Overview

Chaos Labs supports listing zkETH on Venus Protocol’s Core Pool on ZkSync. Below is our analysis and recommendations for initial risk parameters.

Technical Overview

Chaos Labs has conducted a technical overview of the Dinero protocol, pxETH, and apxETH in this post. zkETH is a native ETH LST built for the ZKSync Era mainnet and Elastic Chain. Minted by locking ETH that is staked on Ethereum mainnet validators via Dinero’s two-token model, zkETH is backed by apxETH. However, zkETH is specifically designed for integration with ZKSync Era. As an index token, zkETH’s value appreciates against ETH over time as staking yields accrue.

Users can mint zkETH by staking ETH either on Ethereum mainnet or directly on ZKSync. zkETH can be swapped for WETH on ZKSync DEXes, or it can be redeemed for pxETH through the AutoPxEth.sol contract. However, this withdrawal method requires bridging to Ethereum mainnet to complete the redemption.

Market & Liquidity

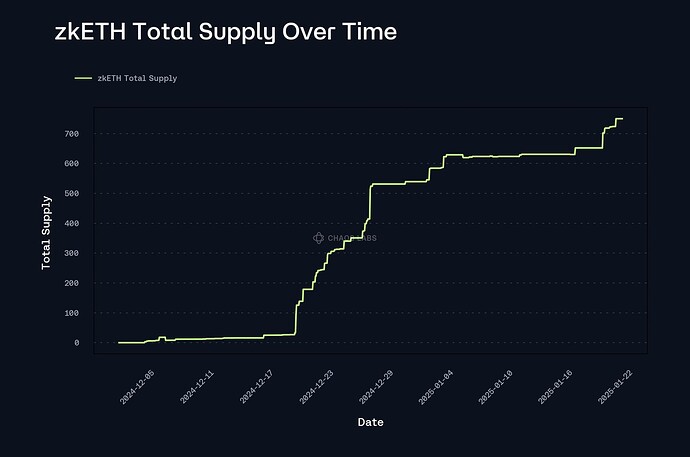

Currently, zkETH has a total TVL of $2.46M, corresponding to 750 ETH locked. Below, we present zkETH’s total supply over time.

Compared to our previous analysis, pxETH has shown an increase in TVL, with approximately $50M growth over the past month. As of this writing, its TVL stands at $178.04M.

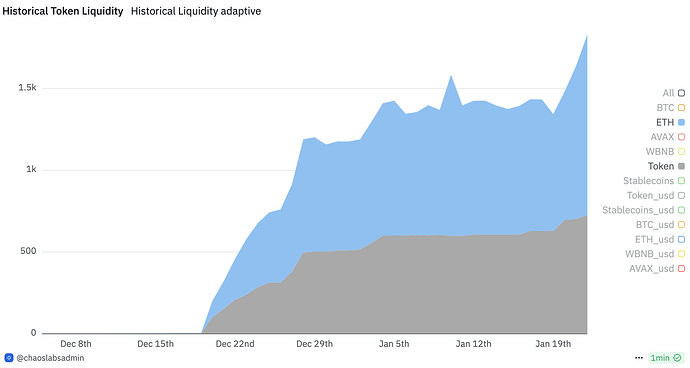

Currently, the primary liquidity for zkETH is sourced from the Maverick WETH/zkETH pool, which holds a total TVL of $6M and a balance of 726 zkETH. Below, we present the liquidity data for this pool from its inception to today, spanning approximately 40 days.

Collateral Factor, Liquidation Threshold, and Liquidation Bonus

Based on the above analysis, it is clear that the Dinero ecosystem is experiencing steady growth. However, zkETH remains relatively new, having been live for just over a month. Additionally, its secondary market liquidity data is limited, with the liquidity pool only launched a month ago and showing growth in the last 15 days. Given these factors, we recommend implementing conservative initial parameters for its inclusion in the core pool.

Therefore, we recommend setting the initial Collateral Factor at 70% and the Liquidation Threshold at 75%.

Supply and Borrow Cap

We typically recommend setting supply caps based on our standard methodology, which is two times the liquidity available below the liquidity bonus. Using this method, we reached an initial supply cap of 2400 zkETH.

Given zkETH’s yield-bearing nature and its anticipated limited borrowing use cases, as observed in our previous analyses, we recommend designating zkETH as non-borrowable at this time.

Pricing/Oracle

We recommend leveraging the internal exchange rate between rzkETH and pxETH when pricing zkETH (LSTPerToken function in the rzkETH contract), augmented with an underlying ETH/USD price feed.

Recommendation

| Asset | zkETH |

|---|---|

| Chain | zkSync |

| Pool | Core |

| Collateral Factor | 70% |

| Liquidation Threshold | 75% |

| Liquidation Incentive | 10% |

| Supply Cap | 2400 |

| Borrow Cap | - |

| Kink | - |

| Base | - |

| Multiplier | - |

| Jump Multiplier | - |

| Reserve Factor | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0