Venus Tokenomics Upgrade v3.0 Proposal

[IDEA]

Venus Protocol is approaching a year since the previous tokenomics were ratified by the community and much has changed in the ecosystem at large. As a new market cycle commences it’s important for the community to adapt to changes in the environment to ensure continued growth.

After collecting feedback and ideas for the next iteration of the Venus Tokenomics, consulting key stakeholders in the ecosystem, and going through multiple rounds of discussion on topics such as risk, treasury, and product development we are publishing a draft for your consideration.

A few principles guided structuring community input into this model: rewarding and incentivizing protocol retention, reinvestment of value, creation of flywheels, embedding greater shortfall defense.

Following these principles, the key points of the new framework are as follows:

Key Points

-

XVS continues to be the core utility token of Venus with voting privileges attached capturing a growing source of protocol value

-

The XVS emissions will be curtailed by 10M, reducing the remaining emissions timeline from 4 years to 2 years, with the total supply capped at 19,745,109 XVS

-

A new SBT (soulbound token) will be issued, Venus′ Prime, which unlocks access to boosted yields across selected markets.

-

A minimum of $1mm equivalent XVS staked in the Venus Vault will be required to access liquidation by external parties

-

Updating the mechanics of the XVS Vault so only active Stakers capture protocol revenue simultaneously with voting rights. Withdrawal period will no longer capture rewards

XVS Emissions Schedule Adjustment

Currently selected markets are incentivized via additional XVS incentives, via daily emissions. These emissions were previously scheduled to run for a total of 6 years, with 4 years remaining, for a total supply of 30mm XVS. This proposal would cut those emissions by 2 years, thus reducing the emission period to 2 remaining years, resulting in a 20mm total supply. The daily XVS emissions schedules will remain intact. We may look to add governance to the markets selected for incentive reception with the launch of additional protocol features, but is not an immediate part of this tokenomics update.

Introduction of Venus Prime Soulbound Token (SBT)

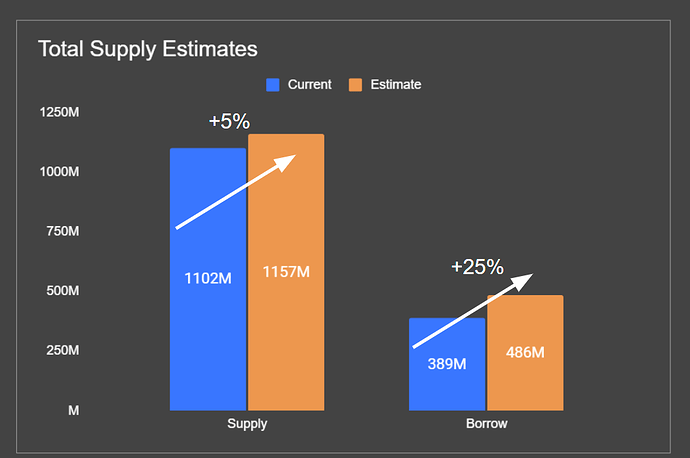

In order to drive protocol retention and further a growing community of dedicated lenders and borrowers, a new mechanism for incentivizing loyalty has been devised using SBTs (soulbound tokens) called Venus Prime . Venus Prime tokens unlock access to variable boosted yields across selected markets as determined by the gross TVL supplied to the markets; combining the TVL power of supply and borrow (ie the sum of the absolute values of the supplied and borrowed amounts, if someone supplies $1k and borrows $500, they would have gross TVL evaluated at $1,500. The gross TVL is based on the daily average balance for the quarter). These SBTs cannot be transferred, bought or sold, and must be earned via the criteria laid out below. The supplemental yield will be paid in the currency in which it is borrowed or supplied, but based on the overall protocol revenue allocation. This is similar to the XVS Vault revenue capture, except paid in the selected supplied assets based on the TVL criteria.

Additionally, the TVL that boosted yields apply to will be capped to $1mm per SBT.

The boosted yield APRs will be applied equally to token holders based on their TVL criteria, and while the boost is based on the revenue collected each quarter, we anticipate yields to be boosted by 5 - 15%.

Venus Prime tokens will be issued in two forms:

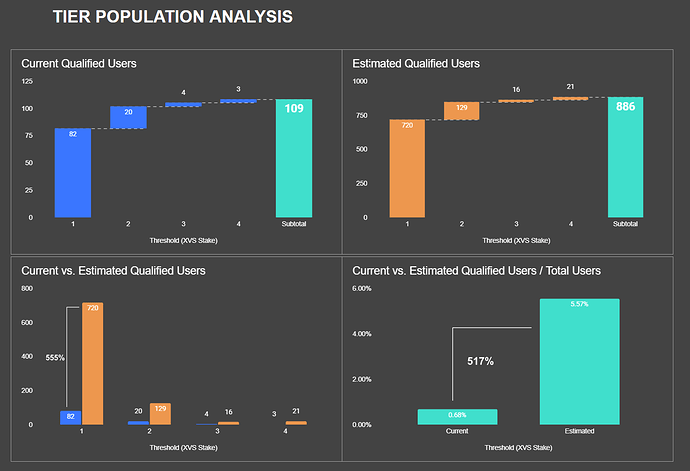

Earned & Revocable: Venus Prime tokens may be earned by staking XVS in the vault for at least 90 days. The XVS vault does not allow for up-front staking, but rather Venus Prime tokens will be issued based on reputation based staking - that is once the staker has staked XVS for 90 days they will be issued the token. The stakers must maintain a minimum stake of 1,000 XVS tokens to qualify. If they unstake their tokens at any point the clock restarts. If they unstake after being issued the SBT, the token will be revoked and thus will have to restart the staking clock to be awarded the SBT again. .

OGs & Irrevocable: Long standing community members and protocol users may qualify for an irrevocable Venus Prime token, that are issued only if the holder is a user in the top 1,000 of active borrowers in terms of borrow transaction count (minimum borrow of $1,000) over a historical rolling period of 1 year, based on other discretionary criteria to be determined.

Other Use cases:

- Discord SBT Token gating (only members with the SBT can access the Venus Prime Discord Channel)

- Token gated in real life Parties and Events held by Venus

- Other swag and perks and more

Updates to the XVS Vault Mechanics

As we have noticed, many XVS stakers are gamifying the Vault by staking their tokens and immediately requesting withdrawal (but not actually withdrawing the tokens). This allows them to continue receiving rewards, but without the 7-day cooldown period, and does not allow those stakers to participate in governance. As Venus is a DAO, we want active participants in governance, and we also do not want users to have access to a ‘free lunch’. The vault will be updated such that when stakers request withdrawals, they will no longer receive XVS vault rewards (and still will not be able to participate in governance). We hope this will incentivize users to keep their XVS staked and partake in governance more actively. Additionally XVS Vault can be auto-compounding by user request, such that the XVS staked is automatically restaked each payout period and automatically compounded.

Income Allocations and XVS Token Economy for Venus Protocol

|30%|Security Module|

|20%|XVS Vault rewards|

|20%|DAO Operation as directed by community|

|20%|Venus Prime*|

|10%|Paydown shortfall (bonds**)|

Nice job…

Nice job…

Interesting incentive proposal for XVS through the new SBT tokens and its benefits of use.

Interesting incentive proposal for XVS through the new SBT tokens and its benefits of use.