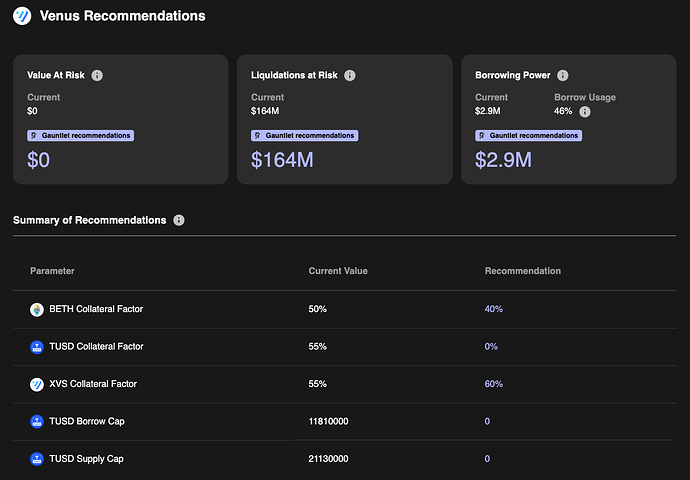

Recommendations from Gauntlet

Summary

-

XVS

- Increase collateral factor to 0.60 from 0.55

-

BETH

- Decrease collateral factor to 0.40 from 0.50

-

TUSDOLD

- Decrease collateral factor to 0.0 from 0.55

- Decrease borrow and supply cap to 0.

Rationale

-

XVS

- To increase capital efficiency and best serve the Venus community, we recommend raising the CF of XVS to 0.60 from 0.55.

- Assuming the supply of XVS stays similar, the CF changes will increase capital efficiency by potentially enabling ~$294k additional borrows against XVS, with minimal impact to the VaR and the LaR ($0 increase to VaR, $12k increase to LaR).

- Currently, $5.3M XVS supports roughly $2.9M borrows. The weighted average APR of these borrows is roughly 2%. At the current supply, increasing the CF by 5% could enable up to ~$3.2M total borrows, which in turn introduces potential added annual reserve revenue for Venus as well.

-

BETH

- In accordance with our recommended BETH deprecation plan, we recommend decreasing BETH’s collateral factor to 0.40 from 0.50. See the breakdown of liquidations that will occur at each CF level:

CF Borrows Supplies Users Liquidated Liquidation Incentive Paid Lost Annual Reserve Revenue 0.40 $9,701 $21,447 67 $485 $26 0.30 $66,502 $188,921 181 $3,325 $177 0.20 $150,758 $533,486 313 $7,538 $402 0.10 $219,484 $936,464 411 $10,974 $585 0.0 $228,248 $945,228 1291 $11,412 $608 - We note that the top 5 wallets holding BETH on BNB represent a total of roughly 1.5M BETH ($2.5B). Globally, BETH’s ADV is ~$8M and its 2% depth across CEX and DEX sources is ~$13M. Thus, the $9.7k in liquidated borrows that will occur at a CF of 40% can be safely absorbed by Venus.

- Further, none of the top 10 BETH suppliers (combined total of $815.6k BETH supply) on Venus are at risk of being liquidated at a CF of 40%. Of the top 50 BETH suppliers on Venus, only one user would be liquidated for a total of ~$2.5k borrows as a direct result of decreasing the CF to 40%.

- We encourage users to convert their positions, or adjust accordingly to avoid forced liquidations from this change.

- In accordance with our recommended BETH deprecation plan, we recommend decreasing BETH’s collateral factor to 0.40 from 0.50. See the breakdown of liquidations that will occur at each CF level:

-

TUSDOLD

- Similarly, as per our recommended TUSDOLD deprecation plan, we recommend decreasing TUSDOLD’s collateral factor to 0.0 from 0.55.

- Current borrow usage for TUSDOLD is $8.6k. Five of the top 10 TUSDOLD suppliers have borrow usages of 0%, and thus their combined supply balance of $676k will not be affected by this CF decrease.

- We recognize the recent concerns around the TUSD market, and note that while TUSDOLD’s liquidity has decreased, the top 5 TUSDOLD wallets on BNB still hold a little over $25M TUSDOLD. Globally, TUSDOLD’s ADV is ~$72k and its 2% depth across CEX and DEX sources is ~$23M. Thus there remains enough liquidity for Venus to safely absorb the $7,982 in borrows liquidated at a CF of 0:

CF Borrows Supplies Users Liquidated Liquidation Incentive Paid Lost Annual Reserve Revenue 0.50 $5,415 $10,390 6 $271 $13 0.45 $5,433 $10,430 19 $272 $13 0.40 $7,053 $14,342 31 $353 $17 0.35 $7,111 $14,491 37 $356 $17 0.30 $7,487 $15,639 50 $374 $18 0.25 $7,651 $16,239 59 $383 $19 0.20 $7,692 $16,419 65 $385 $19 0.15 $7,927 $17,826 71 $396 $19 0.10 $7,946 $17,967 79 $397 $19 0.05 $7,981 $18,324 87 $399 $20 0.0 $7,982 $20,613 263 $399 $20 - While we continue to monitor TUSD market developments and user behavior, we encourage leaving both TUSD and TUSDOLD CF at 0% to mitigate emergent market risk.

- We also recommend reducing the borrow cap to 0 from 11,810,000 and the supply cap to 0 from 21,130,000 to further prevent any new positions.

Methodology

Gauntlet’s parameter updates seek to maintain the overall risk tolerance of the protocol while making risk trade-offs between specific assets.

Gauntlet’s parameter recommendations are driven by an optimization function that balances 3 core metrics: insolvencies, liquidations, and borrow usage. Parameter recommendations seek to optimize for this objective function. Our agent-based simulations use a wide array of varied input data that changes daily (including but not limited to asset volatility, asset correlation, asset collateral usage, DEX / CEX liquidity, trading volume, the expected market impact of trades, and liquidator behavior). Gauntlet’s simulations tease out complex relationships between these inputs that cannot be expressed as heuristics. As such, the input metrics we show below can help explain why some of the param recs have been made but should not be taken as the only reason for the recommendation. The individual collateral pages on the Venus Risk Dashboard cover other vital statistics and outputs from our simulations that can help with understanding interesting inputs and results related to our simulations. To learn more about our methodologies, please see the Quick Links section at the bottom.

Supporting Data

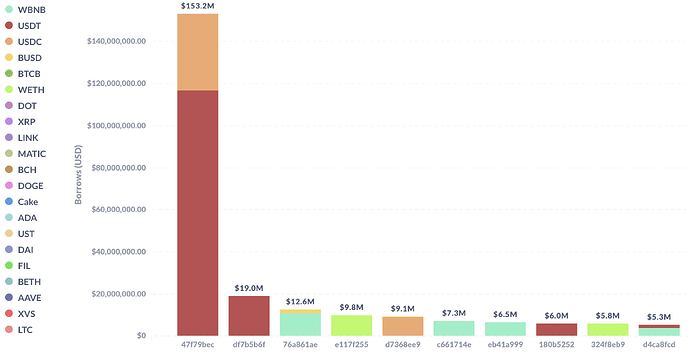

The below figures show trends in key market statistics regarding borrows and utilization that we will continue to monitor:

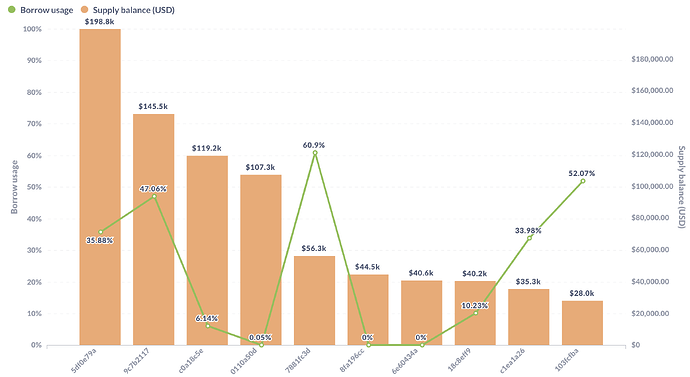

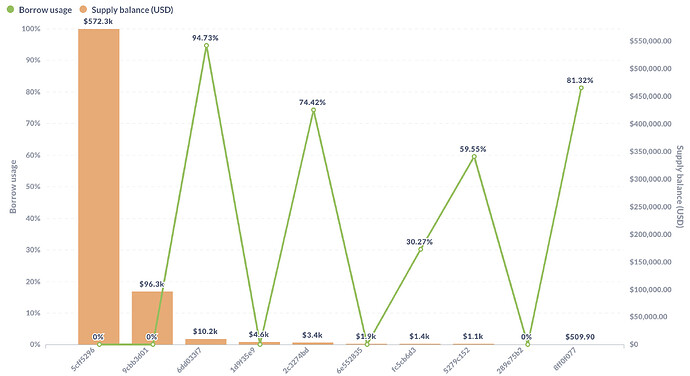

Top 10 Borrowers’ Aggregate Positions & Borrow Usages

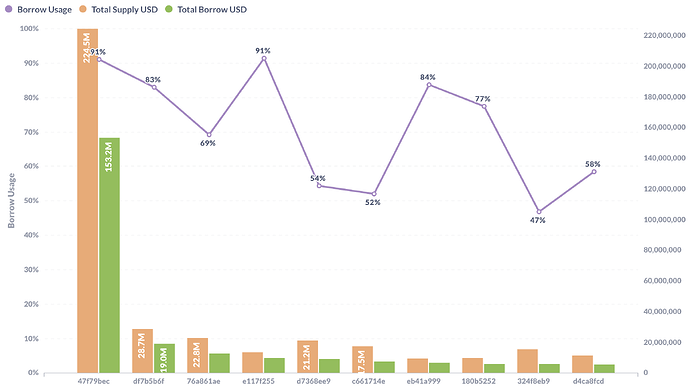

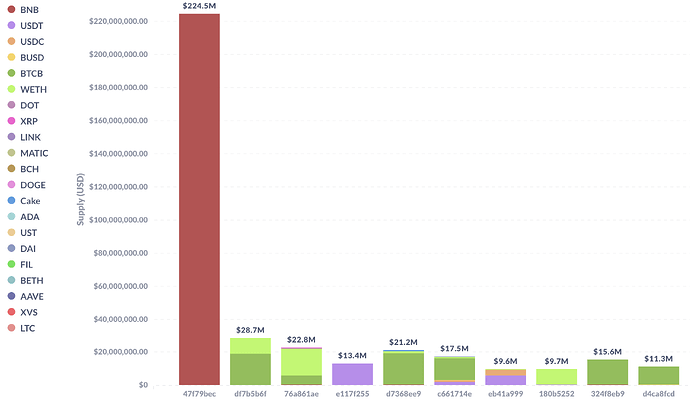

Top 10 Borrowers’ Entire Supply

Top 10 Borrowers’ Entire Borrows

Risk Dashboard

The community should use Gauntlet’s Venus Risk Dashboard to understand better any updated parameter suggestions and general market risk in Venus.

Value at Risk represents the 95th percentile insolvency value that occurs from simulations we run over a range of volatilities to approximate a tail event.

Liquidations at Risk represents the 95th percentile liquidation volume that occurs from simulations we run over a range of volatilities to approximate a tail event.

Quick Links

Please click below to learn about our methodologies:

Gauntlet Parameter Recommendation Methodology

*By approving this proposal, you agree that any services provided by Gauntlet shall be governed by the terms of service available at gauntlet.network/tos.