Overview

Following the introduction of Capped Oracle in Venus, we update the recommendation including listing parameters for sUSDe’s Capped Oracle in Venus Ethereum Core instance.

Capped Oracle Parameters

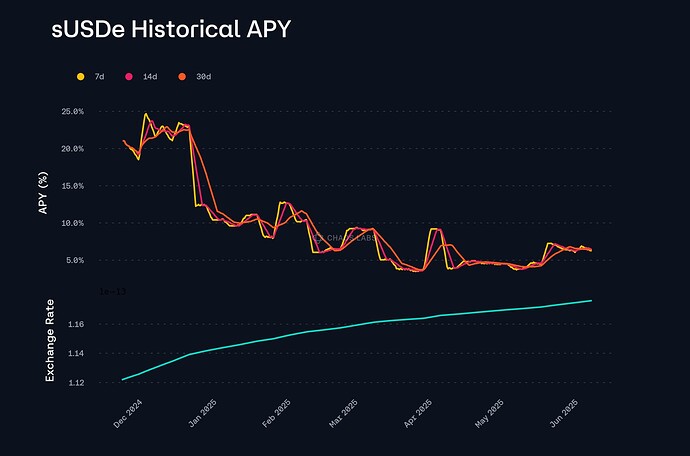

Staking USDe yields sUSDe, a reward-bearing token that accrues value through rewards denominated in USDe, which are streamed into the staking contract and increase the redemption value of sUSDe over time. These rewards are sourced from the protocol’s revenue, which is generated through ETH staking and income from funding and basis spreads via delta-neutral derivatives strategies. Rewards are distributed weekly through a time-vested mechanism designed to prevent front-running and smooth out inflows.

To evaluate rate behavior, a 7-day rolling average is applied to the APY series to reduce noise from short-term fluctuations. Based on the most recent 180-day window, the maximum observed 7-day annualized yield is 23.50%, and the standard deviation of the one-day APY series is 4.77%. These values are combined to produce an Annual Growth Rate of 28.27% for the Capped Oracle.

The snapshot interval is fixed at 30 days to ensure monthly updates of the reference exchange rate.

To prevent the oracle from constraining natural post-deployment expansion, a snapshot gap equivalent to one month of growth at the applied annual rate is included. This value is 2.33%

Specification

Given above, we recommend the following Capped Oracle Parameters:

| Parameter | Value |

|---|---|

| Annual Growth Rate | 28.27% |

| Snapshot Interval | 30d |

| Snapshot Gap | 2.36% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.