Chaos Labs Risk Parameter Updates - TUSD

Summary

Proposal to reactivate the TUSD market on Venus core pool.

Analysis

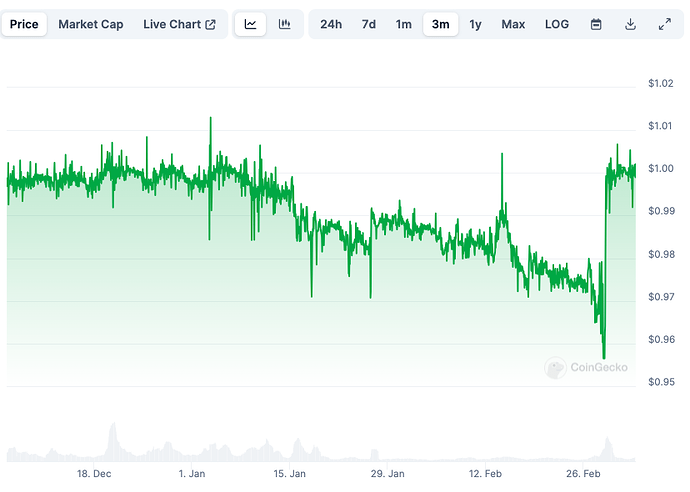

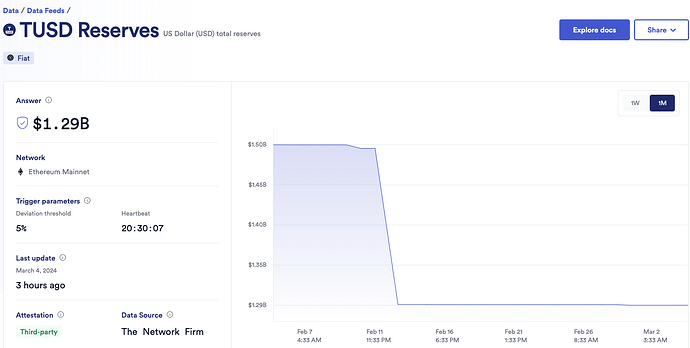

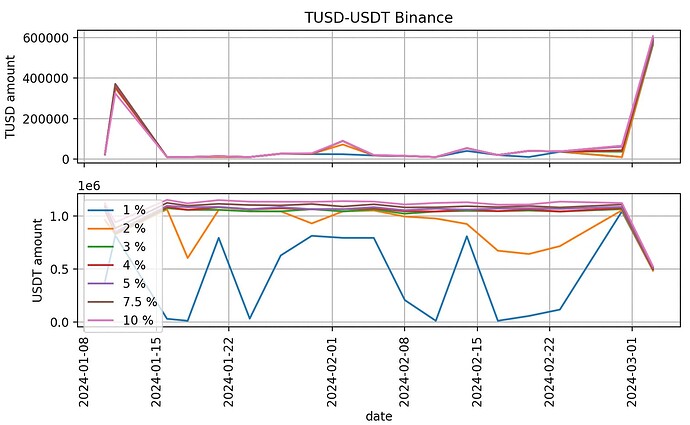

Over the past few days, TUSD has regained its peg after prices dipped to nearly $0.95. This was initially attributed to the significant selling activity of TUSD on Binance following the cessation of TUSD-centric rewards. However, given that TUSD is fully backed 1:1 as per Chainlink Proof of Reserves, the peg ultimately reverted.

Given the recent re-pegging of TUSD and the subsequent upward trend in DEX liquidity, we propose cautiously unpausing this market.

Taking into consideration the current liquidity conditions, our recommendations include implementing specific updates to facilitate the resumption of this market:

- Unpause MINT

- Unpause BORROW

- Unpause ENTER_MARKET - will allow users to start using TUSD as collateral.

- Reintroduce XVS rewards in the TUSD market.

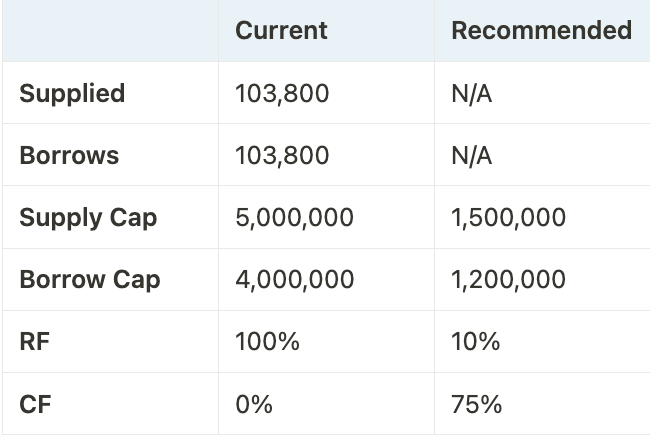

- Reduce TUSD Reserve Factor from 100% to 10%

- Increase CF from 0% to 75%

- Decrease Supply and Borrow Caps from 5M and 4M to 1.5M and 1.2M, respectively.

Recommendations

TUSD is listed in the Venus core pool. The following table provides a breakdown of the TUSD parameters and its current utilization, alongside our recommendations for unpausing the market. (please note that the data is accurate as of the time of this post).

Next Steps

As the market continues to evolve and on-chain liquidity scales, we will provide additional recommendations as necessary. This may involve suggesting further increases to Supply and Borrow caps. Alternatively, in certain scenarios, we may consider the possibility of re-pausing and deprecating the market through a series of CF reductions and IR adjustments.