Overview

Chaos Labs provides a new recommendation for Capped Oracle parameters in the Venus BNB Chain deployment. Please note that assets being deprecated in the Liquid Staked BNB and ETH pools, as per our deprecation plan, are not included in this recommendation, as their borrowing power is already eliminated through setting CF to 0.

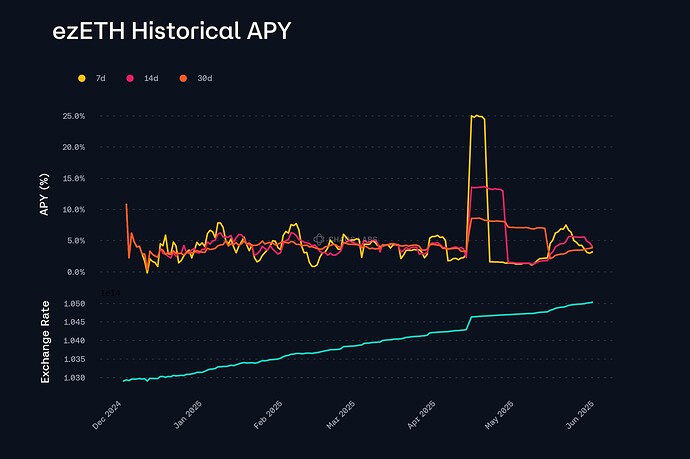

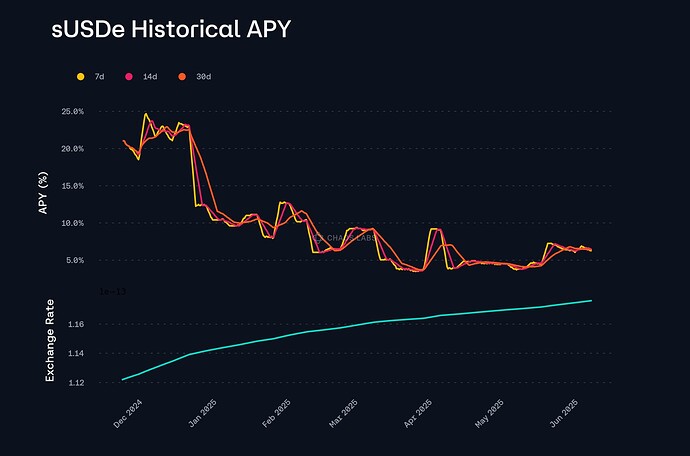

sUSDe

We reiterate our findings in our previous post regarding sUSDe, and recommend aligning its parameters on BNB Chain Core. Specifically, a 7-day rolling average is applied to the APY series to reduce noise from short-term fluctuations. Based on the most recent 180-day window, the maximum observed 7-day annualized yield is 23.50%, and the standard deviation of the one-day APY series is 4.77%. These values are combined to produce an Annual Growth Rate of 28.27% for the Capped Oracle.

The snapshot interval is fixed at 30 days to ensure monthly updates of the reference exchange rate.

To prevent the oracle from constraining natural post-deployment expansion, a snapshot gap equivalent to one month of growth at the applied annual rate is included. This value is 2.36%.

Given these factors, we recommend the following Capped Oracle Parameters:

| Parameter |

Value |

| Annual Growth Rate |

28.27% |

| Snapshot Interval |

30d |

| Snapshot Gap |

2.36% |

PT-sUSDE-26JUN2025

As this PT asset expires in June 2025, it will have stopped accruing yield if and when this proposal is implemented. Thus, we recommend adopting a capped oracle with 0% Annual Growth Rate and a 4% Snapshot Gap.

| Parameter |

Value |

| Annual Growth Rate |

0.00% |

| Snapshot Interval |

30d |

| Snapshot Gap |

4.00% |

xSolvBTC

While BTC staked within Babylon through the Solv Protocol does not currently accrue any yield, given its use of the fundamental exchange rate, we recommend the adoption of the Capped Oracle with parameters designed to prevent exchange rate manipulation while not increasing the maximum price over time. This is done by setting an initial Snapshot Gap of 4%, while maintaining the Annual Growth Rate to 0%.

| Parameter |

Value |

| Annual Growth Rate |

0% |

| Snapshot Interval |

30d |

| Snapshot Gap |

4% |

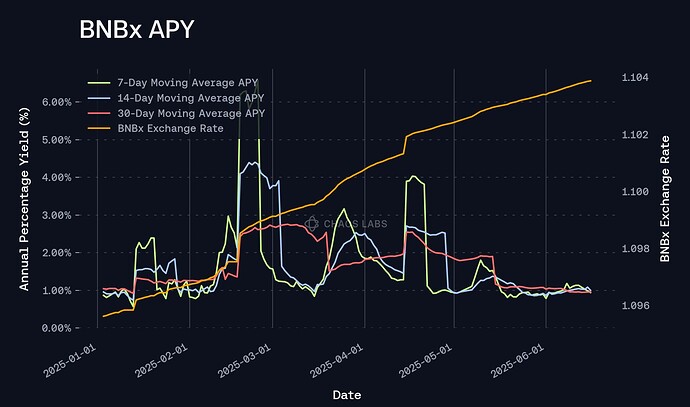

BNBx

The exchange rate growth of BNBx is based on BNB Chain staking and activity managed through Stader. Rewards are generated from native validator yield and are reflected in the increasing BNB-denominated value of BNBx.

To evaluate rate behavior, a 14-day average is applied to the yield series to smooth daily changes. Based on the most recent 180-day window, the maximum 14-day annualized APY observed is 4.40%, and the standard deviation of the 1-day APY series is 3.13%. These values are added to produce an Annual Growth Rate of 7.53% for the Capped Oracle.

A 30-day snapshot interval is applied to ensure consistent monthly updates of the reference exchange rate.

To avoid prematurely capping legitimate growth immediately after deployment, we apply a snapshot gap equivalent to one month of yield at the selected annual growth rate; this results in a gap of 0.63%.

| Parameter |

Value |

| Annual Growth Rate |

7.53% |

| Snapshot Interval |

30d |

| Snapshot Gap |

0.63% |

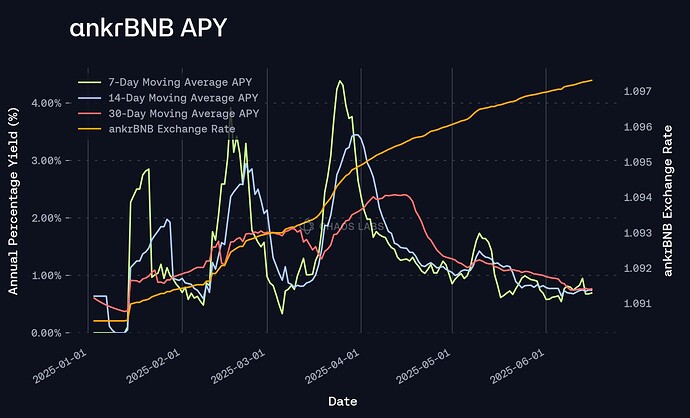

ankrBNB

The exchange rate growth of ankrBNB is based on BNB Chain staking and activity managed through Ankr. As above, rewards are generated from native validator yield and are reflected in the increasing BNB-denominated value of ankrBNB.

A 7-day average is applied to the yield series to smooth daily spikes. Based on the most recent 180-day window, the maximum 7-day annualized APY observed is 4.39%, and the standard deviation of the 1-day APY series is 1.73%. These values are added to produce an Annual Growth Rate of 6.12%.

A 30-day snapshot interval is applied to ensure consistent monthly updates of the reference exchange rate.

To account for initial growth upon deployment, a snapshot gap equivalent to one month of yield is included, resulting in a gap of 0.51%.

| Parameter |

Value |

| Annual Growth Rate |

6.12% |

| Snapshot Interval |

30d |

| Snapshot Gap |

0.51% |

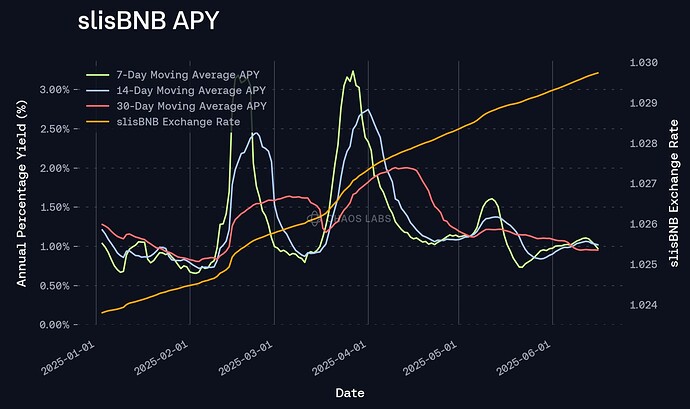

slisBNB

slisBNB is a liquid staking token issued by Lista DAO that represents staked BNB and accrues yield in line with BNB’s staking APR, allowing users to earn passive rewards while maintaining liquidity within the Lista ecosystem. While slisBNB itself generates yield from BNB staking, it also enables users to participate in Binance Launchpool events and earn additional rewards if held in a Binance Web3 MPC wallet, but these Launchpool rewards are not reflected in slisBNB’s exchange rate, reducing rate volatility.

To better evaluate rate behavior, a 7-day average is applied to the yield series. Based on the most recent 180-day window, the maximum 7-day MA observed is 3.24%, and the standard deviation of the 1-day APY series is 0.88%. These values are added to produce an Annual Growth Rate of 4.12% for the Capped Oracle.

A 30-day snapshot interval is applied to ensure consistent monthly updates of the reference exchange rate.

To account for initial growth upon deployment, a snapshot gap equivalent to one month of yield at the derived annual rate is included, resulting in a gap of 0.35%.

| Parameter |

Value |

| Annual Growth Rate |

4.12% |

| Snapshot Interval |

30d |

| Snapshot Gap |

0.35% |

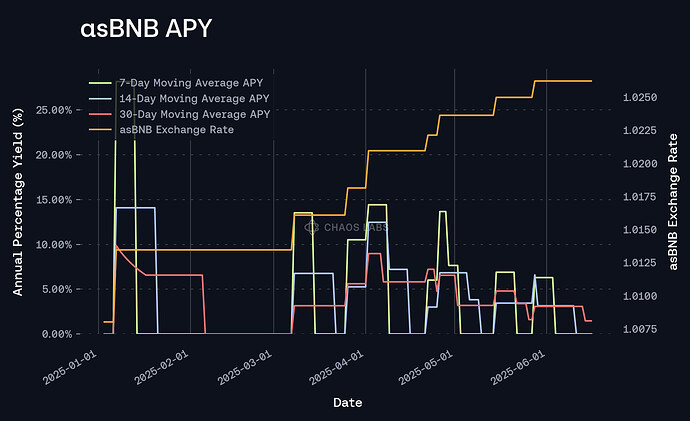

asBNB

asBNB utilizes slisBNB as its base asset, all withdrawals are processed in slisBNB, and its exchange rate is determined against slisBNB, while adding rewards from BNB Launchpool events on top. As such, we recommend layering the asBNB Capped Oracle on top of the slisBNB Capped Oracle (described above), reflecting asBNB’s role as an additional yield-generation layer of slisBNB.

Because rewards are distributed in the form of an increased exchange rate, a few days after the completion of a Launchpool, we opt for a 30-day moving average, the max observed rate of which is 9.86%. Additionally, we add the 1-day MA standard deviation, which is 20.63%. This leads to an annual growth rate of 30.49%.

A 30-day snapshot interval is applied to ensure consistent updates of the reference exchange rate. To account for initial growth upon deployment, a snapshot gap equivalent to one month of yield at the derived annual rate is included, resulting in a gap of 2.54%.

We recommend the following parameters in both the Core and Liquid Staked BNB pools.

| Parameter |

Value |

| Annual Growth Rate |

30.49% |

| Snapshot Interval |

30 days |

| Snapshot Gap |

2.54% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.