As mentioned before, a balanced and healthy tokenomics is currently the top priority for Venus because it determines how Venus multiple participants will collaborate and support the development of the protocol. A good tokenomics model aims to create a selling point where the protocol growth, sustainability, and safety take priority over individual stakeholder objectives.

Based on this principle, we comprehensively considered the opinions from the community and conducted multiple rounds of discussions with external risk control teams and tokenomics model design experts on this basis, and finally formed the tokenomics model framework of Venus.

Model key points

-

XVS will be the core token of Venus, assumes the governance function of the protocol, and will capture the primary value of the protocol.

-

Build a Venus Vault: The Vault has multiple functions such as risk guarantee, voting governance, income distribution and rewards distribution, ensuring that the XVS holders’ benefits and responsibilities are equal.

-

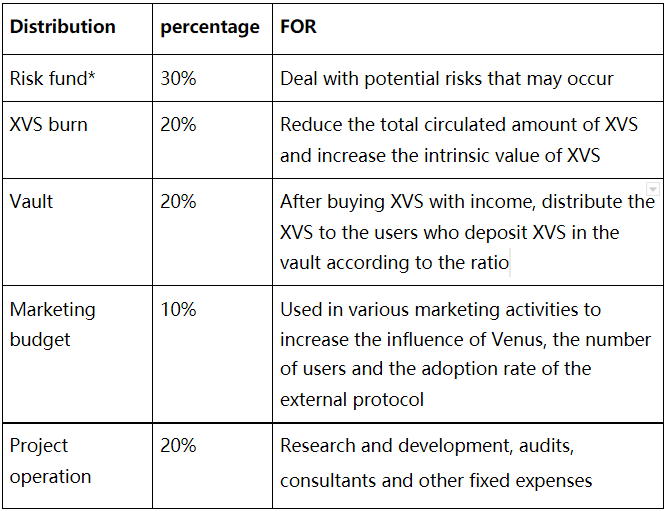

Protocol income distribution: The income will be divided into multiple shares, including risk funds, buyback and burn XVS, vault staking rewards and Venus operations expenses, etc.

-

VRT can be deposited in the VRT vault to obtain rewards, or it can be exchanged for XVS at a fixed rate. The above two functions will be available for a period of 12 months, after which VRT will no longer play a role in the Venus ecosystem.

-

Expand income sources: adjust the distribution ratio of the existing liquidation incentive, part of which will be used as Venus’s income.

Venus Vault

Venus Vault is a mechanism that locks XVS to improve the system’s anti-risk ability and distributes staking rewards. In addition, only XVS deposited in the vault has the right to govern and can capture most of the income of the system. This is very similar to Staking/Delegation in the PoS network.

XVS deposited in the vault:

-

Will receive staking rewards. The rewards are part of the daily XVS output. We will move all the current XVS deposits and borrow rewards to be the XVS deposit rewards in the vault。

-

Will have the ability to initiate or vote on VIPs or delegate voting rights to others.

-

Will obtain the income distributions of the Venus protocol

In short, the only XVS deposited in the vault can get full rights and interests.

XVS deposited in the vault will be subjected to the following rules:

-

7-day unlock period. It takes seven days after the redemption application is initiated to withdraw the tokens from the vault and use them for other purposes.

-

Cannot be used as collateral for borrowing

-

After a risk event occurs in Venus and only if the Venus risk fund account is not sufficient to cover the shortfall, the XVS depositor in the vault will pay a maximum of 10% of the total deposit amount to compensate for the loss.

VRT can also be deposited in the Vault and receive an APY of 3%. The income is paid in VRT. There are no restrictions or unlocking periods for VRT. After the 12 month VRT transition period, the undistributed VRT tokens will be burned.

Reward adjustment of vXVS

With the launch of the Venus vault, the original incentive policies related to XVS deposits will also change:

-

The original XVS market deposit and borrowing rewards will be canceled, which means that users will no longer receive XVS rewards. This part of the rewards will be mainly used for the XVS rewards deposited in the vault.

-

The XVS borrow limit remains close to zero

-

The XVS interest curve will be adjusted to the jump rate curve, which will charge a very high interest rate even after a small amount of XVS is borrowed. This mechanism is to guide existing XVS borrowers to repay as soon as possible.

The Income Model and XVS Token Economy for Venus Protocol

Source of income

All income will first be deposited into Venus’s treasury account. The future sources of income are:

-

Interest reserve

-

Liquidation fees. 5% of the current 10% liquidation fee rewarded to liquidators will be used as income.

Income Distribution

*The risk fund is the first fund pool used for compensation when a shortfall occurs. When the ratio of the amount of the risk fund to the total deposits or the total amount reaches a certain level, and the assessment is sufficient to deal with potential risks, the income distribution ratio to the risk fund can be adjusted.

Shortfall Coverage

Although we will try our best to prevent the occurrence of the shortfall, we should have a set of potential risk response mechanisms. The mechanism we recommend is:

The risk fund will first be used to pay for the shortfall. In the very improbable case that it is not enough to cover, the remaining part will be taken care of by the following two schemes:

-

Up to 10% of XVS in the vault will cover the remaining part.

-

If still not enough, All the residual will be covered by the XVS that has not been emitted.

If all the three above are drained, a bond token will be issued to cover the shortfall. Most of the income will be used to repay the bond first. This bond system will be developed in the future.

Treatment of VRT

After the Venus vault program is launched, VRT has two primary uses:

-

According to the ratio of 1:12000, directly exchanged to XVS, the exchange function will be available on the official Venus platform. The newly acquired XVS exchanged from VRT will be vested with a linear unlocking time of 12 months.

-

Deposit VRT in the vault and get 3% APR, and the income will be distributed in the form of VRT, which comes from the undistributed VRT pool.

The operational time of the above functions is 360 days after the vault is activated. After that, neither the redemption function nor the income distribution will be available, and VRT will no longer have practical uses.

With the above said, we do not expect this doc is the conclusion, but a good start. Venus Protocol is born to be a dynamic creature who will grow and change tirelessly. It will become more assertive with tighter cooperation, swift adjustment, and persistently hard work among all the stakeholders in the decentralized world.

Thanks to all of the community for their support along the way. We believe that Venus driven by the new tokenomics model will be more robust, balanced, and achieve much faster growth. We are also recruiting more talents to accomplish this, and we look forward to seeing you and us witness the rise of the “New Venus” again.

Venus Team

2021.8.6