance | Core Pool | .06875 (5.5% APR at kink) | .1 (8% APR at kink) | .125 (10% APR at kink) | .15 (12% APR at kink) | No Change | |

| DAI | Binance | Core Pool | .06875 (5.5% APR at kink) | .1 (8% APR at kink) | .125 (10% APR at kink) | .15 (12% APR at kink) | No Change | |

| FDUSD | Binance | Core Pool | .06875 (5.5% APR at kink) | .1 (8% APR at kink) | .125 (10% APR at kink) | .15 (12% APR at kink) | No Change | |

| USDT | Binance | Stablecoins | .06875 (5.5% APR at kink) | .1 (8% APR at kink) | .125 (10% APR at kink) | .15 (12% APR at kink) | No Change | |

| USDT | Binance | GameFi | .125 (10% APR at kink) | .15 (12% APR at kink) | .175 (14% APR at kink) | .18125 (14.5% APR at kink) | No Change | |

| USDT | Binance | DeFi | .125 (10% APR at kink) | .15 (12% APR at kink) | .175 (14% APR at kink) | .18125 (14.5% APR at kink) | No Change | |

| TUSD | Binance | Core Pool | .06875 (5.5% APR at kink) | .1 (8% APR at kink) | .125 (10% APR at kink) | .15 (12% APR at kink) | No Change | |

| FDUSD | opBNB | Core Pool | .075 (6% APR at kink) | .1 (8% APR at kink) | .125 (10% APR at kink) | .15 (12% APR at kink) | No Change | |

| USDT | opBNB | Core Pool | .075 (6% APR at kink) | .1 (8% APR at kink) | .125 (10% APR at kink) | .15 (12% APR at kink) | No Change | |

| USDC | Ethereum | Core Pool | .07 (5.6% APR at kink) | .1 (8% APR at kink) | .125 (10% APR at kink) | .15 (12% APR at kink) | 80% | 250% |

| USDT | Ethereum | Core Pool | .07 (5.6% APR at kink) | .1 (8% APR at kink) | .125 (10% APR at kink) | .15 (12% APR at kink) | 80% | 250% |

| crvUSD | Ethereum | Core Pool | .07 (5.6% APR at kink) | .1 (8% APR at kink) | .125 (10% APR at kink) | .15 (12% APR at kink) | 80% | 250% |

| crvUSD | Ethereum | Curve | .07 (5.6% APR at kink) | .1 (8% APR at kink) | .125 (10% APR at kink) | .15 (12% APR at kink) | 80% | 250% |