Overview

Chaos Labs supports listing wstETH on Venus Protocol’s BNB Chain deployment as part of the Liquid Staked ETH pool. Below is our analysis and initial risk parameter recommendation.

BNB Chain Liquidity

The wstETH token in question on BNB Chain is a bridged version of wstETH created by Wormhole and Axelar. The admin for the token is a 3-of-5 multisig composed of two Lido contributors, one member from the Wormhole Foundation, one member from xLabs (a core contributor to Wormhole), and one member from the Axelar Foundation. Following a report from Oxorio regarding issues with the initial proposed deployment, the Wormhole-Axelar team remedied the issues, after which the Lido DAO voted to recognize the bridge as canonical. Currently, on-chain supply and holders are low, though we anticipate that further use cases — such as listing on Venus — will increase demand for the asset on BNB Chain.

Usage on Venus

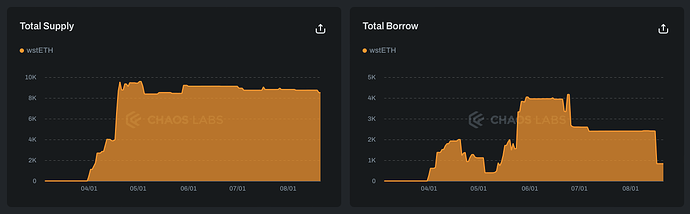

wstETH is one of the most popular collateral assets across all borrow/lend protocols and is currently listed on Venus’ Liquid Staked ETH pool. Its supply in this pool grew rapidly to 10K after listing but has since been flat. Borrows, meanwhile, have been volatile and relatively low, as is expected for a yield-bearing asset.

Collateral Factor

We recommend setting the CF equal to weETH in this pool.

Interest Rate Curve

We recommend aligning the IR curve with similar assets on the Venus protocol.

Supply and Borrow Cap

Given wstETH’s long history and the DAO’s acceptance of the bridged token, we recommend setting the supply cap at 2x the liquidity available under the Liquidation Incentive. Using this methodology, we recommend an initial supply cap of 50 wstETH.

Given limited observed demand for wstETH borrowing, we recommend setting the borrow cap at 10% of the supply cap.

Pricing wstETH

Given that wstETH’s on-chain DEX liquidity is limited, as well as its robust peg stability and demonstrated mean reversion, we recommend pricing the asset according to its exchange rate.

Additional Parameters

- Close Factor - 50%

- Liquidation Incentive - 2%

- minLiquidatableCollateral 100 USD

Recommendations

Following the above analysis, we recommend listing wstETH on BNB Chain within the Liquid Staked ETH isolated pool. We recommend the following parameter settings, including updated parameters for WETH and weETH in the pool, noting that we recommend setting WETH’s CF to 0% to avoid WETH-WETH looping:

| Asset | wstETH | WETH | weETH |

|---|---|---|---|

| Chain | BNB Chain | BNB Chain | BNB Chain |

| Pool | Liquid Staked ETH | Liquid Staked ETH | Liquid Staked ETH |

| Collateral Factor | 90% | 0% | 90% |

| Liquidation Threshold | 93% | 0% | 93% |

| Supply Cap | 50 | 450 | 400 |

| Borrow Cap | 5 | 400 | 200 |

| Kink | 45% | 80% | 45% |

| Base | 0% | 0% | 0% |

| Multiplier | 9% | 3.5% | 9% |

| Jump Multiplier | 75% | 80% | 75% |

| Reserve Factor | 25% | 15% | 25% |