[VRC] Proposing Venus V4

Introduction

Since its inception in 2020, the community-driven Venus Protocol has successfully offered an autonomous and non-custodial utility for supplying liquidity and collateralization of digital assets. In that time, community feedback and data analysis have charted a path toward improving the protocol’s performance.

After 2 years of remarkable growth in which Venus at one point became the most transacted in its category, this Venus Request for Comment (VRC) proposes community approval for upgrading the protocol across numerous areas as outlined below.

We’re pleased to present Venus V4, the next generation of features to advance DeFi. In particular, Venus V4 improvements address three key areas: risk management, decentralization, and user experience.

Risk Management

- Isolated Markets: opens the door to sustainably onboard many more assets than what Venus Protocol currently supports.

- Stable Interest Rate Borrowing: Offers a new financial instrument for stable rate loans across all markets.

- Risk Management Upgrades: Provides a mechanism for shortfall coverage, as well as a stability fee to keep VAI pegged.

- Bonds: a new primitive and mechanism for refinancing of protocol insolvencies

Decentralization

- Governance: faster interest rate parameter modifications, new role assignment, fine-grained pausing of specific actions within specific markets, and longer governance intervals for contract upgrades and role reassignments.

- Price Feed Redundancy: Adds the capability for multiple price feed oracles to be supported on the same asset as a fallback measure to eliminate a single point of failure.

User Experience

- Integrated Swap: Integration with external DEX’s enables one-click borrow and repay. This lets any user borrow or lend any asset of their choice without already having it in their wallet, while on the back end a portion of DEX fees goes towards Venus Protocol.

Challenges with Venus V3

While Venus V3 established itself as one of the DeFi market leaders, community analysis has provided a few areas for improvement:

- Core Pools: the core Venus lending pool does not enable seamless listing of new tokens, may suffer from liquidity issues caused by the extreme volatility of any one token, and lacks customizability of risk parameters. These are issues in themselves and inhibit protocol scalability.

- Variable Interest Rates: variable rates may fluctuate significantly, especially during periods of volatility, and this may cause issues such as additional liquidations. Consumers are often willing to pay a premium for a stable rate, and this should be made possible on Venus as well.

- Governance: governance process can at times be slow and inefficient. Additionally, the entire protocol must be paused to protect against an attack or to do damage control, rather than pausing specific markets.

- Oracles: the current version of Venus relies on a single oracle, presenting a centralized point of failure.

- User Experience: users must switch to a separate application to swap tokens, creating user friction in interacting with the borrow/supply markets and vaults. Users should not need to leave Venus.

- Risk Management: there is no shortfall coverage at the moment, which can lead to liquidations. At the same time, the VAI stablecoin has limited use-cases which results in low liquidity, requiring Venus to force the peg at $1.

Below we will expand on all of the above, proposing relevant solutions for each in turn.

Risk Profiles and Isolated Markets

Since its inception, the Venus architecture has solely consisted of a cross-margin core pool. This optimizes capital efficiency, but spreads risk across all assets because collateral can be used to borrow any other asset in the pool. Consequently, this model is not very scalable for onboarding the long–tail of assets available, especially those with high volatility.

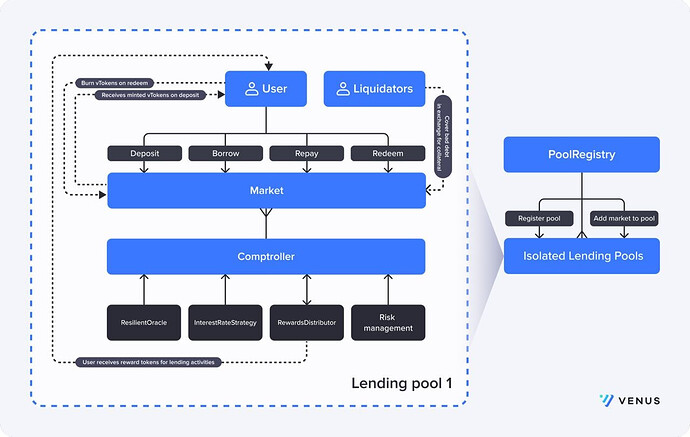

A number of alternatives utilizing isolated pools have emerged within DeFi, each bringing a unique approach. Our proposal accounted for each model in pursuit of the optimal balance between risk and capital efficiency while establishing sustainability and inclusivity for long-tail assets. It will give the ability to create an independent market with specific assets and custom risk management configurations, working similarly to the Venus core lending pool. In turn, users will have more markets to diversify risk associated with any given asset, while also reducing the impact on the core pool due to any potential asset failure.

We also created a risk profiling methodology where each asset is assigned a risk rating and pool type based on its volatility and liquidity:

- Very High Risk

- High Risk

- Medium Risk

- Low Risk

- Minimal Risk

This will help to inform users of the relevant risks of each potential investment.

Isolated lending scales the capability of lending and borrowing across a far greater number of assets, each with lower liquidity than before. That means that it is vital to prioritize ease of use for Venus users so that they may manage their account health. In this model, users are also offered a clear framework for understanding the liquidation risk associated with each asset and pool.

Stable Interest Rate Borrowing

Borrowers often prefer to pay a premium for predictable interest rates, as evidenced by examples such as home mortgages. This is common in traditional finance because it enables individuals or institutions to hedge their investments with greater certainty. Market conditions often give rise to greater demand for fixed-rate borrowing to provide stability and mitigate risk against high volatility.

A new financial instrument is proposed giving users an additional choice for utilizing Venus Protocol: stable interest rate borrowing.

Stable rates act as a fixed rate in the short term but can be re-balanced in the long term in response to changes in market conditions. The variable rate is the rate based on the offer and demand. The stable rate, as its name indicates, will remain pretty stable and it’s the best option for planning in advance how much interest one will have to pay. In contrast, the variable rate will change over time and could be the optimal rate, depending on market conditions. Venus users may switch between the stable and variable rates at any time through their dashboard.

Periods of high market volatility can expose variable-rate borrowers to liquidation risk, as interest rates are updated during protocol interactions. However, stable loan rates remain with fixed interest rates, partially reducing the probability of liquidation due to volatility, whereas successive stable loan rates are adjusted based on market conditions such as market liquidity.

One exception will be a mechanism to provide for rebalancing under extreme market conditions when insufficient supply APY is generating a lack of liquidity provision. Under this scenario, the protocol can adjust the stable rate higher to attract more depositors. When market conditions normalize, the loan is again rebalanced back down accordingly.

The stable loan rate is fixed unless an asset’s utilization rate exceeds a rebalance threshold (as set by Governance), or the market’s average borrow rate is less than a variable borrow rate. At this point, it may either be rebalanced by any given user, or by an agent provided by Venus. The appointed agent will not lead to centralization, nor is it expected to be an issue if the agent goes temporarily offline, as any Venus user may rebalance another given user at any point. However, users will not be incentivized to do so. This implies that it is possible that someone who satisfies the rebalance conditions may not be rebalanced immediately.

Specific details on stable loan rebalancing calculations will be provided in the whitepaper. In summary, the rate of a stable loan is fixed until either one of two conditions are met:

- Utilization_Rate > Rebalance_Rate (set by Governance)

- Average_Market_Borrow_Rate < Variable_Borrow_Rate

This will enable users to have access to a stable loan rate, providing an easier means of predicting future cash flow, and reducing liquidations caused by variable rate volatility.

Governance

The Venus Protocol is directly managed by the Venus DAO, in which protocol updates are being queued and voted upon in 48-hour timelocks. This has several advantages, including adequate voting time, community transparency over proposed changes, and time for addressing any malicious proposals that slip through.

At the same time, there are a few issues:

- Risk parameters may not be adjusted in a timely manner. This can have adverse effects, such as requiring risk managers to make more conservative estimates while planning.

- Upgrading contracts or reassigning roles should have longer governance intervals in order to provide adequate time for community review, avoiding malicious or erroneous proposals.

- Pausing may not be reversed in a timely manner. This can cause lengthy delays, such as when Venus remained offline for several days following the LUNA events in May 2022.

Venus V4 proposes the following changes:

- Interest rate risk parameter changes can be done without requiring a full governance cycle.

Venus will introduce three Venus Improvement Proposals (VIP) roles: Normal, Fast Track, and Critical. Each of these VIP roles has a unique proposal threshold, timelock, and voting period, which will each be configured by Governance. This will enable the expedition of interest rate risk parameter changes to be done more efficiently by those with specific VIP roles, increasing competitiveness against other market rates.

Additionally, certain actions may go via “fast track” or “critical” routes, when needed. To do this, instead of checking whether the caller is the “admin”, most contract methods will rely on a separate Access Control Manager contract.

- Longer Governance cycles for contract upgrades and role reassignment

The current 48-hour Governance period may not be adequate for critical items such as contract upgrades and role reassignment, and it’s possible that malicious parties may try to take advantage of it. Therefore, we propose extending governance cycles for sensitive changes in order to increase protocol security.

- Any actions on any markets may now be paused, rather than requiring the pausing of the entire protocol.

Before, the entire protocol was required to be paused in order to protect against an attack or to do damage control. For example, during the LUNA incident of May 2022 Venus stayed offline for several days during voting and timelock periods, while it was not in fact necessary to pause the entire protocol for that period of time. It is important to have the functionality to pause any actions on any markets, especially as Venus expands to isolated markets.

The above changes are meant to increase Governance efficiency, while reducing opportunities for malicious or erroneous proposals to slip through.

Price Feed Redundancy

In decentralized finance, price feeds remain one of the most critical pieces of infrastructure, ensuring that autonomous applications like Venus can safely offer users the collateralization of assets at fair market value. If an oracle cannot reliably report a market price (as may be the case under extreme market conditions or malicious manipulation) and it is the sole source of prices, the only option is to pause the market. Relying on one price feed oracle also represents a costly single point of failure.

Introducing the capability to support an additional trustless price feed oracle is an important step for DeFi protocols to provide an additional layer of resiliency when a price feed fails. In this architecture, Venus continuously updates prices using two new feeds and monitors for significant deviations between the two. If a significant delta is detected, the price of the underlying is checked against a centralized source for confirmation, and the feed with the greater deviation is halted from updating the price on Venus if it were the primary feed.

Additionally, when fetching an oracle price, for the price to be valid it must be positive and not stagnant. If the price is invalid then we consider the oracle to be not set and treat it as disabled.

Venus will add support for 2 new price feed oracles: Binance Oracle and Pyth Network for the additional price feed implementation. PancakeSwap will also be used as the on-chain price source.

By having several price sources and measures in place to detect abnormality, Venus aims to be resilient during times of extreme volatility and against malicious parties.

Integrated Swap and DEX

Currently, users are restricted to borrowing or lending assets that they have in their wallets. This limits markets that they may participate in, and creates friction by requiring them to go to an external DEX in order to swap.

A simplified user experience will make Venus more widely accessible to new audiences, in turn increasing utilization, daily active users and TVL. A swap integration is therefore proposed with “one-click” borrow and repay functionality, facilitating users in and out of borrowing with more convenience and fewer steps. Specifically, Venus will integrate with PancakeSwap and other DEX’s, so that a user does not need to own a given token in order to participate in a relevant liquidity pool, and does not pay any additional fee.

In the process, Venus can capture a percentage of the fee volume from participating DEX partners for these transactions as well, marking an important opportunity for additional protocol value growth. For every swap that is routed through ecosystem partners such as Pancakeswap and Biswap, Venus treasury will receive 25% of the swap fee, driving further value to the protocol. At the same time, no additional fee will be charged, and the DEX fee will be the same fee as if the user used their site as normal.

Swap integration will streamline the experience of interacting with both supply and borrow markets (in the instance of repayment for example), as well as vaults. In turn, interacting with each Venus market will be vastly simplified, in turn driving revenue to Venus through back-end DEX fee sharing.

Risk Management Upgrade

Our risk management upgrades focus on providing a mechanism for shortfall coverage, as well as a stability fee to keep VAI pegged.

Liquidations may not always occur, leading to a shortfall. This could be for reasons such as an oracle issue, too much price volatility, or liquidators not participating due to a lack of incentives. To address this, Venus Protocol will maintain a risk fund for each pool which receives 40% of the income generated by the given pool in the form of its currency. In the event of a shortfall, the risk fund will auction the risk fund reserve to recover the bad debt. In the event of a bankruptcy address and no liquidator, the insurance fund can help to take over the address and compensate for the loss. Once funds have been shifted to the dedicated Risk Insurance Fund, then funds are reallocated to match currencies with the most exposed in terms of risk of shortfall and bad debt. This risk mitigation process utilizes reporting from Gauntlet and internal cross currency risk analysis that guide the techniques to ensure that if and when shortfalls occur, the Risk Fund has allocated funds properly to address those risks without incurring and creating new currency risks. Additionally, the DAO may utilize the 40% income stream to refinance shortfalls via debt mechanisms that will immediately address the shortfall risk and cover any bad debts, using the income stream to repay the new externally financed debt. These financing mechanisms utilize future cash flows to borrow against, thereby immediately rectifying the bad debt and any risks to the protocol. While such financing transactions have not been executed to date, it is the goal of the DAO and its team to undergo and execute its first of such financing transactions in the near future to refinance and cover the existing shortfall within the protocol, as well as to backstop the Risk Fund with some initial liquidity to be used as necessary to cover future shortfalls and bad debt.

The above sequence of processes are executed when a shortfall is detected so that Venus may pause their borrow’s interest accrual, write off the borrow’s balance, and track the market bad debt.

Additionally, risk management processes will be implemented for the Venus Protocol stablecoin, VAI. Currently, VAI lacks use cases which results in low liquidity, in turn requiring Venus to force set its price to $1. Instead, we propose introducing a stability fee to keep VAI pegged, which users must pay when repaying minted VAI. The stability fee will be adjusted based on a base rate, the price of VAI, and a floating rate. The stability rate is an annual rate that will be divided by the yearly number of blocks on Binance Smart Chain, creating a stability rate per block.

A small stability fee for minting and burning disincentives users from buying and selling, reducing price volatility while creating value for Venus Protocol. The stability fee will in turn be used for handling extreme conditions such as bad debt, risk funds, and so on.

Additionally, at present, the maximum amount of VAI that can be minted is based on total supply and doesn’t take the collateral factor of supplied tokens into consideration. Therefore, it can cause immediate liquidation. Venus V4 will enable users to only mint VAI based on weighted supply , rather than total supply in order to reduce liquidations.

Strategic Financing Activities (Bonds)

Under the umbrella of Risk Management, and in particular managing shortfalls and bad debts within Venus Protocol, Venus along with its strategic advisor (Hedgey) are undergoing a strategic financing transaction with institutional investors to refinance the existing shortfall and shore up the risk fund. The intention is to issue Decentralized Bonds to strategically important institutional investors who will not only provide the financing needed immediately, but also provide partnership as we navigate through a rocky crypto environment. The Bonds issued are critical to ensure that Venus’ finances are in good standing without gaps in the balance sheet from bad debts, and excess issuance will be used to pad the risk fund immediately to prevent further liquidity and shortfall gaps. Venus needs to prove that it can issue bonds to these institutions not only to refinance its own liabilities but also to prove out a use case of bonds for other protocols, which can be productized in the future with Venus as the leading platform for issuance.

Key Points

While some of these points are to be ironed out with investors, as is typical during the investor commitment phase (now), the current overview of terms are overviewed below;

- EIP-4626 - tokenized vaults will be a backbone of the bond infrastructure

- The bonds will utilize the prevailing stable coin rates on Venus as a floating rate infrastructure, and issued with the floating rate plus credit spread standard as is typical in the TradFi space

- This aligns the revenue streams with the liability streams of Venus DAO (duration matching)

- The 40% risk fund allocation will be used to repay the bonds coupon and principal

- The bonds may be amortized and paid early by vote of the DAO should cash flows be significant such that the DAO deems it wise to paydown some of the outstanding bonds

- Goal of $80mm to be raised with a stable coin floating interest rate (based on Venus’ markets oracle) plus a credit spread (targeting 1.50%) to be the all in rate

- 7 - 8 year bullet Bond, noncallable, prepayable without penalty

By the bond tapping into the 40% Risk Fund allocation directly, this makes the bond Secured and a higher seniority than general issued bonds. The bonds themselves will be a new standard issuing credit instruments against future protocol cash flows themselves, thereby allowing investment or refinancing today from future earnings tomorrow.

Community Voting

Our Venus V4 proposal is an introduction to proposed Venus Protocol upgrades, intended to gather community support and feedback.

We have already started internal audits and should the Venus community vote in favor of V4 we will immediately engage external auditors and follow a staggered release schedule beginning this month through to Q1 2023.

Additionally, a whitepaper will be released going into detail on all of the above. For example, outlining the relevant formulas introduced for stable rate calculations, and the logic behind such calculations.

Conclusion

Venus V4 advances upon Venus V3 by improving in specific areas:

- Isolated Pools: improved scalability through isolated pools with adjustable risk parameters and efficient integration of new tokens.

- Stable Interest Rates: an alternative to variable interest rates that enables rate predictability and a reduced probability of liquidation during periods of high market volatility.

- Governance Modifications: fast interest rate parameter modifications, VIP role assignment, fine-grained pausing of specific actions within specific markets, and longer governance intervals for contract upgrades and role reassignments.

- Additional Oracles: integrating both Binance Oracle and Pyth in order to improve oracle resilience and avoid having a single point of failure.

- Improved User Experience: DEX integration to introduce seamless swapping, with 25% of revenue going to Venus.

- Risk Management Improvements: a mechanism for shortfall coverage as well as a stability fee for maintaining VAI’s peg.

- Bonds: a new primitive and mechanism for refinancing of protocol insolvencies**

We believe that the proposed changes move Venus forward in the right direction. Changes will increase scalability, provide stable rates for users, improve Governance processes and Oracle resilience, create a simplified user experience that drives fees to Venus, and improve our risk management processes.

We hope that Venus Protocol users are excited as we are about the proposed changes, and welcome all community feedback and suggestions.

Audit processes are very important, so no rush to get it alive.

Audit processes are very important, so no rush to get it alive.

Venus

Venus