Risk Analysis of BUSD and Potential Deprecation Plan

- Given the increased risk of BUSD due to regulatory risk and market risk from expected reduced liquidity, Gauntlet recommends that the Venus community consider deprecating the BUSD market.

- If the community decides to deprecate BUSD, Gauntlet is providing a plan of action:

- To deprecate safely, the first step is to pause new supplies and borrows of BUSD, increase RF to 100%, and raise awareness of the initiative to deprecate to the community. This should encourage users to close current positions.

- After, Gauntlet recommends gradually reducing the CF of BUSD at a weekly or biweekly cadence, starting with a CF reduction to 80%. After this first CF reduction, Gauntlet will continuously update and provide CF reduction options to Venus to optimize user experience, risk off liquidations and risk management. Biweekly would be the lowest frequency we would recommend.

Deprecation Plan for BUSD

Gauntlet is contacting the Venus community to address the recent news related to the regulatory actions against BUSD and Paxos. As of recent news reports, Paxos plans to sunset BUSD, but they plan to maintain it fully backed and redeemable through until February 2024.

However, Paxos has announced that they will cease minting the token as of February 21, 2023, leading to a decline in the circulating BUSD market over time. Given BUSD is a widely used asset on Venus, we defer to the community on whether the BUSD market should or should not be deprecated and delisted.

The economic trade-offs of keeping/deprecating BUSD on Venus are summarized below. We hope that this data helps the Venus community make an informed decision about asset deprecation:

- Upside: If BUSD remains on Venus, at $123.3m in borrows with 7.80% APY and 10% reserve factor, BUSD as a borrowed asset would contribute about $964k in annual reserve revenue to the protocol. At $151.8m in supplies that account for $87.6m in various borrowed tokens (excluding BUSD) with a weighted average APY of 2.23% and reserve factor of 17.02%, BUSD as a collateral asset would contribute $333k in annual reserve revenue. In total, BUSD is expected to contribute ~$1.3m in annual reserve revenue to Venus assuming no exogenous events occur.

- Downside: If BUSD remains on Venus, in the case of a black swan event where BUSD’s price fluctuates and liquidity collapses, we estimate liquidations of BUSD borrowers and suppliers could range between $1m-20m (based on historical instances of other stablecoins depegging). If BUSD’s liquidity declines dramatically in a black swan event, these liquidations could fail and become losses for the protocol.

Should the community decide to deprecate and delist BUSD, Gauntlet recommends that Venus start to reduce its exposure to BUSD by utilizing the following risk parameters:

- Immediately freeze the BUSD market by pausing both borrow and supply.

- Immediately adjust the IR curves of BUSD to disincentive further supply and borrow of BUSD.

- Increase reserve factor to 99% for BUSD (suppliers will essentially stop receiving interest). While the reserve factor would seem to increase reserve revenue, the revenue impact of this is hard to quantify because usage would likely decline.

- This will incrementally increase BUSD reserves and incentivize suppliers to remove their BUSD positions since they are not receiving any further Supply APY.

- After steps 1 and 2, allow users some time to reduce their BUSD usage (including the reduction of recursive borrowing of BUSD), after which Venus incrementally reduces BUSD’s collateral factor. The general approach here is to lower BUSD’s collateral factor in a gradual way that does not cause major liquidations. After each incremental decrease, Venus then allows users time (say, a week) to lower their BUSD usage. Venus then lowers the collateral factor again to a point that does not cause major liquidations. Venus repeats this process until BUSD’s collateral factor is 0%. After the initial collateral factor reduction, Gauntlet will recommend further reductions depending on how market and protocol conditions evolve.

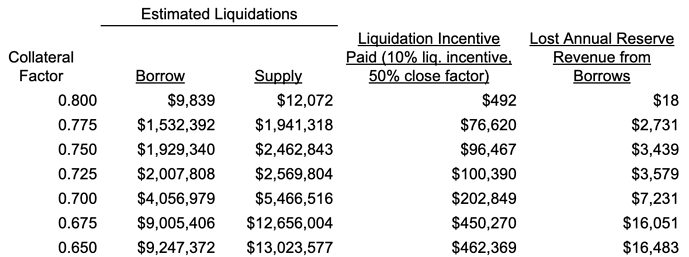

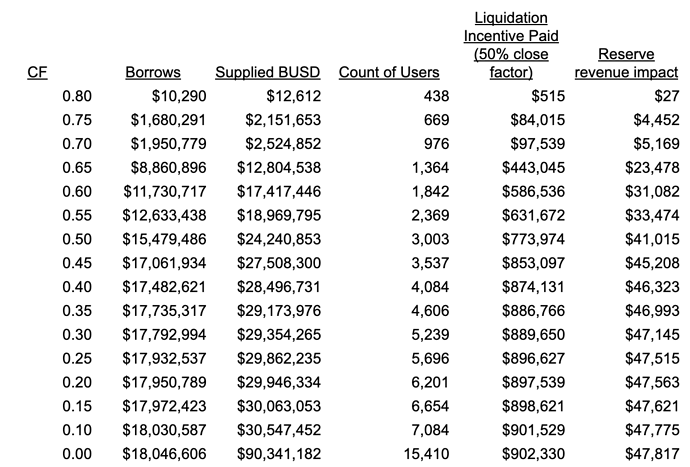

Below we show the borrow and supply amounts of BUSD suppliers that would be liquidated under different BUSD collateral factor levels and the estimated lost annual reserve revenue at each level:

We note that the borrows of $1.5m that will be liquidated at 0.775 collateral factor is very large and would be significantly disruptive to user experience. Venus protocol has not experienced liquidations greater than $1.5m in borrows in a single day for the past year. This is why we recommend first freezing the BUSD market and increasing its reserve factor, then allowing users to adjust their positions before Venus reduces BUSD’s collateral factor.

Methodology for Gradually Lowering Collateral Factor

Gauntlet recommends deprecating BUSD via gradual collateral factor reductions to avoid liquidations. This involves allowing users to adjust their position and factoring in the collateral token’s liquidity, affecting how much liquidation the protocol can endure before seeing bad debt. Right now, BUSD’s liquidity is still robust:

- Across all sources: CEX + DEX 2% market depth of $200+m and ADV of $12-16b.

- On BNB Chain: 2% market depth of about $6m.

Quantitative Analysis

DISCLAIMER: Gauntlet does not manage or quantify depeg risk as we do not have visibility into BUSD centralization risks. Instead, we are providing additional context here on our methodology. Further, we simplify the assumptions below, such as ignoring the recursive borrowing of BUSD in our analysis.

Due to the recent news that Paxos will stop issuing new BUSD tokens on regulators’ orders, Gauntlet is investigating potential risks to Venus in different scenarios involving BUSD. The main risks stem from 1) depegging of the fiat-backed stablecoin and 2) a decline in BUSD’s liquidity.

Impact from a Price Decline in BUSD

[NOTE: BUSD has low depeg risk, given it is redeemable until February 2024. It may be more prone to upward price swings.]

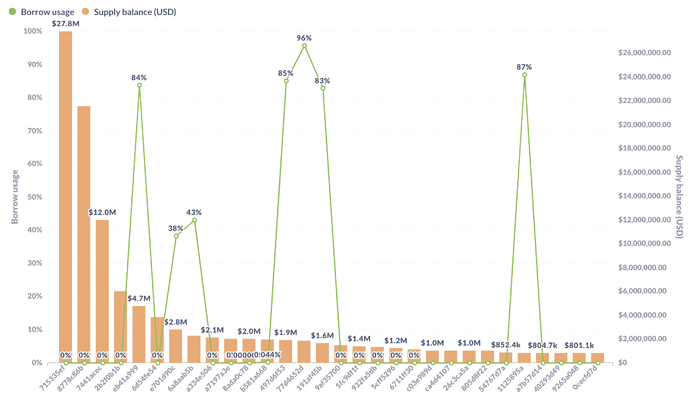

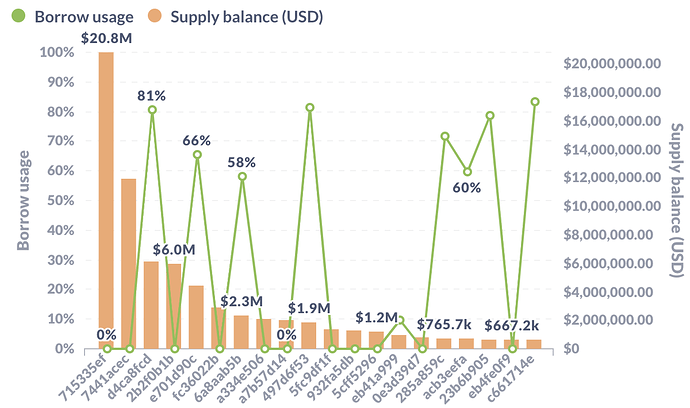

A decline in BUSD’s price presents a risk to BUSD suppliers since a decline in their collateral value could cause their accounts to be liquidated. Below is a chart of the 30 largest suppliers of BUSD on Venus.

Top 30 suppliers of BUSD as of February 28, 2023

To solve for the price decline in BUSD that would cause a liquidation for a certain BUSD supplier, we consider factors such as liquidity, collateralization ratios, and collateral factors.

History of Stablecoins Depegging

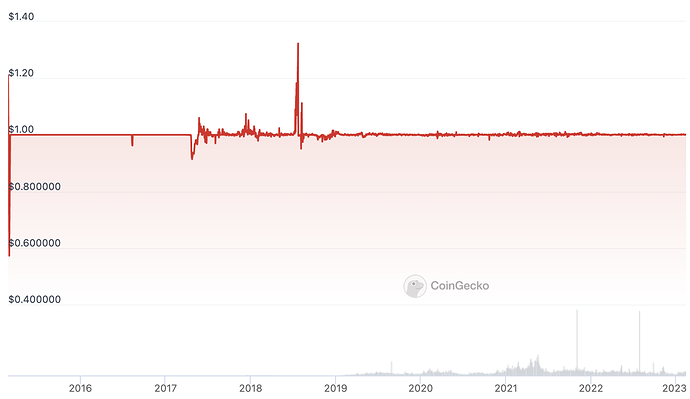

We can use prior price volatilities of stablecoins as a reference for our analysis. Below are price charts for Tether and Terra. A decline of 10% in BUSD’s price would cause $1.15m in borrowed tokens of BUSD suppliers to become liquidated, while a price increase of over 30% would cause ~$20m in BUSD borrowers’ debt to become liquidateable.

Historical Price - Tether

Source: https://www.coingecko.com/en/coins/tether

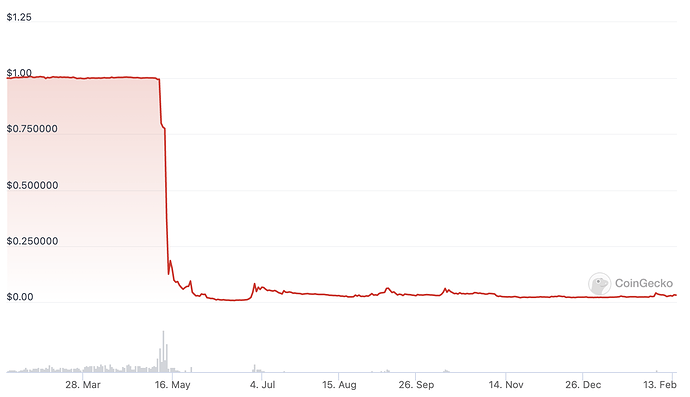

Of course, there have been instances of signifcant depegging situations such as that of Terra:

Historical Price - Terra

Source: https://www.coingecko.com/en/coins/terraclassicusd

BUSD itself has seen price volatility, declining 6% in 2020 (a decline that would cause ~$1m in BUSD suppliers’ borrowed tokens to be liquidateable today):

Source: https://www.coingecko.com/en/coins/binance-usd

Other Risks from a Liquidity Crunch

If the liquidity of BUSD were to fall drastically and Venus does not freeze BUSD markets, Venus could face an increased risk of insolvencies due to price manipulation attacks. At the moment, this scenario does not seem likely, given the market depth of BUSD is very high. But if BUSD’s 2% market depth falls to the range of $2-3m, then then the cost of price manipulation falls significantly (high risk).

Next Steps

- Gauntlet will monitor this post for community feedback to ensure our analysis is understood

- If the community decides to deprecate the BUSD market, Gauntlet will propose the next steps as a governance proposal