Summary:

This proposal seeks to list Etherfi’s weETH as a supported collateral and borrowable asset on Venus Protocol’s Unichain deployment. Etherfi is aiming to scale the usage of weETH on Unichain as a DeFi hub for capital efficient collateral.

Motivation:

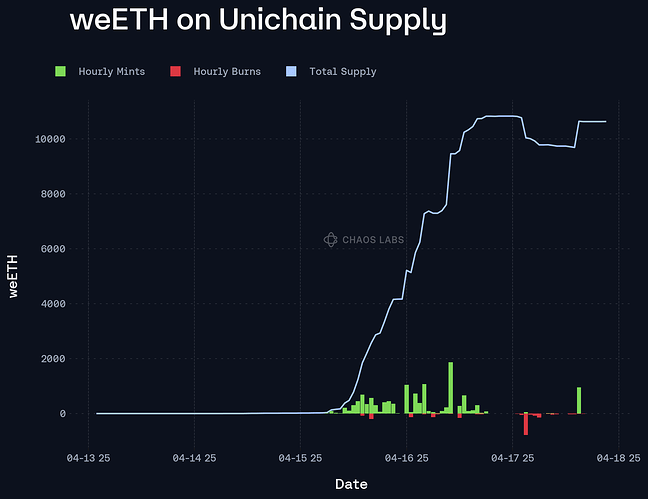

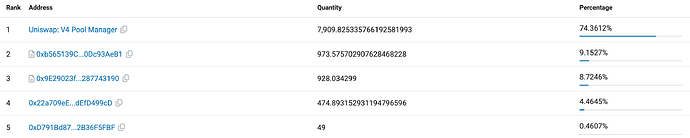

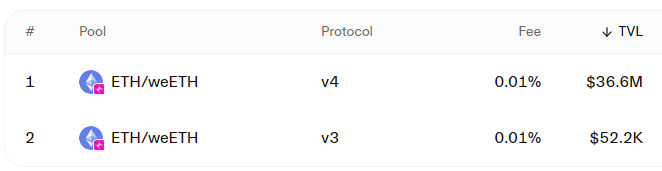

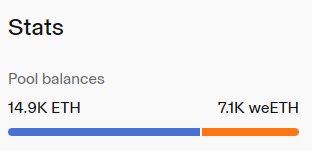

Etherfi is the leading decentralized, non-custodial liquid staking protocol on Ethereum, with over $5.3B in total value locked. Its restaked liquid staking token, weETH, is rapidly gaining adoption across DeFi ecosystems. Further information about holdings, liquidity, & deployments can be found from the following suite of analytics - https://dune.com/ether_fi/etherfi.

Listing weETH on Venus Unichain will support Venus’s money markets by providing additional ETH-based assets to the Unichain deployment, providing additional yield bearing collateral options for Venus users.

Benefits:

-

Enhanced Market Offering: Enables Venus users on Unichain to supply, borrow, and earn with a blue-chip, yield-bearing ETH derivative.

-

Marketing Support: Etherfi will join Venus in co-marketing this initiative to bring awareness of this new market to Ethereum users and the Etherfi community.

-

Ecosystem Alignment: Strengthens Venus’s positioning within the broader Etherfi and restaking narrative.

We look forward to receiving feedback on this proposal and look forward to supporting Venus with their Unichain deployment.