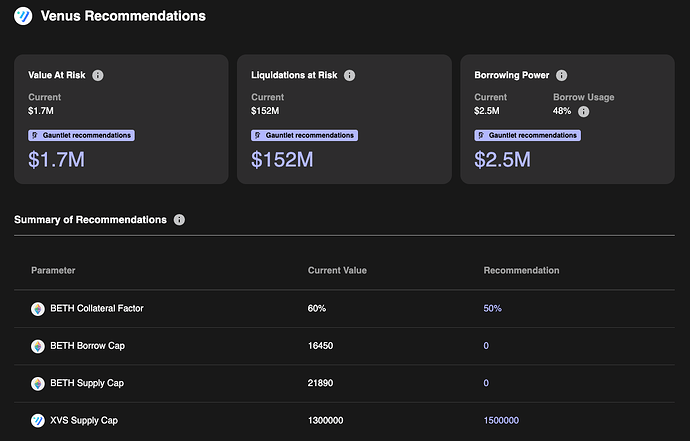

Recommendations from Gauntlet

Summary

-

XVS

- Raise supply cap to 1,500,000 from 1,300,000

-

TRXOLD

- Raise base multiplier to 1.0 from .15

(Raise borrow APR to ~100%)

- Raise base multiplier to 1.0 from .15

-

SXP

- Raise base multiplier to .30 from .15

(Raise borrow APR to ~100%)

- Raise base multiplier to .30 from .15

-

BETH

- Decrease collateral factor to 0.50 from 0.60

- Decrease borrow and supply cap to 0

-

WBETH

- Raise borrow cap to 550 from 200

- Raise supply cap to 800 from 300

Rationale

-

XVS

- Gauntlet understands the importance of Venus users’ ability to keep their positions healthy during periods of market downturn like that which we’ve seen recently. XVS represents a particularly important token to the Venus community in this respect; XVS supply cap usage has reached nearly 100% since raising the supply cap to 1.3M in our last set of parameter recommendations. Given XVS’s supportive global liquidity, Gauntlet recommends raising XVS supply cap to 1.5M from 1.3M, as 1.5M XVS represents only ~10% of its total circulating supply (14.9M).

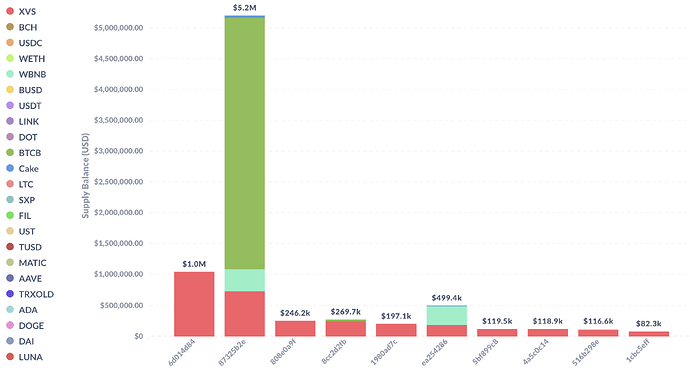

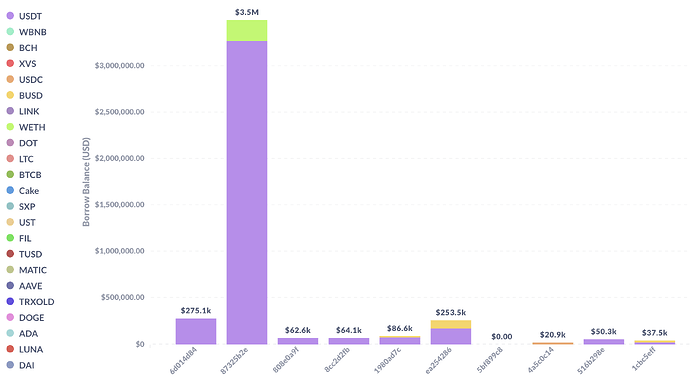

- When looking at the top 10 XVS suppliers on Venus, we note the largest supplier (account ending

...87325b2e) supplying $1M XVS and borrowing $275K of USDT.

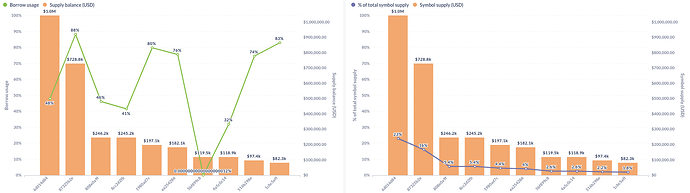

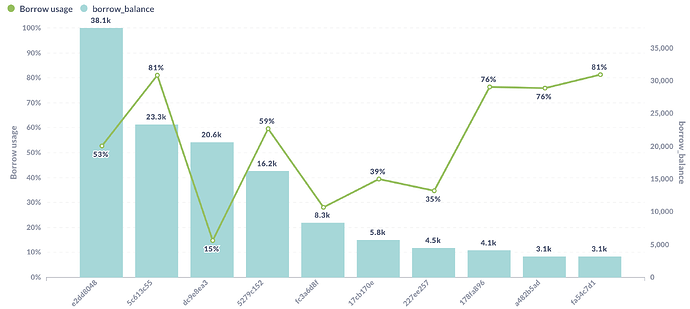

Top 10 XVS suppliers supply balance:

Top 10 XVS suppliers borrow balance:

- Further, we note that the top XVS supplier’s supply balance represents only 23% of the total XVS supply on Venus. Borrow usages amongst these top 10 suppliers are also within a healthy range, and thus raising XVS supply cap does not pose any outsized risk to the protocol.

-

TRXOLD & SXP

- To address the remaining borrow balances of TRXOLD and SXP and aid in their full deprecation on Venus, Gauntlet recommends raising the borrow APR of these assets to ~100% by raising the base multiplier of their interest rate curves. This will help to disincentivize remaining borrowers from maintaining their positions.

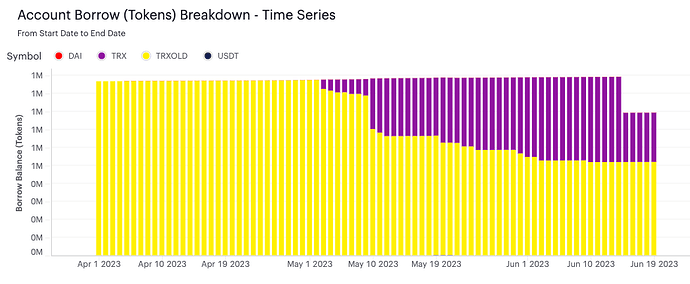

- The TRXOLD borrow balance of one user (account ending

…42cea138) makes up over 90% of the total current TRXOLD borrow balance on Venus. Since April, this user had seemingly been converting their TRXOLD balance to TRX, but this conversion has slowed down since June:

- SXP’s remaining borrow balance on Venus (161.9K SXP) is more evenly distributed amongst its top 10 borrowers, which make up around 121.7K (79%) of the total borrow balance:

- For context, we calculate the days to liquidation for the top borrowers of TRXOLD (account ending

…142cea13; $36,722 TRXOLD) and SXP (account ending…e2dd8048; $12,087 SXP). This represents the days it would take for these users to become liquidatable if they take no action from now on, and allow their borrows/supplies to accrue based on current borrow/supply rates (assuming prices don’t change). At current parameterization, it would take 877 days and 5,782 days respectively for these TRXOLD and SXP users to become liquidatable. However, if the borrow rate APY were raised to ~100% (by raising the multiplier to 1.0 for TRXOLD and 0.30 for SXP), that time reduces to 114 days and 192 days respectively. This prevents any immediate forced liquidations of these users while also providing a definitive window of time for them to convert their positions to avoid liquidation. - Gauntlet will monitor how the lingering TRXOLD and SXP borrowers respond to this adjustment and make further borrow rate increase recommendations if warranted.

-

WBETH

- WBETH reached 100% supply cap utilization upon its listing on Venus on June 19. While WBETH’s global liquidity is robust and developing, we recommend raising caps conservatively to avoid local liquidity concentration risks. The approximate 25% price slippage point for WBETH on PancakeSwap is currently 800 WBETH. Thus, we recommend raising WBETH’s supply cap to 800 from 300, and the borrow cap to 550 from 200.

- Gauntlet will monitor the WBETH market closely and continue to recommend raising borrow and supply caps as warranted by user behavior and as is safely justified based on its available liquidity.

-

BETH

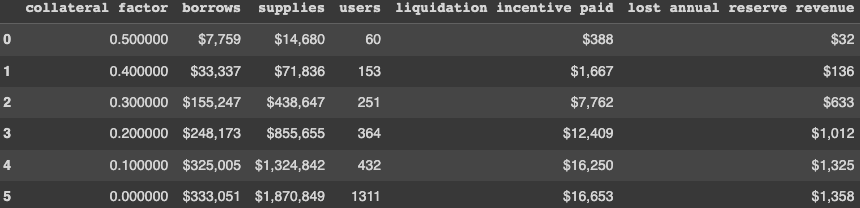

- Now that WBETH has been officially listed on Venus, we recommend carrying on with BETH’s deprecation by lowering the collateral factor to 0.50 from 0.60. From here, we will recommend decreasing BETH’s CF in 10% increments until it reaches 0% to allow users time to adjust their positions and avoid forced liquidations. See the breakdown of liquidations that will occur at each CF level:

- We note that BETH’s aggregate DEX liquidity is currently ~$680K. The top 5 wallets holding BETH on BNB represent a total of 1.5M BETH ($2.5B). Globally, BETH’s ADV is ~$7M and its 2% depth across CEX and DEX sources is ~$21M. Thus, the $14.6K in liquidated supplies that will occur at a CF of 50% can be safely absorbed by Venus. We encourage users to convert their positions, or adjust accordingly to avoid forced liquidations from this change.

- Additionally, with borrowing frozen for BETH, we recommend lowering BETH’s borrow and supply caps both to 0 to prevent any new positions.

- Now that WBETH has been officially listed on Venus, we recommend carrying on with BETH’s deprecation by lowering the collateral factor to 0.50 from 0.60. From here, we will recommend decreasing BETH’s CF in 10% increments until it reaches 0% to allow users time to adjust their positions and avoid forced liquidations. See the breakdown of liquidations that will occur at each CF level:

Methodology

Gauntlet’s parameter updates seek to maintain the overall risk tolerance of the protocol while making risk trade-offs between specific assets.

Gauntlet’s parameter recommendations are driven by an optimization function that balances 3 core metrics: insolvencies, liquidations, and borrow usage. Parameter recommendations seek to optimize for this objective function. Our agent-based simulations use a wide array of varied input data that changes daily (including but not limited to asset volatility, asset correlation, asset collateral usage, DEX / CEX liquidity, trading volume, the expected market impact of trades, and liquidator behavior). Gauntlet’s simulations tease out complex relationships between these inputs that cannot be expressed as heuristics. As such, the input metrics we show below can help explain why some of the param recs have been made but should not be taken as the only reason for the recommendation. The individual collateral pages on the Venus Risk Dashboard cover other vital statistics and outputs from our simulations that can help with understanding interesting inputs and results related to our simulations. To learn more about our methodologies, please see the Quick Links section at the bottom.

Supporting Data

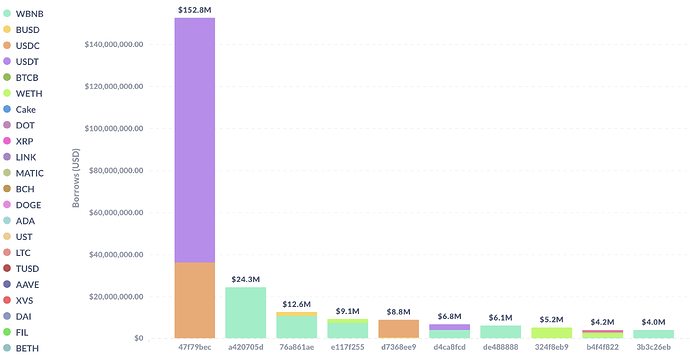

The below figures show trends in key market statistics regarding borrows and utilization that we will continue to monitor:

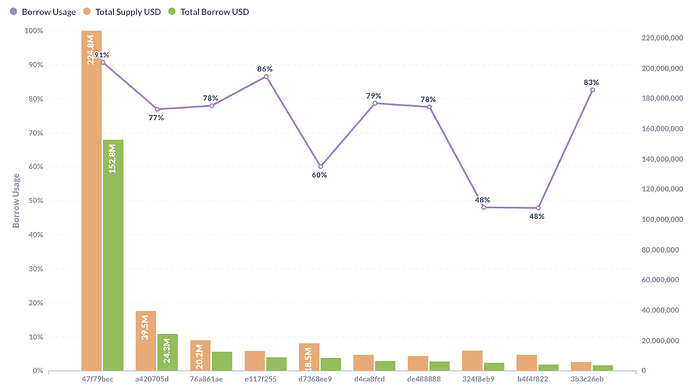

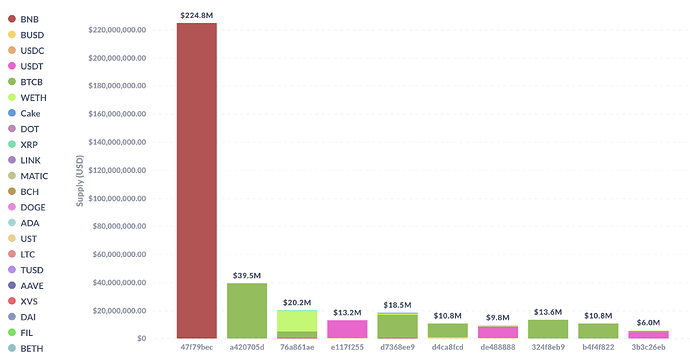

Top 10 Borrowers’ Aggregate Positions & Borrow Usages

Top 10 Borrowers’ Entire Supply

Top 10 Borrowers’ Entire Borrows

Risk Dashboard

The community should use Gauntlet’s Venus Risk Dashboard to understand better any updated parameter suggestions and general market risk in Venus.

Value at Risk represents the 95th percentile insolvency value that occurs from simulations we run over a range of volatilities to approximate a tail event.

Liquidations at Risk represents the 95th percentile liquidation volume that occurs from simulations we run over a range of volatilities to approximate a tail event.

Quick Links

Please click below to learn about our methodologies:

Gauntlet Parameter Recommendation Methodology

By approving this proposal, you agree that any services provided by Gauntlet shall be governed by the terms of service available at gauntlet.network/tos.