Hi all, I wanted to share some more in depth analysis and details of the specifics around the Prime Token SBT part of the new tokenomics, which even though it only is allocated 20% of the protocol revenue we believe is a critical element and should have outsized beneficial impacts to the protocol and tokenomics of XVS at large.

Updates to the Venus Prime Soul Bound Token

Big Takeaways:

- $2.5 million in marginal revenue to the protocol

- Stable Coin APY Boosts for borrow & supply of 2 - 7%

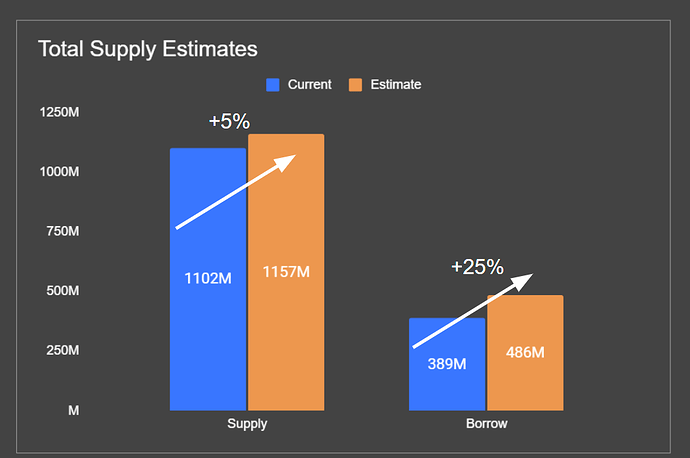

- Estimating 5 - 10% total TVL growth for Venus Protocol (combined Supply & Borrow)

- Estimating 50% increase in XVS staked

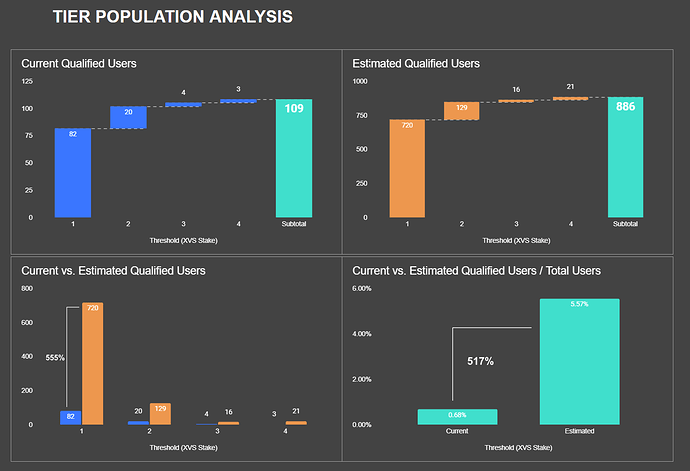

- Qualified User Growth of 500% (defined as users both staking & providing TVL to markets)

The details for the Prime Tokenomics:

The Venus Prime Token is a segment of the new Venus Tokenomics V4 specifically designed to incentivize XVS staking and protocol usage, and in return for those members that qualify, they will receive a soul bound token, the Prime Token, which enhances their stable coin APYs by paying in cash back rewards 20% of the Venus Protocol Revenue (which was formerly used to buyback and burn XVS). There are two forms of the Prime Token, an ‘OG’ irrevocable token, and a revocable token which can be earned via staking XVS. We outline the details further on how to earn the Prime Token, however the cash back boosts apply to both versions of the Prime Token. One important thing to note - we are treating this as a pilot program whereby only a maximum of 100 Irrevocable Prime tokens and 1,000 revocable Prime Tokens will be issued during this pilot period (est. 6 months post production deployment). If you are a recipient of an Irrevocable Prime Token, you won’t have to qualify for the Revocable - and in fact will only receive the 1 OG token even if you qualify for both. From this pilot program we will be assessing the effectiveness of the tokenomics, analyzing the impact to the amount of XVS staked, protocol TVL, community engagement, and other qualitative and quantitative metrics. If successful, the maximum amount of tokens can be increased (by community consensus) to allow new entrants (both irrevocable and revocable).

The 100 OG’s to be issued Irrevocable Prime Tokens are based on the trailing 12 months of usage of the Venus Protocol plus staking XVS.

To qualify for the Prime Token you will have to stake XVS for a minimum of 90 days, and at least 1,000 XVS tokens. The staking mechanism is not based on optimistic staking, but rather you can claim the Prime Token once you have actually staked your 1k XVS for 90 days, whereupon the app will present you with the opportunity to claim the Prime Token. Just staking XVS, however, does not reward you on the value of your XVS staked, but rather on the amount of Supply and Borrow you provide to the protocol. This we call Qualified Value Locked (QVL). As a user with a prime token, you will get cash back rewards on your QVL, which effectively is a boosted APY. This means that when the boost is above the borrow rate, you will get paid to borrow!

There are 4 tiers for the staking, however, which can be modified by the community on a regular basis by vote. These tiers reflect a cap on your QVL. What this means is that if you are staking 1k XVS (Tier 1), and have supply of $200k and borrow of $100k, you will get cash back on the first $50k of your supply, and 100% of your $100k in borrow - for a QVL of $150k. The $150k of excess supply will get paid the standard APY rate for that market plus the XVS emissions (as per the updated emissions schedule). Based on our modeling exercise, the hope is that users in this situation will borrow additional money to purchase XVS to stake it to reach the next tier. The Prime Token, however, is revocable such that when you request a withdrawal of your staked XVS, if that amount drops your XVS below the bottom tier your Prime Token will be burned and you will have to restart the 90 day clock to claim it again. We believe this will create a stickiness to staking XVS such that it will be sufficiently disincentivizing to withdrawal for all qualified token holders.

After weeks of data modeling we have some exciting estimates to share, please note these are estimates and not to be taken as facts. We are basing these on several scenarios, of which this tiering system we decided was the most beneficial to the overall goals to start with. The intent is to have these tiers malleable based on community voting, to allow for changes as the community sees best fit.

Each tier requires a minimum amount of XVS to be staked (the Threshold) for at least 90 days to qualify. Once qualified, the supply and borrow balances are capped to a maximum level for fairness and balance of our users. Each tier is an incremental of additional QVL that users will be paid on, so at tier 2, users already have $150k of available QVL and now get an additional $750k for a total of $900k cap on QVL. All Tiers are paid the same boost rate, only the QVL cap is different at each level. Of note - these QVL balances only apply to the stable coin, BTC, BNB, BETH, and ETH markets.

| Tier | Threshold (XVS Stake) | Supply TVL Cap | Borrow TVL Cap | Total QVL |

|---|---|---|---|---|

| 1 | 1,000.00 | $50,000 | $100,000 | $150,000 |

| 2 | 10,000.00 | $250,000 | $500,000 | $900,000 |

| 3 | 50,000.00 | $1,000,000 | $2,000,000 | $3,900,000 |

| 4 | 100,000.00 | $5,000,000 | $10,000,000 | $18,900,000 |

User Journey Example:

Suppose you are a user with the following token data points;

| XVS Staked | Supply Balance | Supply QVL | Supply APY | Borrow Balance | Borrow QVL | Borrow APY | Prime Boost APY |

|---|---|---|---|---|---|---|---|

| 40,000 | $1,200,000 | $300,000 | 1.00% | $200,000 | $200,000 | -3.10%* | 5.00% |

*using averages from the selected markets current APY

Currently you are qualified for Tier 2, and assuming your 40,000 has remained in the Venus Vault for 90 days, you can now claim your Prime Token. At Tier 2, you can qualify $300k of your supply to be paid the boost, and up to $600k in borrow (but you only have $200k in borrow). So you would receive the following cash back boosts and net interest payments:

Supply * rate + supply QVL * boost - (Borrow * (Boost minus rate))

1,200,000 * 0.01 + 300,000 * 0.05 - (200,000 * (0.05 - 0.031)) = $30,800

With the current boost above the borrow rate, you are receiving a net benefit from borrowing (and this does not include the additional XVS emissions rewards). Because of this net positive borrowing, and you are close to the next tier 3 - you may want to borrow enough money to buy 10,000 XVS to stake and qualify for tier 3. Lets assume XVS price is $6, so you borrow $60,000 to buy XVS and stake - and after 90 days now you are bumped up to tier 3. Now your earnings look like this:

| XVS Staked | Supply Balance | Supply QVL | Supply APY | Borrow Balance | Borrow QVL | Borrow APY | Prime Boost APY |

|---|---|---|---|---|---|---|---|

| 40,000 | $1,200,000 | $1,200,000 | 1.00% | $260,000 | $260,000 | -3.10%* | 4.50% |

*using averages from the selected markets current APY

At tier 3, now 100% of your supply balance is qualified value locked, so you’ll earn the entire prime boost on those balances plus all of your borrow balances. Let’s suppose the prime boost drops by 0.5%, now the economics of your new investments look like this:

Supply * rate + supply QVL * boost - (Borrow * (Boost minus rate))

1,200,000 * 0.01 + 1,200,000 * 0.45 - (260,000 * (0.045 - 0.031)) = $69,640

By borrowing some money and stalking it to get to the next tier, you have over doubled your annual earnings with the Prime Boost!

With this in mind, and based on our datasets we have been utilizing for the models, we anticipate significant growth in users that are both staking and providing supply and borrow to the markets. This should drive value to the protocol, and those that are simply supplying and borrowing may also be enticed to buy XVS to stake it to qualify for one of the tiers - thus leading to further strength in the XVS Vault and tokenomics. By our estimates, supply may increase as much as 5% and borrow as much as 25%, leading to an increase in protocol revenue of ~ $2.5mm annually

(~100mm additional borrow @ 3.1% minus 55mm additional supply @ 1% )

A few graphs for illustrative purposes: