Overview

Chaos Labs supports listing weETH on Venus’s Unichain Core pool. Below, we provide our analysis.

weETH

weETH is one of the most popular collateral assets in DeFi and is already deployed on multiple lending markets; we have previously approved the listing of the asset on BNB Chain and multiple of its derivatives, including weETHs.

Market Cap and Liquidity on Unichain

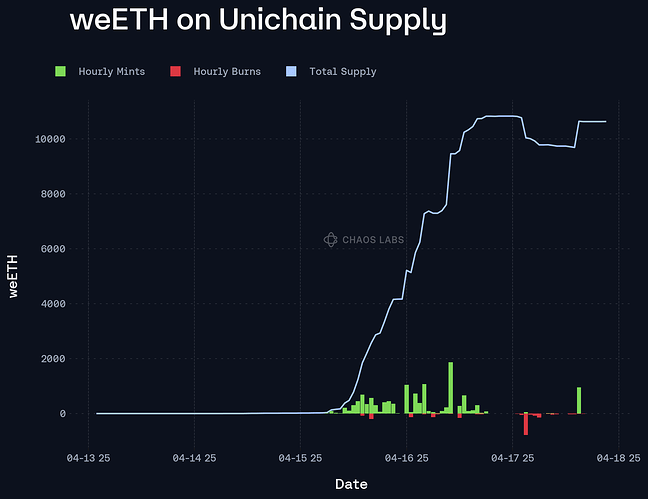

weETH currently has an on-chain supply of 10.6K; while it was first created in February 2025, it only experienced significant growth in the last few days. This coincided with the implementation of Unichain incentives, which have led to a surge in TVL on the chain.

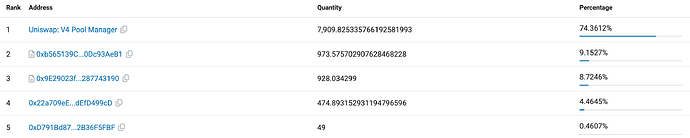

Notably, the asset’s distribution is highly concentrated in the Uniswap V4 Pool Manager; this does not present a risk to the protocol and is beneficial to its listing.

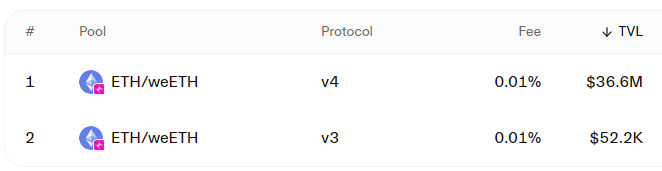

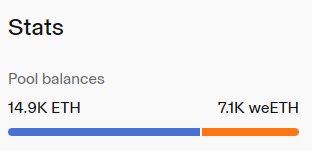

The asset currently has two liquidity pools accounting for more than $36M in TVL, with the ETH/weETH v4 0.01% pool accounting for the vast majority of its overall DEX liquidity, holding 14,900 ETH in buy liquidity.

This strong liquidity is the result of recent Unichain incentives, which are designed to encourage users to provide liquidity in high-volume pools and similarly to its growth, we expect the ending of the incentive programs to coincide with a significant contraction in on-chain liquidity.

Collateral Factor

Given that this asset is highly trusted and its supply and liquidity have grown rapidly, we recommend aligning its parameters with those of other LST/LRTs listed in Core pools. Specifically, we recommend setting it CF to 70% and its LT to 75%.

IR Curve

We recommend aligning its interest rate curve with that of other LSTs and LRTs.

Supply and Borrow Caps

We recommend utilizing our normal methodology for its supply cap, setting it at 2x the liquidity available below the Liquidation Penalty (10%). This leads to a recommendation of 4,000 weETH.

We recommend setting the borrow cap to 10% of this value. Changing Uniswap incentives could eventually lead to users looping the asset with itself. Thus, we recommend a 40% Reserve Factor, which will not dissuade suppliers from entering the market but will benefit Venus in the form of increased revenue should significant looping activity arise.

Specification

| Parameter | Value |

|---|---|

| Asset | weETH |

| Chain | Unichain |

| Pool | Core |

| Collateral Factor | 70.00% |

| Liquidation Threshold | 75.00% |

| Supply Cap | 4,000 |

| Borrow Cap | 400 |

| Kink | 45% |

| Base | 0.0 |

| Multiplier | 0.09 |

| Jump Multiplier | 3.0 |

| Reserve Factor | 40% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0