Overview

Chaos Labs is providing risk parameter recommendations for adding TUSD to the Venus Core Pool on Ethereum, should the Venus community decide on its addition. Following is our analysis and risk parameter recommendations for the initial listing.

Liquidity and Market Cap

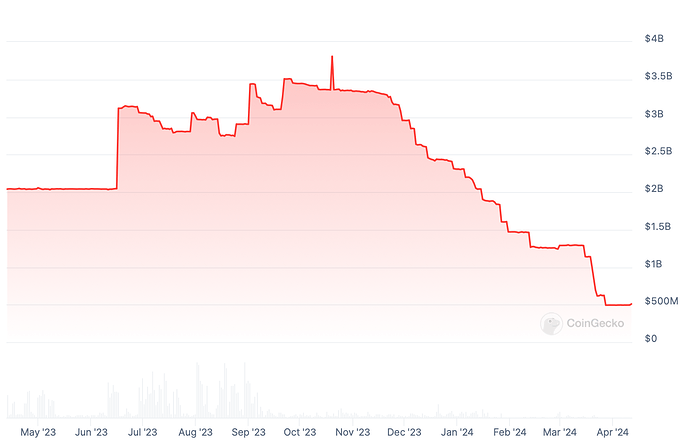

Over the last 180 days, DAI has an average market cap of $2.4B, though its current market cap is just $500M. It has a daily average trading volume of $524M over this timeframe.

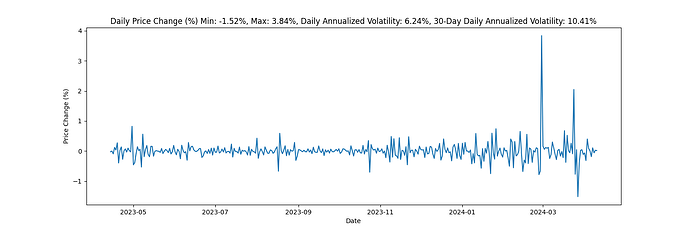

Additionally, it has shown signs of peg instability, with a 30-day daily annualized volatility of 10.41% and a max daily drop of 1.52%.

The asset was previously listed on the BNB Chain Core Pool before being deprecated because of peg instability; the market was recently reopened. We will continue to monitor the TUSD’s peg to minimize risk to the protocol.

TUSD provides Proof of Reserves via a Chainlink feed using data from MooreHK, an accounting firm in Hong Kong.

Collateral Factor

We recommend setting the Collateral Factor to 75%, at parity with TUSD’s parameters on the BNB market.

Supply Cap and Borrow Cap

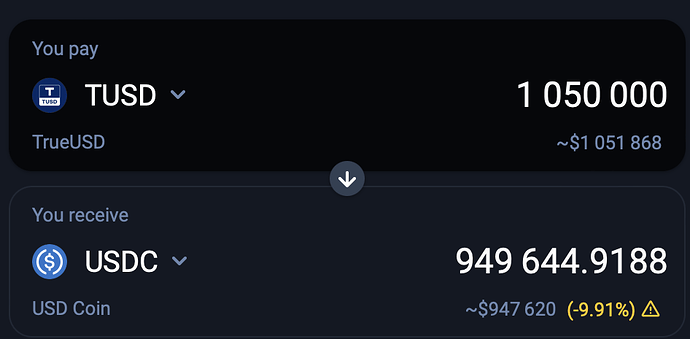

Applying Chaos Labs’ approach to setting initial supply caps for new assets, we propose setting the supply cap at 2X the on-chain liquidity available under the Liquidation Incentive (configured to 10%) price impact.

This leads us to recommend a 2M TUSD supply cap and a borrow cap of 1.8M TUSD.

IR Curves

We recommend setting the IR curve in line with those of the major stablecoins on the Ethereum Core pool:

- Base - 0%

- Kink - 80%

- Multiplier - 15%, aligned with our Stablecoin IR proposal

- Jump Multiplier - 250%

- Reserve factor - 10%

Recommendation:

| Parameter | Value |

|---|---|

| Borrowable | Yes |

| Collateral Factor | 75% |

| Liquidation Threshold | 77% |

| Supply Cap | 2,000,000 |

| Borrow Cap | 1,800,000 |

| IR — Base | 0% |

| IR — Multiplier | 15% |

| IR — Jump Multiplier | 250.00% |

| IR — Kink | 80.00% |

| Reserve Factor | 10.00% |