Overview

Chaos Labs provides a review of stablecoin utilization and interest rates on the Venus protocol. Based on our observations, we provide a recommendation to adjust IR curves.

Interest Rate Analysis

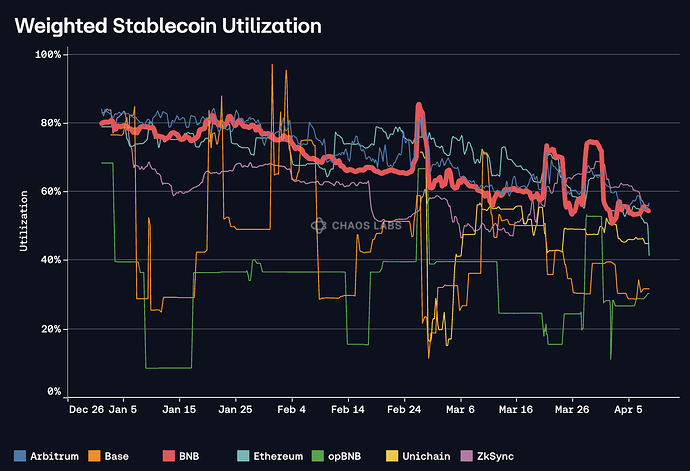

We have observed consistent decreasing utilization on Venus (as well as throughout DeFi) in the past two months. The chart below shows the utilization of stablecoins on each chain, weighted by the amount of each asset borrowed (i.e. USDT factors more heavily into the BNB line than does USDD).

Barring sharp and transient increases associated with Binance Launchpool events, the chart shows a consistent downtrend in utilization, though smaller deployments like Unichain have demonstrated sharp fluctuations.

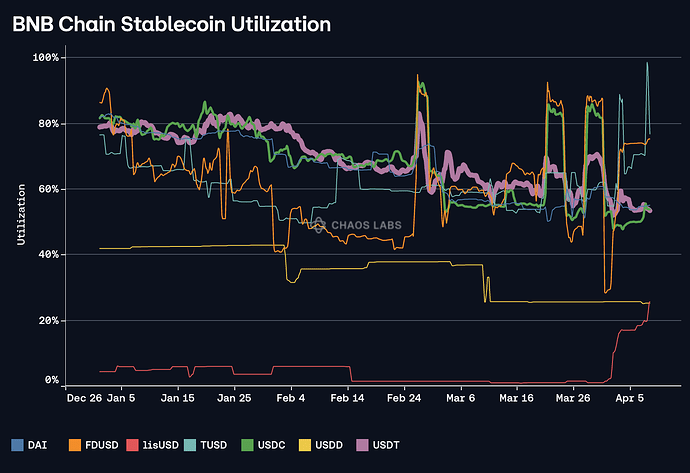

A closer examination of BNB Chain markets reveals that the downtrend has been displayed across all of the largest stablecoin markets; USDC and FDUSD have demonstrated the sharpest increases in utilization during Launchpool events.

This indicates a need to lower borrowing rates to boost utilization across the protocol.

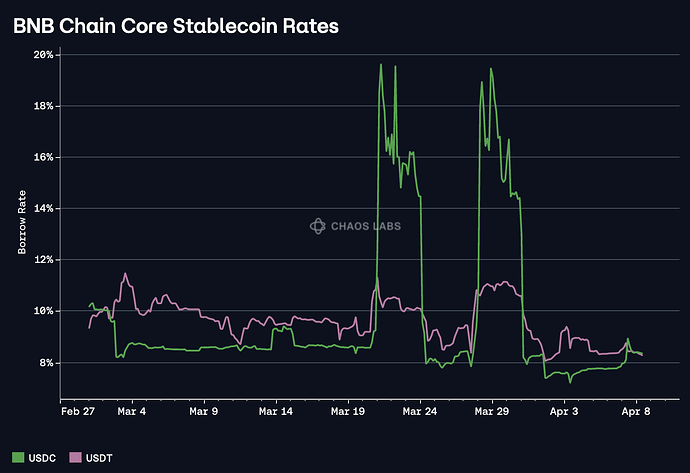

Finally, a close review of USDC and USDT on BNB Core — the two largest stablecoin markets on Venus — shows that borrow rates have recently dipped below 9%.

We recommend setting the rate at 80% utilization — Kink 1 for these two assets — to 8%, allowing the market to slide into the rate discovery zone (between Kinks 1 and 2) at times of higher utilization.

Recommendation

We recommend aligning this Multiplier across all active and borrowable stablecoins on Venus, significantly improving the user experience by providing a predictable IR curve. In some isolated pools with riskier collateral assets there is a base rate of 0.02; we recommend leaving this as is. Additionally, we recommend implementing the Two Kink model for all USDC and USDT markets, aligning the 2nd Multiplier at 0.7. We do not recommend any changes to the JumpMultiplier and thus have excluded it from the table below.

Our previous IR curve proposal, which established the Two Kink model and and increased the Multiplier for a number of stablecoins, can be found here.

Specification

| Symbol | Market | Base Rate | 1st Multiplier | Kink | 2nd Multiplier | 2nd Kink |

|---|---|---|---|---|---|---|

| USDC | Arbitrum-Core | 0 | 0.10 | 80% | 0.7 | 90% |

| USDT | Arbitrum-Core | 0 | 0.10 | 80% | 0.7 | 90% |

| USDC | Base-Core | 0 | 0.10 | 80% | 0.7 | 90% |

| FDUSD | BNB-CorePool | 0 | 0.10 | 80% | - | - |

| USDC | BNB-CorePool | 0 | 0.10 | 80% | 0.7 | 90% |

| DAI | BNB-CorePool | 0 | 0.10 | 80% | - | - |

| TUSD | BNB-CorePool | 0 | 0.10 | 80% | - | - |

| USDT | BNB-CorePool | 0 | 0.10 | 80% | 0.7 | 90% |

| USDT | BNB-DeFi | 0.02 | 0.10 | 80% | - | - |

| USDD | BNB-DeFi | 0.02 | 0.10 | 70% | - | - |

| USDT | BNB-GameFi | 0.02 | 0.10 | 80% | - | - |

| USDD | BNB-GameFi | 0.02 | 0.10 | 70% | - | - |

| USDT | BNB-Meme | 0 | 0.10 | 80% | - | - |

| USDD | BNB-Stablecoins | 0.02 | 0.10 | 70% | - | - |

| USDT | BNB-Stablecoins | 0 | 0.10 | 80% | - | - |

| lisUSD | BNB-Stablecoins | 0.02 | 0.10 | 50% | - | - |

| USDD | BNB-Tron | 0.02 | 0.10 | 70% | - | - |

| USDT | BNB-Tron | 0.02 | 0.10 | 80% | - | - |

| USDS | Ethereum-Core | 0 | 0.10 | 80% | - | - |

| USDC | Ethereum-Core | 0 | 0.10 | 80% | 0.7 | 90% |

| crvUSD | Ethereum-Core | 0 | 0.10 | 80% | - | - |

| FRAX | Ethereum-Core | 0 | 0.10 | 80% | - | - |

| DAI | Ethereum-Core | 0 | 0.10 | 80% | - | - |

| USDT | Ethereum-Core | 0 | 0.10 | 80% | 0.7 | 90% |

| TUSD | Ethereum-Core | 0 | 0.10 | 80% | - | - |

| crvUSD | Ethereum-Curve | 0 | 0.10 | 80% | - | - |

| USDC | Ethereum-Ethena | 0 | 0.10 | 92% | - | - |

| USDT | opBNB-Core | 0 | 0.10 | 80% | - | - |

| FDUSD | opBNB-Core | 0 | 0.10 | 80% | - | - |

| USDC | Unichain-Core | 0 | 0.10 | 80% | 0.7 | 90% |

| USDC.e | ZkSync-Core | 0 | 0.10 | 80% | 0.7 | 90% |

| USDT | ZkSync-Core | 0 | 0.10 | 80% | 0.7 | 90% |

| USDC | ZkSync-Core | 0 | 0.10 | 80% | 0.7 | 90% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0