Gauntlet Recommendations

TUSD (OLD) Deprecation

Summary

- Freeze borrow/supply

- Increase reserve factor to 100%

- Decrease CF from 80% to:

- Conservative: 55%

- Aggressive: 0%

Rationale

- In anticipation of deposits and withdrawals of TUSD being suspended, we recommend immediately freezing borrows/supplies, as well as increasing RF to 100% to disincentivize any further borrowing and supplying of TUSD on Venus.

- We recommend reducing the CF either conservatively or aggressively to further encourage the deprecation of TUSD (OLD), based on the community’s preferences.

-

Conservative: Decrease CF to 55% → Decrease CF to 0%

- With less incentive to borrow or supply TUSD with the above parameter changes, gradually decreasing CF will allow users to adjust their positions over time if they wish to avoid being liquidated.

- After raising awareness around TUSD deprecation and giving users time to adjust their positions, we can then follow up by reducing CF to 0% at which point the remaining suppliers of TUSD will be liquidated and TUSD will no longer be usable as collateral.

-

Aggressive: Decrease to 0% CF immediately.

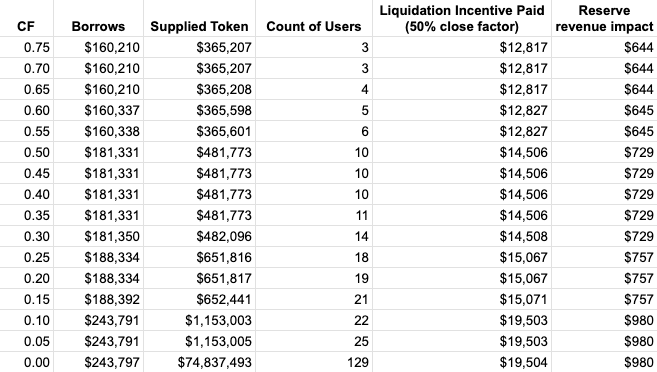

- Gradually reducing CF typically serves to mitigate insolvency risk, however, lowering the CF of TUSD aggressively, to 0% from 80%, results in $243.7k in liquidated borrows, which does not pose significant insolvency risk to the protocol. A $243.7k liquidation volume would result in < 5% slippage for TUSD on BNB chain.

- That said, forced liquidations would disrupt user experience. As such, we leave it to the community as to what level they would like to lower TUSD’s CF.

TUSD (NEW) Asset Listing Recommendations

Summary

For new asset listings, Gauntlet’s goal is to ensure that insolvency and liquidity risks are minimized and that liquidations can be executed effectively. We always recommend setting Collateral Factor for new assets to 0 on the initial listing. Given the uniqueness of this situation (the new token having zero circulating supply and liquidity), we believe this setting should be strongly considered. However, should the community wish to enable the new TUSD token as collateral, we recommend implementing conservative initial parameters with the expectation that we will enable collateral gradually over time once the initial inflow of market supply and demand has been realized.

See our recommendations below:

| TUSD (NEW) | Collateral Factor | Liquidation Incentive | Reserve Factor | Borrow Cap | Supply Cap |

|---|---|---|---|---|---|

| 0% | 10% | 25% | 600,000 | 1,000,000 |

Rationale

Normally, we consider the following metrics when recommending parameters:

- Market cap of the token

- Total supply of the token

- Largest liquidity sources (exchanges including CEX and DEX)

- Volatility (30 day, 90 day, 1 year)

- Average daily trading volume on CEX and DEX

- Other DEX metrics

Building upon our experience making recommendations for TRX and TRXOLD, we will follow a similar approach that employs conservative heuristics to make up for the lack of existing market data for the new TUSD.

We can confidently assume the price of the new TUSD is the same as the old TUSD, and assume its liquidity starts at 1% of that of the old TUSD (2% market depth = $22,021,638 depth), then its 2% market depth would be $220,216. Additionally, the old TUSD’s circulating supply on BNB chain is 28M tokens, 25% depth on BNB chain is 575,000 tokens, and ADV across CEX and DEX sources is 2.04B tokens.

Currently, circulating supply of the new TUSD on BNB chain is only 131k, but being that TUSD is a stablecoin and its old contract has large global liquidity, we are not overly concerned with liquidity concentration risk as we prioritize efficiently migrating users from old to new TUSD. Further, with CF set to 0% we minimize the risk of price manipulation while liquidity develops.

As such, we recommend setting borrow and supply caps of 600,000 and 1,000,000, respectively.

Gauntlet will monitor the TUSD markets closely and make recommendations to improve market activity safely and efficiently as market data continues to accumulate.