Venus Protocol Governance Topic

Summary

A proposal to adjust stablecoin Interest Rate parameters across all Venus stablecoin markets.

Motivation

Following recent changes to Venus’s stablecoin interest rates and MakerDAO’s Dai Savings Rate (from 10% to 8%), we review stablecoin balance changes and rate reactions to ensure rates are optimized.

Stablecoin Total Supply and Borrow:

Examining balances on the BNB Chain Core Pool, we find strong growth in supplying and borrowing USDT over the past 90 days. There were small outflows in the amount of USDC supplied and borrowed.

| Asset | Total Supply ($M) - Feb 13 | Total Supply ($M) - May 13 | Supply Change ($M) | Supply Change (%) | Total Borrow ($M) - Feb 13 | Total Borrow ($M) - May 13 | Borrow Change ($M) | Borrow Change (%) |

|---|---|---|---|---|---|---|---|---|

| USDT | 243.7 | 323.3 | 79.6 | +32.7% | 206.2 | 234.5 | 28.3 | +13.7% |

| USDC | 118.8 | 109.7 | -9.1 | -7.7% | 100.2 | 88.2 | -12.0 | -12.0% |

| DAI | 4.08 | 3.57 | -0.51 | -12.5% | 3.37 | 2.74 | -0.63 | -18.7% |

| Total | 366.58 | 436.57 | 69.99 | +19.1% | 309.77 | 325.44 | 15.67 | +5.1% |

However, the growth of the USDT market was enough to offset both of these decreases, leading to an overall increase in the amount of stablecoins supplied and borrowed on BNB Core.

Interest Rate Analysis

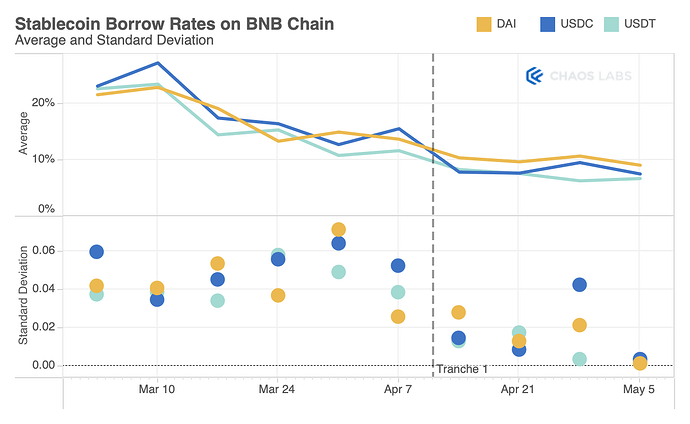

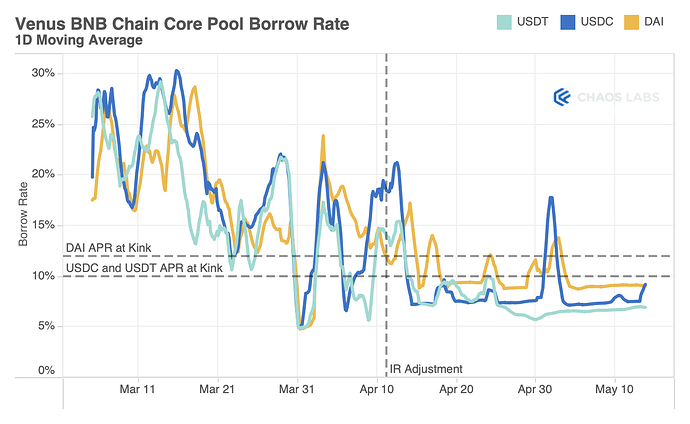

We recommended interest rate increases for all stablecoins in April to reduce rate volatility; these were implemented on April 11. The chart below shows that this was largely successful, decreasing average rates as utilization converged to optimal levels and the Jump Multiplier became less of a factor. Importantly, the standard deviation of borrow rates has also decreased significantly, improving the user experience.

While rates have been much more stable, we also find that USDC and DAI are quite close to the optimal level achieved at the kink, while USDT is lower. Thus far in May, the average borrow rate for USDC is 8.48%, for USDT is 6.62%, and for DAI is 9.72%, relative to an APR at the kink of 8%, 8%, and 10%.

As rates adjust in light of MakerDAO’s DSR adjustment, it is prudent to align stablecoin rates on Venus to ensure they remain competitive.

Specification:

We recommend decreasing all stablecoin rates, with a slightly smaller decrease for USDC and USDT on BNB Core, given that they did not undergo a second tranche of rate increases. Rates for higher risk pools — DeFi and GameFi — continue to be set higher.

| Asset | Chain | Pool | Current Multiplier (Annualized) | Recommended Multiplier (Annualized) |

|---|---|---|---|---|

| USDT | BNB Chain | Core Pool | .1 (8% APR at kink) | .0875 (7% APR at kink) |

| USDC | BNB Chain | Core Pool | .1 (8% APR at kink) | .0875 (7% APR at kink) |

| DAI | BNB Chain | Core Pool | .125 (10% APR at kink) | .0875 (7% APR at kink) |

| FDUSD | BNB Chain | Core Pool | .125 (10% APR at kink) | .0875 (7% APR at kink) |

| TUSD | BNB Chain | Core Pool | .125 (10% APR at kink) | .1 (8% APR at kink) |

| USDT | BNB Chain | Stablecoins | .125 (10% APR at kink) | .1 (8% APR at kink) |

| USDT | BNB Chain | GameFi | .175 (14% APR at kink) | .15 (12% APR at kink) |

| USDT | BNB Chain | DeFi | .175 (14% APR at kink) | .15 (12% APR at kink) |

| USDC | Ethereum | Core Pool | .125 (10% APR at kink) | .0875 (7% APR at kink) |

| USDT | Ethereum | Core Pool | .125 (10% APR at kink) | .0875 (7% APR at kink) |

| crvUSD | Ethereum | Core Pool | .125 (10% APR at kink) | .0875 (7% APR at kink) |