Rationale

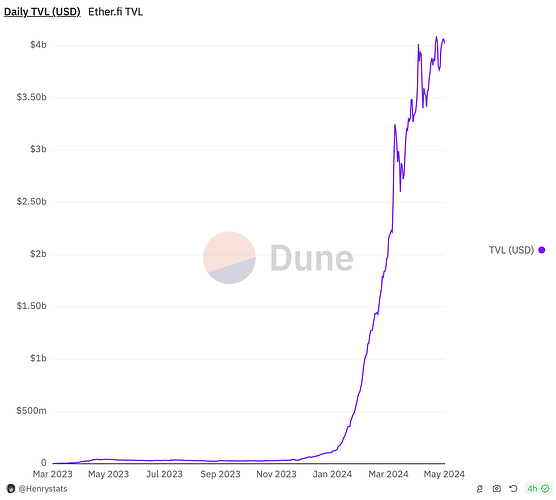

Restaking narrative has gained tremendous traction over the past month with various LRT protocols capturing significant liquidity, of which Pendle currently contributes approx $600M liquidity across various LRT pools.

Through supporting Pendle’s Principal Tokens (PT) as collateral, Venus Protocol can tap into Pendle’s LRT liquidity and capture borrowing demand from the rising restaking narrative.

Proposal Summary

- Support Pendle’s LRT Principle Tokens (PT) as collateral on Venus’s ethereum mainnet

- Delegate full discretion for Venus’s risk managers to decide which LRT assets on Pendle to support, including decisions on whether to include PT tokens in existing pools or creating separate pools for restaking related assets, and also parameters such as collateral factors, borrow limit etc.

Motivation

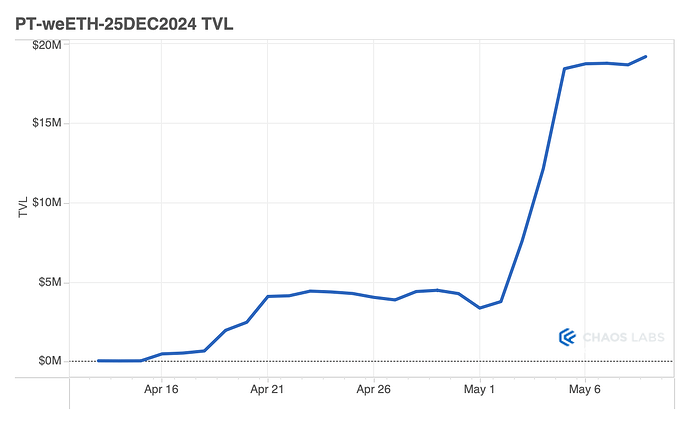

- Pendle currently contributes approx $600M of LRT’s overall TVL

- Principal Tokens (PT) held by users can be unlocked as liquidity if they are supported as collateral on money markets

- Current liquidity breakdown of floating PT-LRTs

- PT-weETH (27 Jun 2024): >100,000 ETH (~$290M)

- PT-rsETH (27 Jun 2024): >22,000 ETH (~$63M)

- PT-ezETH (25 Apr 2024): >21,000 ETH (~$60M)

- Venus Protocol can be one of the first money markets supporting PT-LRTs as collateral

- Borrowing demand from these floating PT tokens will create attractive deposit yield for Venus’s lenders

What is Pendle

The Pendle protocol enables permissionless tokenization and trading of yield. Pendle allows anyone to purchase assets at a discount, obtain fixed yield, or long DeFi yield. The protocol enables this by taking yield-bearing tokens and then splitting them into their principal and yield components, PT (principal token) and YT (yield token) respectively, which allows them to be traded via Pendle’s AMM.

Pendle brings the TradFi interest derivative market into DeFi. In traditional finance, interest rate swaps are the biggest market in the world at >$500T. PT is the equivalent of zero-coupon bonds while YT is the equivalent of coupon payments. Pendle is positioning itself to become a core infrastructure for on-chain yield trading.

Principal Tokens Mechanics

PT is a non-rebasing token. PT represents the principal portion of the underlying asset and can be redeemed 1:1 for the underlying asset at maturity. Since the yield component (staking/restaking rewards and points accrual) has been separated, PT can be acquired at a discount compared to the underlying asset. The value of PT will approach and ultimately match the value of the underlying asset on maturity.

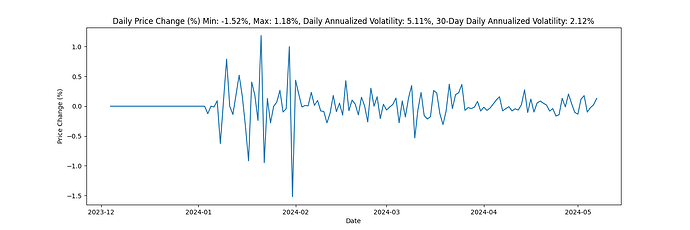

Due to its mechanics, the value of PT is tightly correlated with the value of its underlying asset. At maturity, the price of 1 PT is equivalent to 1 underlying asset.

Details on how PT is minted can be found here:

https://docs.pendle.finance/ProtocolMechanics/YieldTokenization/SY

Details of PT Oracle can be found here:

https://docs.pendle.finance/Developers/Integration/PTOracle

Details of using PT as collateral in Money Markets can be found here:

https://docs.pendle.finance/Developers/Integration/PTAsCollateral

Security and Audit

Pendle smart contracts have been audited by Ackee, Dedaub, Dingbats, and some of the top wardens from Code4rena. All of Pendle’s smart contracts are open source.

The complete list of audit reports can be found on our Github repo:

https://github.com/pendle-finance/pendle-core-v2-public/tree/main/audits

Risk Analysis

-

Depeg of underlying LRTs: The value of LRTs such as eETH, rsETH and ezETH although pegged to an ETH value that can be redeemable, is still subject to market forces that might cause temporary depegs from its actual value. Arbitrageurs are fast to capture this inefficiency but nonetheless, this can cause liquidations to users as the price of LRTs and PT-LRTs fluctuates

-

PT-LRTs price fluctuation: Historically, price of PT has shown low volatility and is tightly correlated with the price of its underlying asset. However, during extreme market conditions, the price of PT might be temporarily dislocated, potentially causing liquidation to users.

-

Redemptions: PT-LRTs are redeemable for its underlying LRTs with a 1:1 ratio at maturity. Users that wish to exit their PT position before maturity can either sell into Pendle’s AMM or by matching their PT with an equivalent amount of YT to redeem underlying LRT. However, during extreme market conditions, the liquidity of PT-LRT pools might fluctuate wildly, potentially impacting users’ ability to exit their PT positions.

-

Slippage: Based on current liquidity, slippage when selling $1M worth of PT-LRTs in a single transaction ranges between 0.05% to 0.1%. Note that the price-impact range will fluctuate based on the future liquidity of PT-LRT pools.

-

Smart Contract Vulnerabilities: Although PT has been audited by top auditors in the space, there is always the risk of black swan events with vulnerabilities that were not found by the audits or exploited yet.

-

Oracles: Any issues with PT’s price oracle might result in wrongful liquidations of users.

Reference

- Other money markets that has already supported Pendle’s PT or LP tokens as collateral include Stella, Dolomite, Seneca, Timeswap, Myso Finance, Teller Finance etc