Summary

Proposal to temporarily pause and reduce protocol exposure to the TUSD market on Venus core pool, utilizing the following actions:

- Pause MINT

- Pause BORROW

- Pause ENTER_MARKET - will not allow users to start using TUSD as collateral. Users who have already enabled TUSD as collateral will not be affected by this update.

- Set XVS rewards in the TUSD market to 0.

- Increase TUSD Reserve Factor to 100%

- Reduce CF from 75% to 65%

Analysis

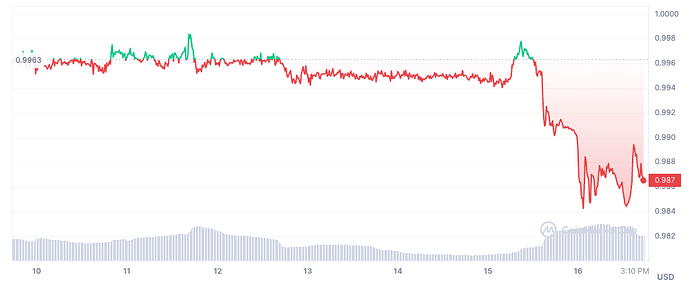

Over the past 24 hours, TUSD has experienced high volatility, with prices reaching a low of nearly 0.981$. This follows a substantial selling activity of TUSD on the Binance cryptocurrency exchange. The market saw approximately $340 million in TUSD sales against about $300 million in purchases, culminating in a net outflow exceeding $40 million.

Considering the uncertainty on the TUSD peg and the downward trend in DEX liquidity, we suggest immediate measures to minimize Venus’ risk associated with this asset. Taking into account Venus’ current utilization and the prevailing liquidity conditions, we recommend the following updates to address these challenges.

- Pause MINT

- Pause BORROW

- Pause ENTER_MARKET - will not allow users to start using TUSD as collateral. Users who have already enabled TUSD as collateral will not be affected by this update.

- Set XVS rewards in the TUSD market to 0.

- Increase TUSD Reserve Factor to 100%

- Reduce CF from 75% to 65% - at this time, this update does not lead to any accounts becoming eligible for liquidation.

TUSD Exposure on Venus

TUSD is listed in the Venus core pool. The following table provides a breakdown of the TUSD parameters and its current utilization (please note that the data is accurate as of the time of this post)

| Current supplied | Supply Cap | Current borrows | Borrow Cap | Utilization | Borrowed Against ($) | CF |

|---|---|---|---|---|---|---|

| 5,000,000 | 5,000,000 | 1,025,199 | 4,000,000 | 20.5% | 2.83M | 75% |

Liquidations

At this time, we haven’t observed liquidations involving TUSD collateral

Next Steps

As the market continues to evolve, we will provide additional recommendations as necessary. This could include recommendations to further reduce exposure and deprecate the market via a series of CF reductions and IR adjustments