Recommendations from Gauntlet:

SXP

- Decrease CF to 0.25

TRXOLD

-

Conservative:

- Decrease CF to 0.30

-

Aggressive:

- Decrease CF to 0.0

TRX

-

Conservative:

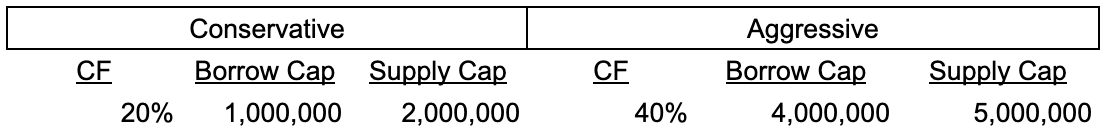

- Increase CF to 0.20

- Increase Borrow Cap to 1,000,000

- Increase Supply Cap to 2,000,000

-

Aggressive:

- Increase CF to 0.40

- Increase Borrow Cap to 4,000,000

- Increase Supply Cap to 5,000,000

Deprecation Plan for SXP

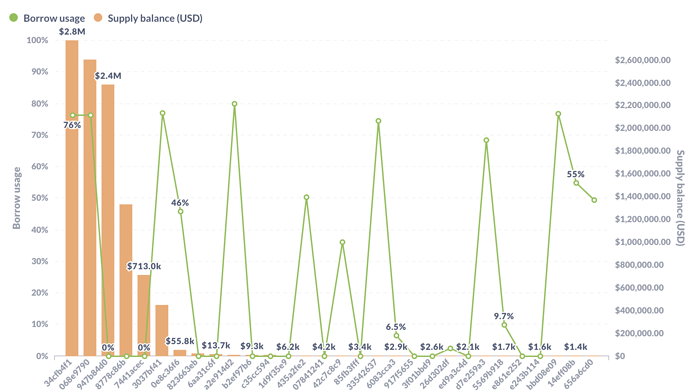

We are updating our recommendations for deprecating SXP from Venus protocol. See the chart below of the largest 30 suppliers of SXP and their respective borrow usages:

Risk Off Liquidations

Only the top 6 accounts have supply balances of SXP greater than $100,000. Of these, the first ($2.8m of supplied SXP), second ($2.6m of supplied SXP), and sixth ($452k of supplied SXP) accounts have positive borrow usages. These three accounts’ borrow usages are 76%, 76%, and 77%, respectively. Thus, we do not expect a reduction in CF to 25% to cause any significant risk off liquidations.

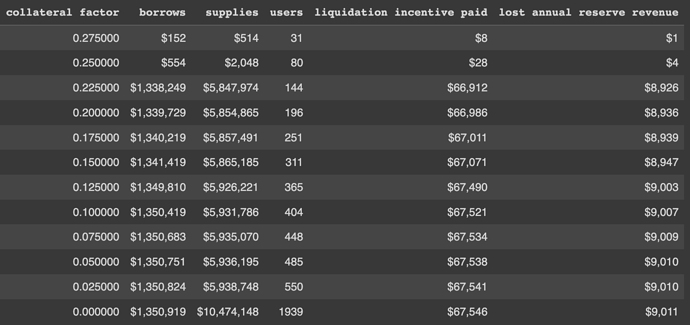

The table below details the liquidations of accounts supplying SXP that would occur at lower collateral factors, their borrows, liquidations incentives that would be paid, and potential lost reserve fee revenue.

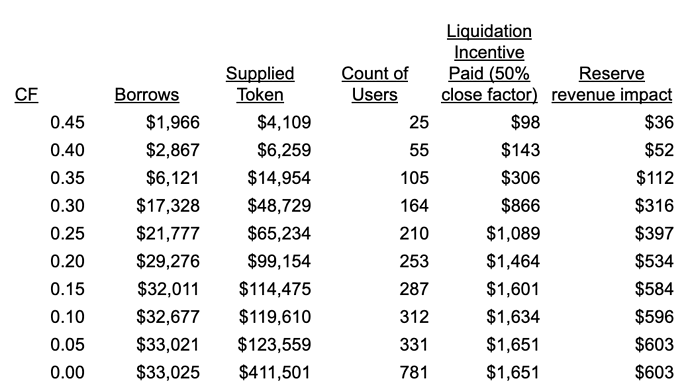

Deprecation Plan for TRXOLD

Both the borrows and supplies of TRXOLD on Venus have decreased since our last analysis, and as such the deprecation of TRXOLD can be accelerated without adding outsized risk to Venus.

- Conservative: Decrease collateral factor to 0.30.

- Aggressive: Decrease collateral factor to 0 immediately.

See the chart below for updated forced liquidations resulting from lower collateral factors of TRXOLD.

The aggregate 2% depth of TRXOLD (on CEX and DEX sources) is ~$200k, while the 2% depth of TRXOLD on Binance chain is $66k. As such, the market can easily absorb liquidations for all the accounts that supply TRXOLD on Venus. As such, lowering TRXOLD’s collateral factor to 0 would not introduce significant risk to Venus.

TRX Updated Parameters

Given the improved liquidity conditions of the new TRX token, we provide updated parameter recommendations:

Normally, we consider the following metrics when recommending parameters:

- Market cap of the token

- Total supply of the token

- Largest liquidity sources (exchanges including CEX and DEX)

- Volatility (30 day, 90 day, 1 year)

- Average daily trading volume on CEX and DEX

- Other DEX metrics

In this case, because there is no extensive history of data for the new TRX token, we use on chain liquidity metrics to assess its risk. The circulating supply is about the same between TRXOLD and the new TRX (~280m tokens), and the top five wallets currently hold ~69m of the new TRX compared to 31.5m TRXOLD held by its top five wallets. As such, liquidity of the new TRX on Binance chain appears to be comparable to TRXOLD. We also assess the risk of price manipulation with respect to collateral factor, borrow cap, and supply cap recommendations; that risk is relatively low for our conservative and aggressive recommendations.

Next Steps

- These recommendations will be put up for a VIP vote

By approving this proposal, you agree that any services provided by Gauntlet shall be governed by the terms of service available at gauntlet.network/tos.