Summary

- Core Pool CF Updates

| Asset | Parameter | Current | Recommended | Change |

|---|---|---|---|---|

| XRP | Collateral Factor | 60% | 65% | +5% |

| FIL | Collateral Factor | 61% | 63% | +2% |

| LTC | Collateral Factor | 62% | 63% | +1% |

| ADA | Collateral Factor | 60% | 63% | +3% |

-

Supply and Borrow Cap Updates

- TUSD

- Increase supply cap to 3,000,000

- WBETH

- Increase borrow cap to 2,200

- TUSD

Analysis

Core Pool CF Updates

Chaos Labs’ Parameter Recommendation Platform runs hundreds of thousands of agent-based blockchain simulations to examine how different Venus risk parameter configurations would behave under adverse market conditions - and find the optimal values to maximize protocol borrow usage while minimizing losses from liquidations and bad debt.

You can view the simulation results and breakdown for the different assets by clicking on them on this page.

The output of our simulations reveals an opportunity to optimize parameters for XRP, FIL, LTC and ADA in the Core Pool, resulting in improved capital efficiency of the system, with a negligible effect on the projected VaR (95th percentile of the protocol losses that will be accrued due to bad debt from under-collateralized accounts over 24 hours) and EVaR (Extreme VaR, the 99th percentile of the protocol losses that will be accrued due to bad debt from under-collateralized accounts over 24 hours)

Simulating the changes jointly yields a projected borrow increase of ~$180K, with no increase in VaR and Extreme VaR compared to simulations with the current parameters.

Liquidity Analysis:

Based on our analysis, we have determined that there is adequate on-chain liquidity to support any significant liquidations with the updated parameters.

Positions Analysis

We have not identified any outsized positions that are actively affecting our recommendations.

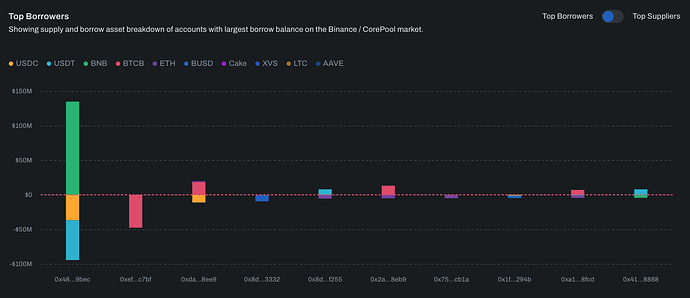

Top Borrowers

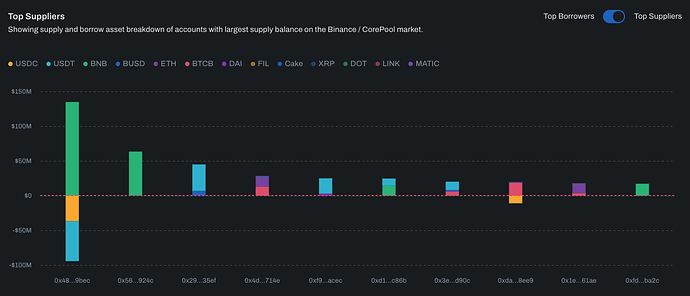

Top Suppliers

Supply and Borrow Cap Updates

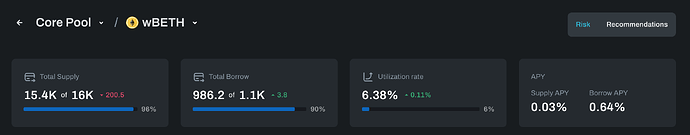

WBETH

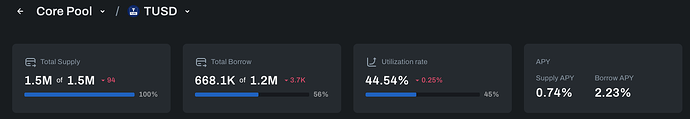

TUSD (Core Pool) Supply Cap Utilization has reached 100%:

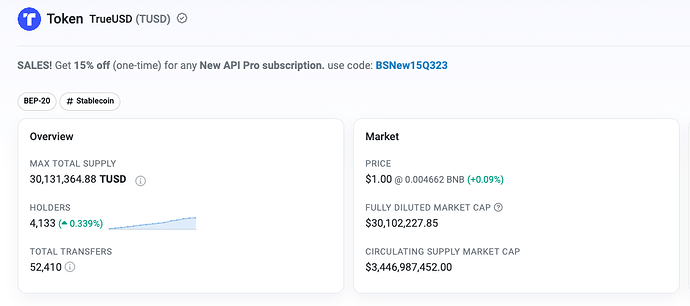

By utilizing our stress test framework, we conclude that doubling the supply cap to 3M does not increase the VaR of the system. Additionally, our methodology caps the supply cap of a single asset at 50% of its total on-chain circulating supply. As the current circulating supply of TUSD is ~30M, this does not impact our recommendation.

WBETH

WBETH (Core Pool) Borrow Cap Utilization has reached 100%:

Given the current distribution of borrowers and liquidity conditions, we recommend doubling the borrow cap to 2,200.