Summary

This proposal seeks to approve the listing of PT-sUSDe (26 June) as a non-borrowable asset in Venus Core Pool on BNB.

Context

Since its launch, PT-sUSDe has consistently been the top most used collateral within the Pendle ecosystem. Currently, more than $315m PT-sUSDe are used as collateral across major money markets.

Following Ethena’s expansion on BSC and Venus DAO’s approval to list sUSDe and USDe on Venus BNB Core Pool, supporting PT-sUSDe as a non-borrowable collateral will further cement Venus as the main money market for all Ethena and Pendle related assets on BSC.

This proposal builds upon previous success of listing Pendle’s PTs such as PT-weETH, PT-SolvBTC.BBN and PT-clisBNB.

Details

Pendle Website: Pendle

PT-sUSDe (26 June) contract: https://bscscan.com/address/0xdd809435ba6c9d6903730f923038801781ca66ce

Github: GitHub - pendle-finance/pendle-core-v2-public

Audits: pendle-core-v2-public/audits at main · pendle-finance/pendle-core-v2-public · GitHub

PT Oracles: Introduction of PT Oracle | Pendle Documentation

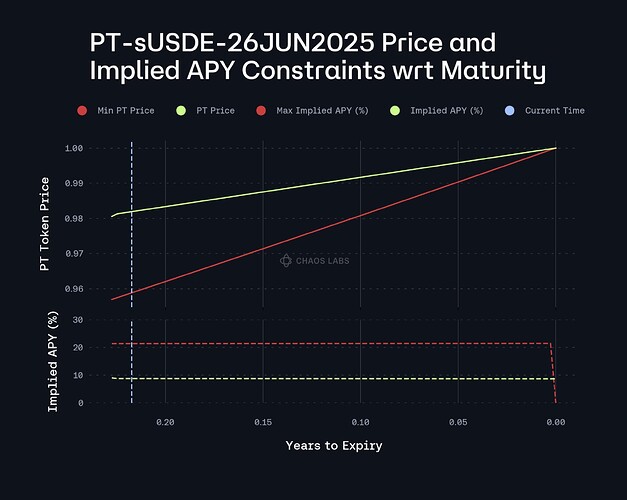

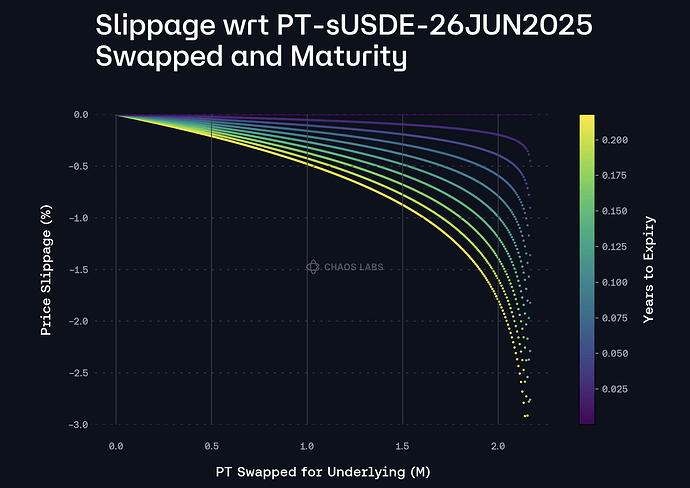

Risk Parameters

Full discretion for Chaos Labs to determine suitable risk parameters for PT-sUSDe (26 June) as a non-borrowable collateral in Venus BNB Core Pool.