Overview

Chaos Labs supports listing apxETH on Venus Protocol’s Liquid Staked ETH deployment on Ethereum. Below is our analysis and recommendations for initial risk parameters.

Technical Overview

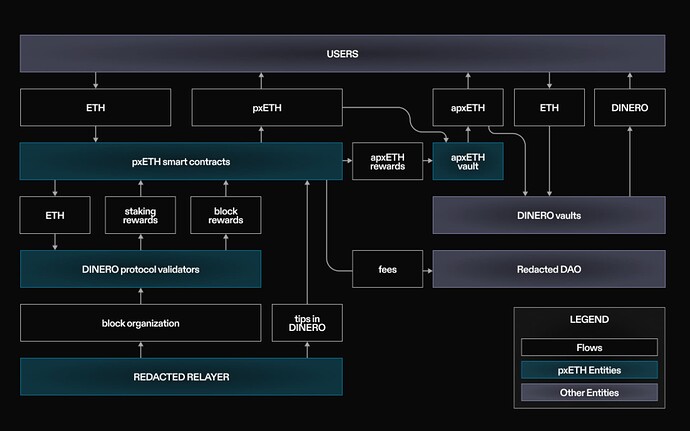

The Dinero protocol integrates ETH staking, block proposal and building, RPC services, leverage, and yield stripping into a unified ecosystem built around pxETH, the Dinero Relayer RPC, and the DINERO stablecoin. It offers a public, permissionless RPC for user access, a decentralized stablecoin (DINERO) designed as a medium of exchange on Ethereum, and an ETH LST that captures staking yield along with benefits from the Dinero protocol.

Pirex ETH (pxETH) is a new LST for ETH. Users deposit ETH into the Dinero protocol on-chain via immutable pxETH smart contracts, minting pxETH at a 1:1 ratio for the deposited ETH. The majority of this ETH is staked by Dinero protocol validators. These validators use a custom Ethereum execution client integrated with Dinero smart contracts to manage validator and withdrawal keys. Initially, the Dinero protocol will primarily operate these validators. A portion of the deposited ETH is kept unstaked as a buffer to enable instant withdrawals when funded. Instant withdrawals incur a 0.5% withdrawal fee but provide zero price impact for liquidators. While performing a standard withdrawal takes up to 8 days with a 0.03% fee.

The pxETH token itself does not earn rewards. However, it can be deposited into an auto-compounding rewards vault in exchange for apxETH, an ERC-4626 vault share token. This vault accrues rewards from Ethereum staking and sources like MEV tips. Since the Dinero Protocol DAO incentivizes pxETH liquidity on DEXs using treasury holdings, not all pxETH will be deposited into the rewards vault. This dynamic creates a leverage effect, where each pxETH in the vault benefits from rewards tied to more than one ETH staked in the Dinero protocol.

DINERO Protocol Architecture

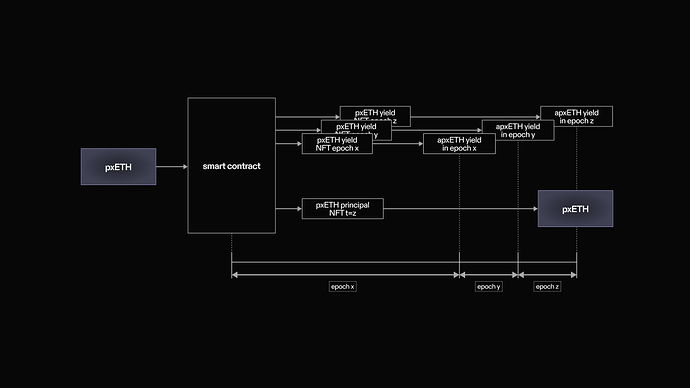

Besides simply holding apxETH, the Dinero protocol introduces yield stripping, enabling users to tokenize the future yield and principal of their staked pxETH into ERC-1155 semi-fungible tokens. By depositing pxETH into the apxETH rewards vault, users can exchange it for two distinct tokens: a principal token (redeemable for the original pxETH after a specified period) and yield tokens (representing staking rewards for specific periods). This feature caters to users seeking liquidity, speculative opportunities, or participation in other DeFi strategies.

Yield Stripping Mechanism

Market & Ecosystem

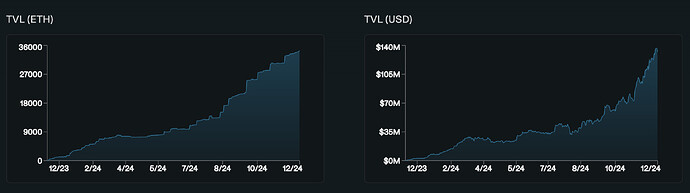

pxETH’s TVL has shown a steady growth trend. As of December 2024, a total of 34,427 ETH, equivalent to approximately $132 million, has been locked. Additionally, pxETH’s TVL experienced significant growth recently, rising from $75 million to $123 million in November 2024 alone, marking an increase of approximately 64%.

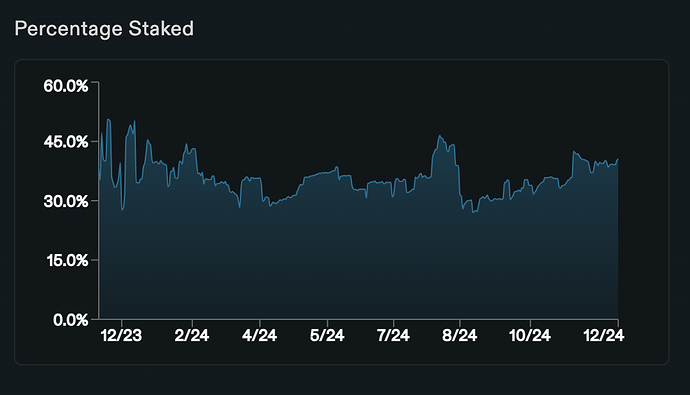

Taking it a step further, if we examine the percentage of pxETH that is staked, we find that this proportion has consistently remained between 30% and 45%. As of now, the total supply of apxETH is approximately 13.2K.

Liquidity

apxETH does not have direct liquidity, as it represents a share in the auto-compounding rewards vault and accrues value over time relative to pxETH. However, since Dinero Protocol’s smart contract facilitates frictionless conversion between apxETH and pxETH, apxETH liquidity can be accessed indirectly through pxETH.

The conversion from apxETH to pxETH is handled internally within the AutoPxEth.sol smart contract. This process is fully managed within the protocol, eliminating slippage and price impact since no external market interactions are required.

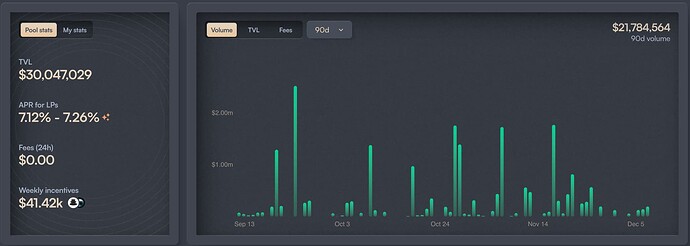

Currently, the largest pxETH liquidity pool is on Balancer. As shown in the chart below, its TVL is approximately $30 million.

Additionally, the pxETH provides an ETH buffer to enable instant withdraws, which currently accounts for 1724 ETH or $6.3M. The size of this buffer can be found by calling the buffer read function in the pxETH smart contract, and a maximum value of 1724 ETH is currently set for it. Instant withdrawals from the ETH buffer incur a 0.5% withdrawal fee but no price impact.

Volatility

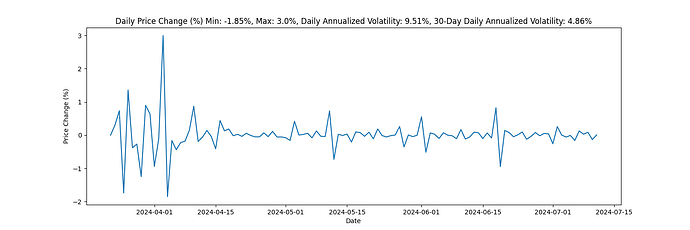

Relative to WETH, pxETH has low and decreasing volatility, measuring 9.51% daily annualized over the last 180 days and 4.86% over the last 30 days. The maximum price drop over the last 180 days is 1.83%.

Isolated Pool

Given the anticipated use case for the asset — leveraging staking yield — we recommend listing it in the Ethereum Liquid Staked ETH isolated pool.

Collateral Factor, Liquidation Threshold, and Liquidation Bonus

Given the above analysis, we can observe that the Dinero ecosystem is experiencing steady growth, as reflected in its steadily increasing TVL. Additionally, pxETH maintains a strong peg to WETH, and liquidity remains robust enough to withstand highly stressed market conditions.

Given these considerations, as well as the fact that it can only borrow ETH-correlated collateral, we recommend setting the initial Collateral Factor at 80% and the Liquidation Threshold at 85%.

Interest Rate Curve

Based on the project’s novelty and current user behavior (where 30% to 45% of pxETH is typically staked for apxETH), we recommend setting the kink at 45% for now.

Supply and Borrow Cap

We recommend setting supply caps according to our usual methodology, at two times the liquidity available below the liquidity bonus. Thus, we recommend setting the supply cap to 12,000 apxETH, with the borrow cap set to 10% of this value.

Recommendation

| Asset |

apxETH |

| Chain |

Ethereum |

| Pool |

Liquid Staked ETH |

| Collateral Factor |

80% |

| Liquidation Threshold |

85% |

| Liquidation Incentive |

2% |

| Supply Cap |

12,000 |

| Borrow Cap |

1,200 |

| Kink |

45% |

| Base |

0.0 |

| Multiplier |

0.09 |

| Jump Multiplier |

2.0 |

| Reserve Factor |

20% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this Recommendation.

Copyright

Copyright and related rights waived via CC0