Summary:

DeFi lending protocols often use rewards in the form of token emissions to boost supply and borrow APYs, in hopes of attracting new users. Nonetheless, high emissions rates increase the protocol’s token circulating supply, affecting the price negatively, especially in a bear market.

When market conditions are not favorable cutting emissions may have a positive effect on the protocol token price and could also create an opportunity for growth if used as an investment.

Lastly, the previously proposed and ratified prime token program is intended to serve as the strategic solution for boosted supply APY and borrow rate subsidies, ensuring that any valued integrators and protocol participants will continue to reap competitive rates.

For this reason, we are proposing the following:

- Reduce XVS emissions on supply and borrow markets by 50% of their current rate.

- Remove XVS emissions of supply and borrow for SXP

*XVS Vault Rewards will remain the same.

Methodology of the Analysis:

The reduction of emissions is only possible if market conditions allow for staying competitive in the lending market. For this, a comparative analysis was compiled to evaluate the impact of XVS emission reductions in contrast to the top DeFi protocols in the market.

Results

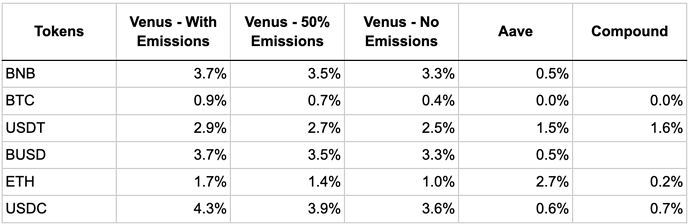

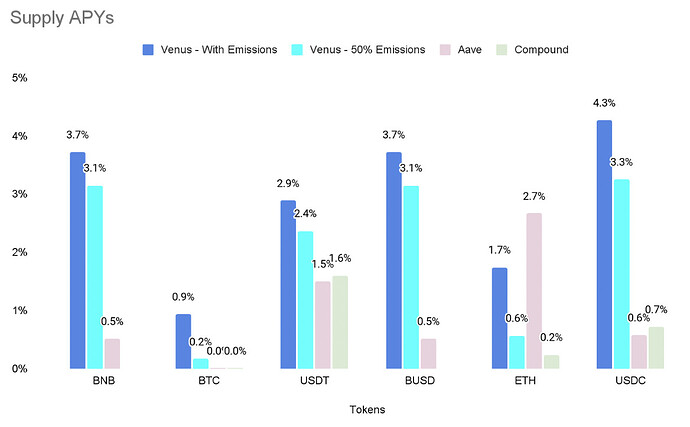

*The following values account for the tokens responsible for +90% of the protocol TVL:

30-day average supply APYs:

- Venus has the highest APY offering for BNB, BTC, USDT, BUSD, and USDC. Even when reducing the XVS emissions by 50%.

- ETH has a more competitive market with a competitor offering a higher APY. Nonetheless even when reducing emissions, Venus is still in a competitive position.

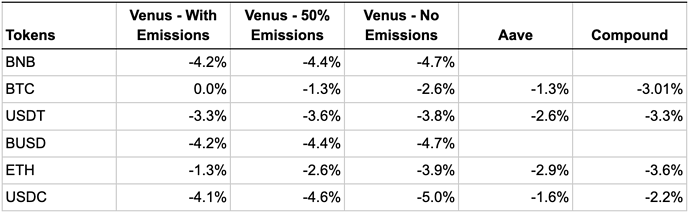

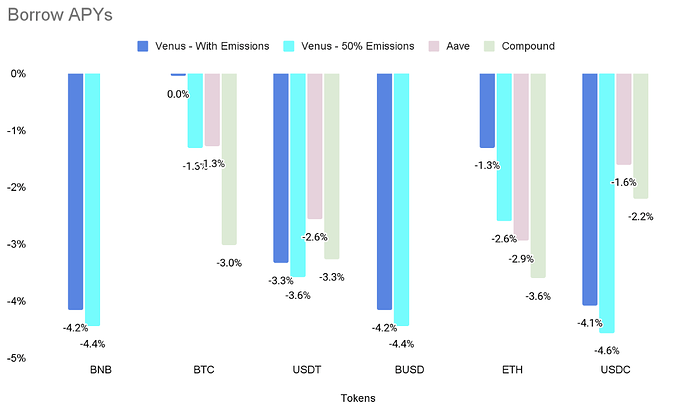

The following are the results for the borrowing market:

30-day average borrow APYs:

- BNB and BUSD borrowing is not available for other competitive protocols. Other DeFi protocols offer these assets but are not considered in the analysis due to their low participation, accounting for less than 10% of Venus total TVL.

- For USDT and USDC the difference between base APYs and emissions-incentivized APYs is relatively low when compared to ETH and BTC. Reduction in emissions is expected to have a low impact as it doesn’t drastically change the protocol’s competitive profile.

- ETH and BTC have a big change in APY when reducing emissions, nonetheless remaining in a competitive range when compared to other protocols.

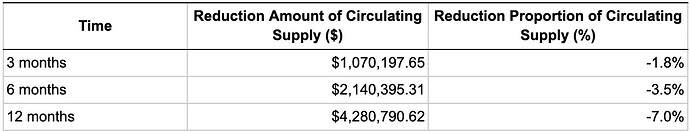

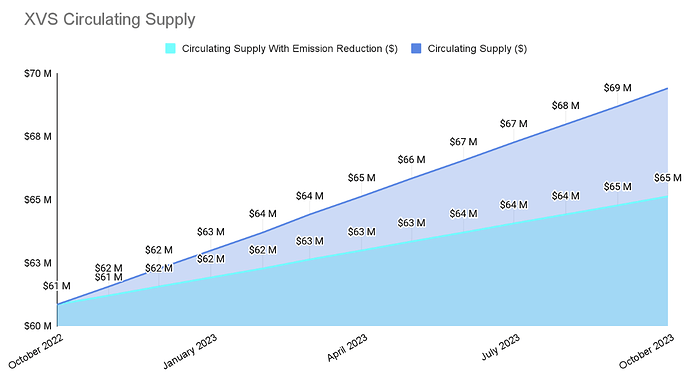

Reduction in emissions will have a significant impact on the circulating supply of the XVS token. The following results show the potential amount saved, on circulating supply if the proposal is implemented:

It is important to consider that the prime token proposal will drastically boost APYs for users that qualify (Prime Token Proposal).

Conclusion:

The results of the analysis suggest that cutting emissions will have a minimal impact on user participation and protocol TVL.

Venus Protocol has a dominant position in the BNB Chain lending ecosystem, holding more than 80% of the total TVL. Moreover, even when decreasing emissions, it still offers competitive APYs when compared to the top protocols. For this reason, a reduction of emissions and the reinvestment of a portion of this value in protocol initiatives would be more beneficial as it allows for more growth opportunities and an increase in XVS price long-term.