At the end of the day the only way the price goes up and sticks is if the 65 million dollar shortfall is covered. Investors need to have confidence in the platform stability. Its been 18 months now and nothing has been done about that, so an inflation reduction will only go so far.

That’s my point

With an inflation around 2%. And many strong platforms got hacked, like Cream (total loss), Fulcrum (ditto), Uranium (ditto)… Venus got exploited several times, but survived. So that was very high-risk high-reward. With a 1% yield, the risk is still the same, but the reward no longer makes sense.

That’s it. Your name says you’re focused on XVS. I’m focused on the platform yield. You’re thinking about the why, i’m about the what. I’d be happy to see XVS being a success, i like Venus, but i stacked on Venus to get yield, no care if it comes from lending fees or XVS or whatever. It’s about yield compared to other yielding options, including Banks or Bonds. If XVS raises by +20% in one year thanks to the cut emission but my yield gets slashed in half, obviously I would quit.

Greetings, the proposal is very good without a doubt that has been presented and analyzed to the community, since it guides and shows the steps forward to continue

Probably I’m not very experienced in DeFi, but I think there is a little difference. Just a quick q: can you reinvest your bank-owned money in the same way as we can do in DeFi? Over and over?

Agreed. It’s a very good point to look FROM the other’s side.

Glad this passed, will significantly lower sell pressure on XVS

XVS Emission Cut Follow Up

The following report will analyze the movement on TVL following the emission cut to determine the impact of the proposal.

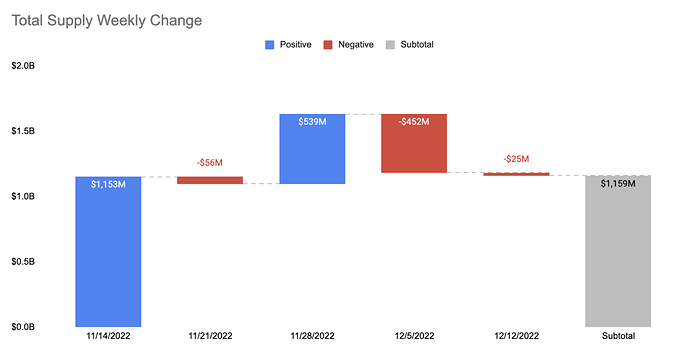

Supply TVL

- Total supply amounts had a lot of movement, increasing to $1.7B, then reducing back to $1.2B.

- At the end of the 30 days, the total value increased by 0.6%.

- There is no sign of any effect on the protocol supply after the 50% XVS emission cut.

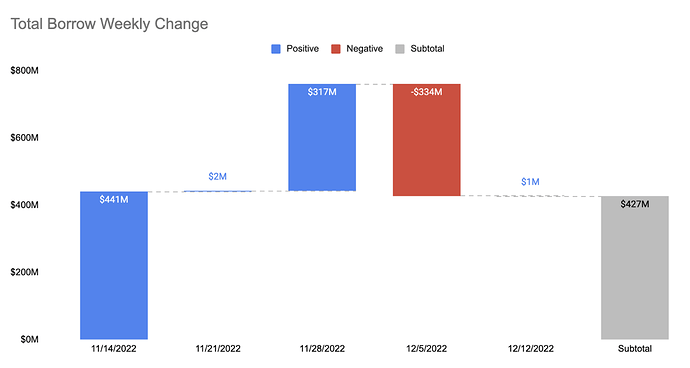

Borrow TVL

- Total borrow amounts had a lot of movement, increasing to $900M, then reducing back to $427M.

- At the end of the 30 days, the total value was reduced by -3.2%.

- There is no sign of any effect on the protocol supply after the 50% XVS emission cut.

Conclusions & Recommendations:

- There is no sign of effect over the protocol’s total TVL after the XVS emission cut. Following this behavior, the recommendation is to proceed with reducing an additional 50%.