Summary

Exploring potential enhancements to the Interest Rate curve formula to better synchronize with observed patterns in the Venus FDUSD core pool, particularly influenced by activities on Binance launchpads. The objective is to mitigate situations of 100% utilization by introducing elevated borrow rates beyond a defined maximum utilization threshold by doubling the jump multiplier, based on historical rates observed in other Launchpool-affiliated markets such as BNB. This adjustment is intended to increase the cost of borrowing FDUSD during these events, thereby discouraging excessive utilization and allowing a sufficient buffer for liquidations and withdrawals.

Motivation

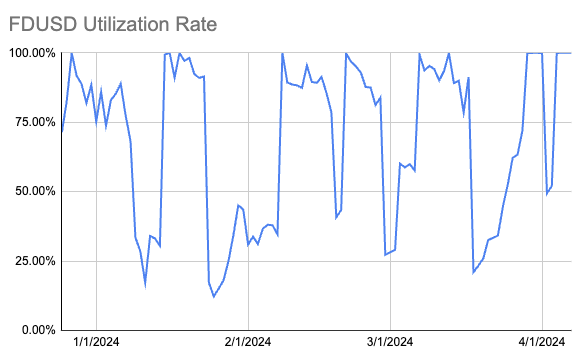

After examining utilization rates of FDUSD during significant events such as the introduction of launchpads or launchpools, we consistently observe utilization rates reaching 100%. This highlights the necessity to adjust interest rates to either incentivize deposits further or deter borrowers from scaling their positions excessively.

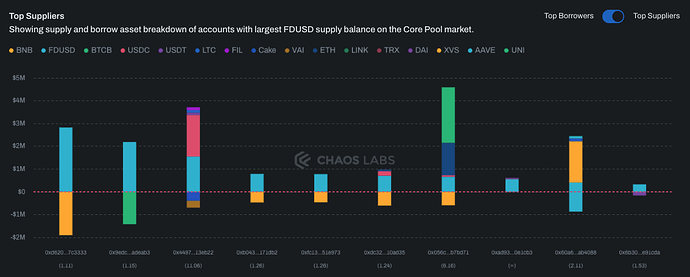

Considering the existing distribution of FDUSD-collateralized variable debt, there’s a potential risk to efficient liquidations, especially in relatively risky positions, as the value of debt assets like BNB and BTC increases.

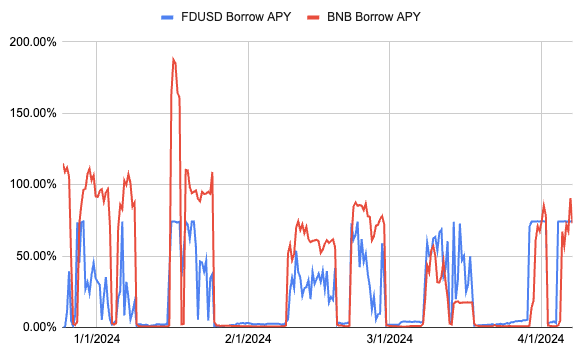

Expanding on this observation, the chart below illustrates a significant correlation in noise between FDUSD and BNB rates during these launchpools, emphasizing the need to map rates according to BNB’s expected behavior, which does not reach maximum utilization at 100%. We define the target APY for FDUSD based on the rate historically achieved for BNB during its peaks in similar launchpool events, ranging from 80% to 100% APY.

Adjustment:

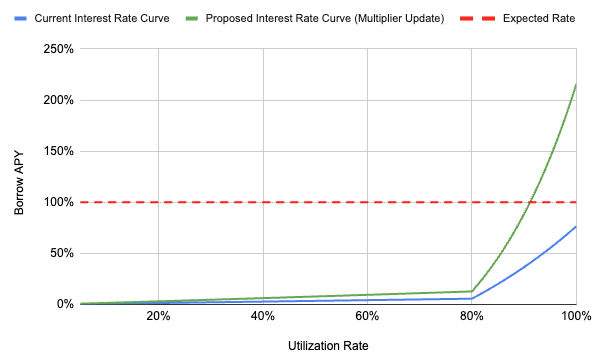

Below is the current interest rate curve, mapped alongside our recommendation. We suggest doubling the jump multiplier to enable the rates to converge at approximately 100% APY during temporary spikes at 90% utilization, particularly during launchpool events. This adjustment allows for a sufficient buffer for adequate withdrawals and liquidations. Our proposal also assumes an expected multiplier adjustment from 5.5% APR to 12% APR at the kink point, as we have adjusted accordingly in our latest recommendations. When such events are not actively taking place, we anticipate rates to converge to the market-priced stablecoin rate, or approximately at the kink point.

Specification

| Parameter | Current Value | Recommended Value |

|---|---|---|

| Jump Multiplier (Annualized) | 2.5 | 5 |