Summary

-

Core Pool CF Updates

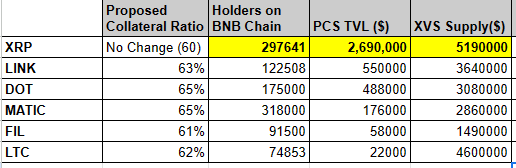

Asset Parameter Current Recommended Change MATIC Collateral Factor 60% 65% +5% DOGE Collateral Factor 40% 43% +3% LTC Collateral Factor 60% 62% +2% FIL Collateral Factor 60% 61% +1% DAI Collateral Factor 60% 75% +15% LINK Collateral Factor 60% 63% +3% DOT Collateral Factor 60% 65% +5% -

agEUR (Stablecoin Isolated Pool)

- Recommendations for launch parameters

Asset Collateral Factor Liquidation Threshold Supply Cap Borrow Cap Base Kink Multiplier Jump Multiplier Reserve Factor agEUR 75% 80% 100,000 50,000 0.02 0.5 0.1 2.5 0.1 -

TUSD

- Proposal to enable TUSD as collateral on the Venus core pool

-

WBETH

- Increase supply cap to 27,000

Analysis

Core Pool CF Updates

Chaos Labs’ Parameter Recommendation Platform runs hundreds of thousands of agent-based blockchain simulations to examine how different Venus risk parameter configurations would behave under adverse market conditions - and find the optimal values to maximize protocol borrow usage while minimizing losses from liquidations and bad debt.

You can view the simulation results and breakdown for the different assets by clicking on them on this page.

The output of our simulations reveals an opportunity to optimize the collateral factor for MATIC, DOGE, LTC, FIL, DAI, LINK, and DOT in the Core Pool, resulting in improved capital efficiency of the system, with a negligible effect on the projected VaR (95th percentile of the protocol losses that will be accrued due to bad debt from under-collateralized accounts over 24 hours) and EVaR (Extreme VaR, the 99th percentile of the protocol losses that will be accrued due to bad debt from under-collateralized accounts over 24 hours)

Simulating all changes jointly yields a projected borrow increase of ~$230K, with no increase in VaR and Extreme VaR compared to simulations with the current parameters.

Liquidity Analysis:

Based on our analysis, we have determined that there is adequate on-chain liquidity to support any significant liquidations with the updated parameters.

Positions Analysis

We have not identified any outsized positions that are actively affecting our recommendations.

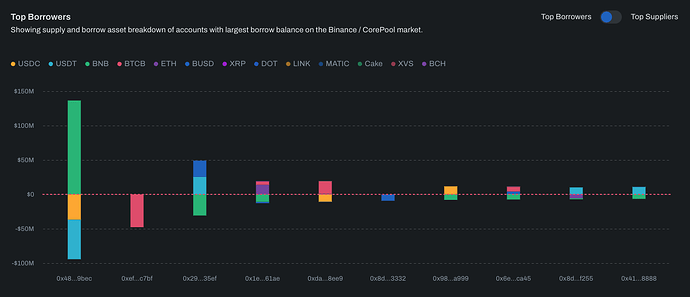

Top Borrowers

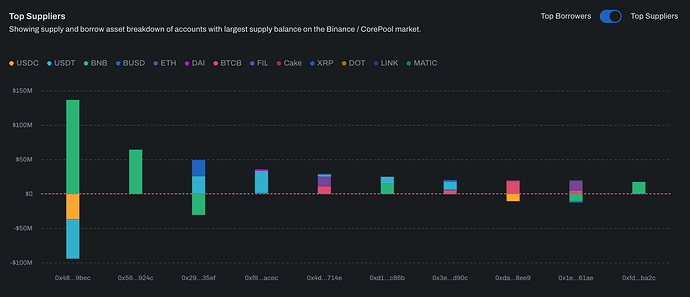

Top Suppliers

TUSD

Chaos Labs ****supports enabling TUSD as collateral in Venus Core Pool based on the asset’s historical stability and its potential to diversify the range of stablecoins available for use as collateral on Venus, further empowering the use of decentralized stablecoins.

Following is our analysis and risk parameter recommendations.

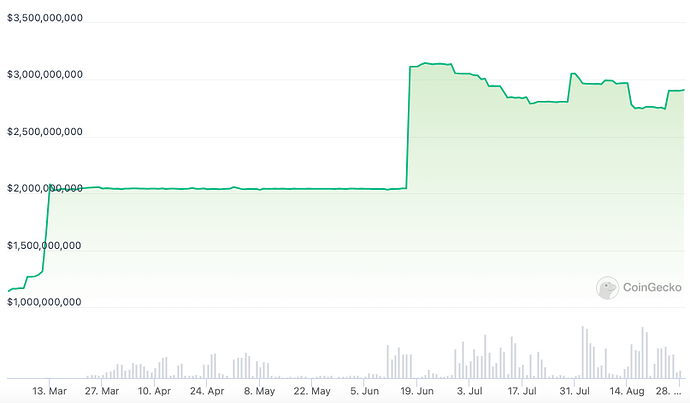

Liquidity and Market Cap

When analyzing market cap and trading volumes of assets for listing, we look at data from the past 180 days. The average market cap of TUSD over the past 180 days was ~$2.3B, and the average daily trading volume was ~$830M (CeFi & DeFi).

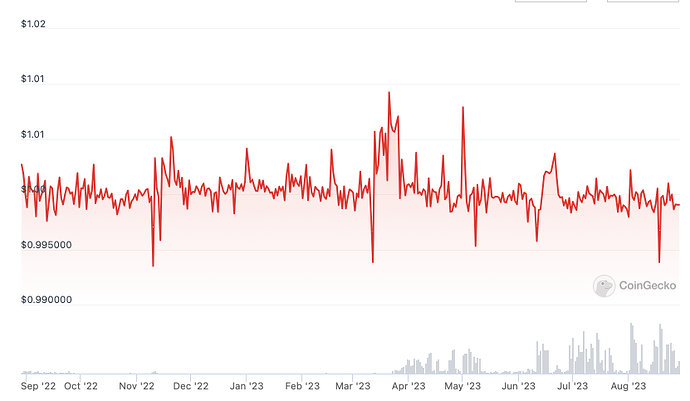

Historic Stability

TUSD has demonstrated stability, weathering various market fluctuations and black swan events. Its consistent performance showcases its reliability and suitability for being used as collateral on the Venus Protocol.

Collateral Factor

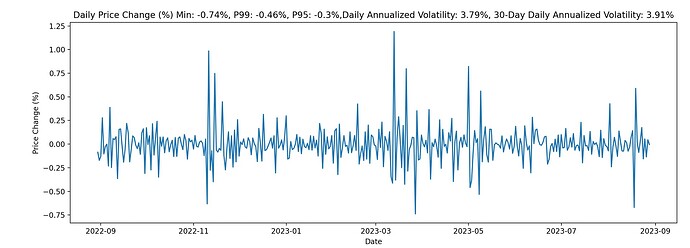

Analyzing TUSD price volatility over the past, we observed a daily annualized volatility of 3.79% and a 30-day annualized volatility of 3.91%. Considering this volatility and the market cap of the asset, alongside the setting of other stablecoins in the Core Pool, we recommend setting a Collateral Factor of 75%.

Current Risk Parameters

While acknowledging the inherent risks associated with adding any new asset as collateral, the potential risks associated with TUSD are mitigated through the prudent implementation of supply and borrow caps. These caps will ensure that the exposure to the asset remains limited and controllable, preventing any undue impact on the stability and security of the Venus Protocol.

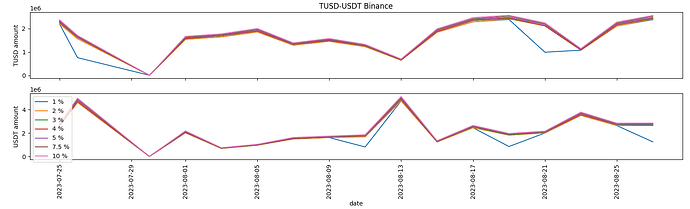

The current supply cap of 1.5M TUSD and borrow cap of 1.2M TUSD are aligned with the current on-chain liquidity. These caps are continuously being monitored and updated according to market state.

IR Curves

Regarding the specific parameters for the Reserve Factor and Interest Rate curves, we suggest keeping the current parameters as they are configured.

We will continue to closely monitor user behavior and track the asset’s performance as collateral. We will proactively adjust these parameters based on real-world data and the asset’s evolving use case to ensure optimal risk management and continued platform security.

WBETH

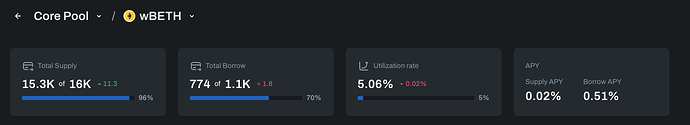

WBETH in Core Pool Supply Cap Utilization has reached 96%:

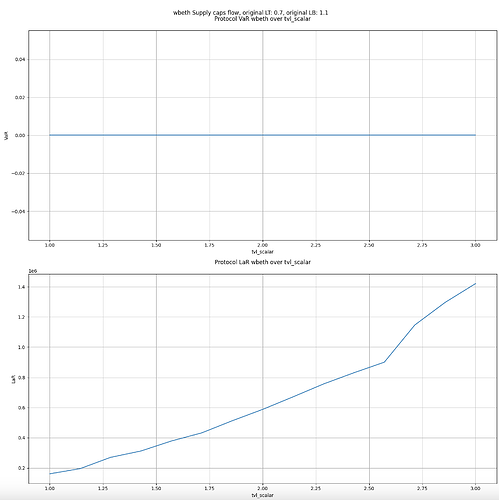

By utilizing our stress test framework, we conclude that increasing the wBETH supply cap to 32,000 does not increase the VaR of the system. However, our methodology caps the supply cap of a single asset at 50% of its total on-chain circulating supply. As the current circulating supply of WBETH is ~54K, we recommend setting the supply cap at 27K.

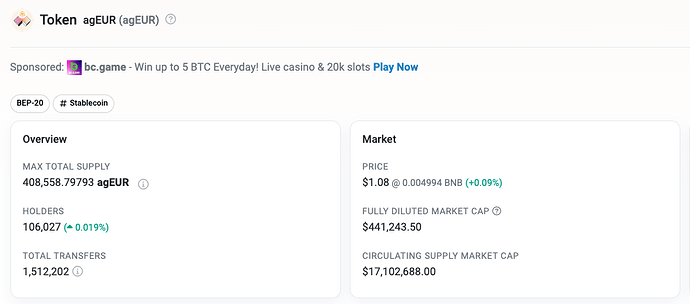

agEUR (Stablecoin Isolated Pool)

Chaos Labs supports listing agEUR in Venus Isolated Stables Pool as part of an overarching strategy to increase the offering of Venus protocol with more stable assets. As a low market cap asset, listing it with appropriate supply and borrow caps is crucial to safeguard the protocol from any imminent risks. Following are our analysis and risk parameter recommendations for the initial listing utilizing the methodology we shared for the Isolated Pools.

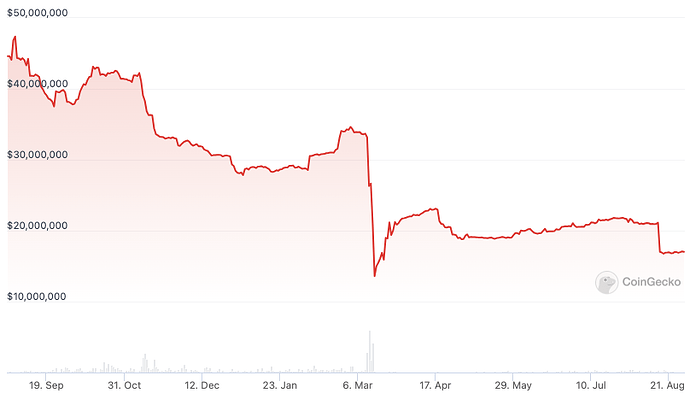

Liquidity and Market Cap

When analyzing market cap and trading volumes of assets for listing, we look at data from the past 180 days. The average market cap of agEUR over the past 180 days was ~$21M, and the average daily trading volume was ~$2.5M (CeFi & DeFi). It should be noted that the token market cap is relatively low. For comparison, HAY’s market cap, which is the lowest market cap token in the isolated stable pool, is ~$40M.

Collateral Factor

Similar to the other stablecoins in the pool, we recommend an initial CF of 75% and a liquidation threshold of 80%

Supply Cap and Borrow Cap

Applying Chaos Labs’ approach to setting initial supply caps for new assets, we propose setting the supply cap at 2X the on-chain liquidity available under the Liquidation Incentive (configured to 10%) price impact. Additionally, for the launch, we advise setting a restriction such that the supply cap does not exceed 25% of the total circulating on-chain supply for each asset.

Given the concentrated liquidity of agEUR, we recommend a supply cap of 100,000 agEUR (25% of on-chain supply), and a borrow cap of 50,000 agEUR.

IR Curves

We recommend the following setting, similar to that of HAY on the isolated market, which may be adjusted after analyzing the usage of the assets post-launch.

- Base - 0.02

- Kink - 0.5

- Multiplier - 0.1

- Jump Multiplier - 2.5

- Reserve factor- 0.1