Overview

Chaos Labs supports listing weETH on a new Venus BNB Chain isolated pool alongside WETH. Following is our analysis and risk parameter recommendations for the initial listing.

Note: The following analysis is conducted solely from a market risk viewpoint, excluding centralization and third-party risk considerations. If the community aims to reduce exposure to weETH, adopting more conservative supply and borrow caps should be considered.

Liquidity and Market Cap

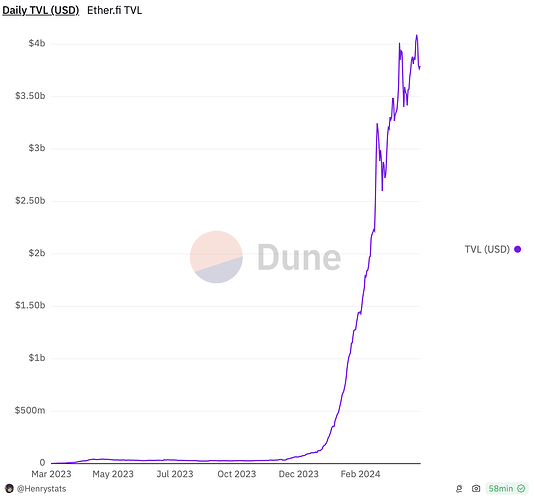

The launch of eETH withdrawals, or the native “liquidity pool,” occurred at the end of December 2023. Since then, alongside a speculative point-based incentive structure, EtherFi’s TVL has grown rapidly, reaching $4B, while weETH has averaged $24.5 million in daily volume. The limited historical data, alongside the asset’s rapid growth, highlight the need for a more conservative listing approach, as rapid growth driven by speculative incentives could lead to significant and sudden reductions in liquidity down the line.

However, the asset is still relatively small on BNB Chain, with an on-chain supply of 256 weETH at the time of writing.

weETH Volatility

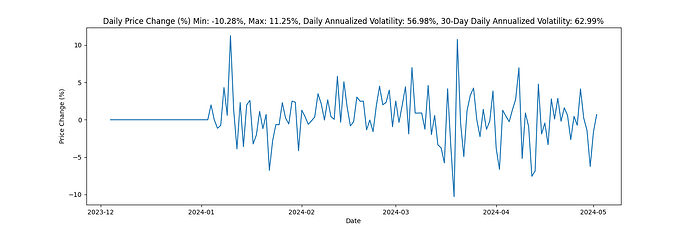

Since launch, relative to USD, weETH’s 30-day annualized volatility is 62.99%, with a maximum single-day price drop of 10.28%.

Relative to ETH, weETH’s 30-day annualized volatility is 2.07%, and its largest single-day price drop is 1.52%.

Collateral Factor

To optimize the CF and LT setting for LST/Underlying Asset borrowing and allow more leverage for looping, we recommend implementing a calculated price oracle. This oracle would utilize the primary exchange rate to determine the oracle price for weETH in correlation with the price of WETH.

Considering this, we recommend setting the CF similarly to the recommended parameters of wstETH and WETH in the Ethereum LST Isolated Pool, at 90%, with LT at 93%

Supply and Borrow Cap

Chaos Labs’ approach to initial supply caps involves setting the Supply Cap at 2x the liquidity available under the Liquidity Penalty (set at 10%) price impact.

This would call for a 500 weETH initial supply cap. However, we do not recommend exceeding 75% of a chain’s circulating supply for LSTs. The current on-chain supply is 355 weETH; we propose starting at 50%, for an initial supply cap of 150 weETH. We will monitor this closely and may recommend increasing caps should on-chain liquidity and supply grow.

The utilization rate for LSTs has been historically low on borrow/lend protocols due to additional borrowing costs. However, as we’ve observed increased demand for borrowing weETH on the Ethereum deployment, we recommend an initial borrow cap of 50% of the supply cap.

IR Curve Parameters

We recommend aligning the interest rate parameters with those of similar assets to ensure consistency across similar assets on Venus.

Additional Parameters

- Close Factor - 50%

- Liquidation Incentive - 2%

- minLiquidatableCollateral 100 USD

Recommendations

Following the above analysis, we recommend listing weETH in a new isolated pool with WETH with the following parameter settings:

| Asset | WETH |

|---|---|

| Collateral Factor | 90% |

| Liquidation Threshold | 93% |

| Supply Cap | 125 |

| Borrow Cap | 110 |

| Kink | 80% |

| Base | 0% |

| Multiplier | 3.5% |

| Jump Multiplier | 80% |

| Reserve Factor | 15% |

| Asset | weETH |

|---|---|

| Collateral Factor | 90% |

| Liquidation Threshold | 93% |

| Supply Cap | 125 |

| Borrow Cap | 65 |

| Kink | 45% |

| Base | 0% |

| Multiplier | 9% |

| Jump Multiplier | 75% |

| Reserve Factor | 20% |