how do you check liquidations man? I need to learn exploring the blockchain

Pro-tip: look for VAI that go to the Null address.

That’s either VAI repay or VAI liquidation. Since repay is an official function, other, custom ones, are the liqui-bots.

This works for VAI, not for other tokens.

About the fee, I see this commit

And more globally, this branch

I’ve bet on it since Joselito announced the fee almost one year ago. And one year stuck with a lame yield and unusable token since, even if I admit I could arb it or exit a few times when it reached 1:1 so it was more like trading than staking.

Like you’ve said before it is a speed game, and these players are probably market neutral and can’t be warehousing VAI.

I’m a little disappointed we haven’t had more VAI returned it’s about 1mill a week, with the big whale sitting on over half the supply staked in the vault. Hopefully they return some more and we get a yield at 6-7%

Been sitting on VAI for nearly a year as well too, caught a few spikes down and exited but have always come back. Patience is they key!

If the stability fee comes it could still be volatile, you need utility and good community, I would imagine it would probably over correct then bounce around for a bit before stabilising with the odd spike here and there.

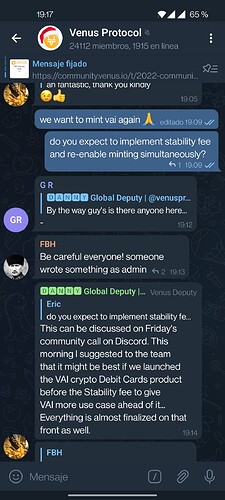

Guys seems that Vai cards are more developed than we thought, and ready to launch?

What do you think?

found also this adress 0x0da75a862ce2d93508d3f72369f5029026cb598f which is also a dumper

I found an address that was 3m short a couple of weeks ago, probably still is.

I think the yield of stablecoins is now so low that the VAI one looks decent again. 2.36% against 2.78%

One year ago it was in the 30%, now is lower than inflation.

I think the yield of stablecoins is now so low that the VAI one looks decent again. 2.36% against 2.78%

One year ago it was in the 30%, now is lower than inflation.

You are true , if we don’t consider Anchor Protocol … they keep their 19.5% ![]()

![]()

Might be time to load up on VAI

^^ too good to be true

Regarding the stability fee this is inline with my estimations of how long it would take based on previous announcements, not sure about the complexity of the other stuff, but the stability fee should be a fairly easy implementation.

Either way $0.85≈ for a VAI seems pretty reasonable considering the mint is coming down everyday.

Very good point, we’ll see how high will VAI go. Previous record were in the 1.12

New Record @ 1.20

New liquidation interface](New liquidation interface) is coming and may reduce the spikes.

I’m guessing the snap back rallies are due to the loosing bot(s) immediately unloading the VAI, also accounts for the overshoot in price.

Good spot. The record @1.12 were sustained for a few hours, and not just an instant spike, but for sure at some point a VAI has been sold for $1.20 so that’s actually a record.

24h Volume(VAI)

3,512.16

(Binance)

This is getting boring…

1 million+ of bids @1

The stability fee was meant to be released this month after Vrt swap.

considering the swap is not done yet and it takes a good 4-5 days to pass and execute, I would say that the deadline is missed.

The question is now how many months more? Over 3 then your better selling at 1.07 and picking up 20% yield on UST.

Hopefully will be less but we might see a spike back to 1.10 even 1.20

BUSD/UST is doing $20 m in volume a day so at least you can get a fill lol.

Hello,

I am new in Venus forum.

Stability fee is of course a must to provide some price stability mechanism for VAI.

Market Makers will be needed to maintain the price, and this could be Venus itself using the collected stability fees.

Listing on a pegged token DEX would certainly help, but listing on Ellipsis is not permissionless.

Integrations on other lending platforms to increase VAI utility is also nice to have.

One issue that I see as a very big inefficiency is that VAI and Venus should be different platforms in my opinion and a spin-off of VAI from Venus would be desirable.

Why?

Users can mint VAI from their collateral on Venus, but this collateral counts only once as TVL and TVL tends to give value for tokens.

So if there is a spin-off of VAI to let’s say VAIMaker, a new protocol functioning similarly to Abracadabra, it could accept v-tokens from Venus as collateral as well as other tokens. New token is created backed by new TVL getting multiplied, which is justified by the ability of the protocol to earn stability fees. VAI is then deposited on Venus in the common lending pool like any other stablecoin, boosting Venus TVL. New token from VAIMaker can be distributed to incentivize usage of VAI (e.g. incentivize LP, lending supply on Venus, etc.).