GM Venus DAO, I’m a Lido Protocol Defi Relations contributor writing this to propose getting wstETH listed as a collateral in the BNBChain LST ETH Pool.

Summary

wstETH is the bridged canonical wrapped version of Lido staked Ether available on BNBChain. Lido Protocol is a family of open-source peer-to-system software tools deployed functioning on Ethereum Mainnet and Polygon. The protocol enables users to stake their tokens with validators and receive rewards from validation activities. stETH (Lido Staked Ether) is the token minted when a user deposits Ether into the protocol while wstETH is the wrapped non-rebaseable, value accruing version of stETH. The proposal’s intent is to get wstETH which has been recognised as canonical by the DAO as a collateral asset on the LST ETH pool on BNBChain.

Motivation

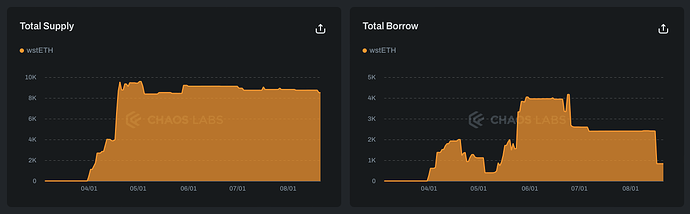

- wstETH has been listed on Venus Core Pools on Ethereum Mainnet - BNBChain is another market that could bring in large amounts of TVL. There is currently over 6k wstETH being supplied on Ethereum Mainnet, enabling wstETH on BNBChain should see similar traction

- Capital efficiency - Enabling wstETH as a collateral asset on Venus BNBChain gives users access to a highly favoured collateral asset for leverage. Rewards accrued in wstETH also makes it more capital efficient

- Integrations: Lido DAO will be integrating wstETH into the BNBChain ecosystem from DEXes to CDPs which will contribute to liquidity growth and usage onchain.

- Market Acceptance: With wstETH being 8th largest in all of crypto’s marketcap (from Coingecko), wstETH is a highly liquid and useable asset which should drive significant usage within Venus Protocol.

Risks

- Smart Contract Risks: As with every other token, wstETH on BNBChain is subjected to smart contract risks. This is mitigated through the multiple audits and verification reports

- Slashing Risk: As with every liquid staked token, wstETH is also subjected to slashing risks from the validators. This is mitigated through the stringent selection of node operators. Lido also has a cover fund of approximately 6.4k stETH that could be used to cover some of the slashing estimated risks

- Market Risks: Volatility as well as unwinding of positions in the market could affect stETH’s stability as it isn’t a pegged asset. Historically stETH has traded within the 2% of ETH’s price.

Benefits

- Usage of wstETH as a collateral on Venus on Ethereum mainnet shows that there should be demand for wstETH as a collateral on Venus BNBChain. Users are able to then either supply wstETH for borrowers and earn rewards for it or take on leverage with their wstETH.

- Vaults that run yield strategies such as recursive staking strategies can tap on Venus’s market and borrow ETH to loop wstETH.

Specifications

- wstETH contract address

https://bscscan.com/token/0x26c5e01524d2E6280A48F2c50fF6De7e52E9611C?a=0x5A9d695c518e95CD6Ea101f2f25fC2AE18486A61 - Oracle and Price Feeds: Implementation expected with Chainlink and Redstone. Expected price feeds for wstETH:stETH and stETH:USD

Useful Links