Overview

Chaos Labs supports listing sUSDe and USDe on Venus’s BNB Chain Core pool. Below we provide our analysis and recommendations.

(s)USDe

sUSDe is one of the most popular collateral assets in DeFi and is already deployed on Venus’s Ethereum Ethena pool. USDe is the unstaked version of sUSDe, not accruing yield in its price and thus not as popular a collateral asset, though there is observed demand to borrow it. Our prior recommendation for such assets is linked here, with a comprehensive overview of associated risks with such an integration.

Market Cap and Liquidity on BNB Chain

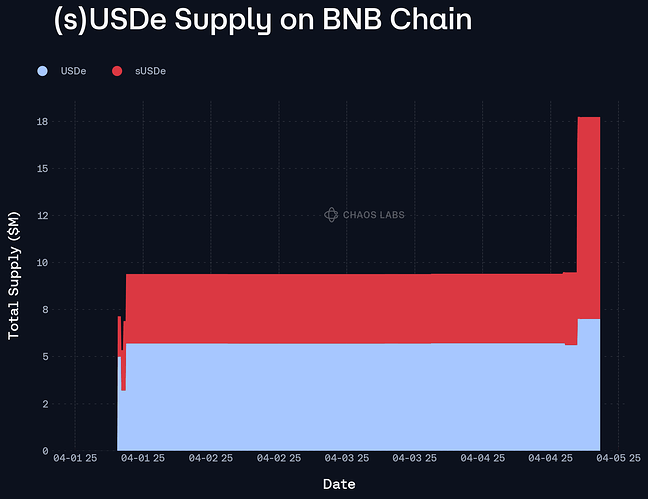

Both sUSDe and USDe were deployed on BNB Chain on March 11, 2024, though they did not register any significant supply until April 2025, increasing rapidly to over $18M combined.

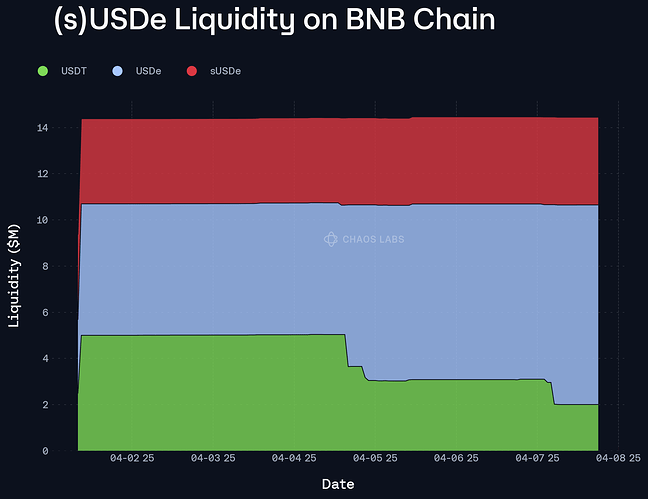

Their on-chain liquidity is largely limited to two PancakeSwap pools: USDT/USDe and sUSDe/USDe. This means, in order to complete an sUSDe to USDT swap, a trade would likely be routed through both pools, putting sUSDe’s liquidity in a somewhat riskier position than USDe’s, which is paired directly with USDT.

The amount of liquidity on BNB Chain has not increased since the pools were first created; the amount of USDT pooled has decreased as a result of swaps.

Listing Parameters

These assets will be listed in the Core pool to grant them access to liquidity. It is expected that sUSDe will primarily be utilized as collateral against stablecoins, while USDe will serve as the borrowed asset. However, given that they will be listed alongside uncorrelated assets, we recommend applying more conservative collateral parameters than those typically preferred by leveraged users. Specifically, we propose setting the Collateral Factor for both assets at 75%.

Due to minimal integration with aggregators and a limited number of liquidity pools, these assets currently cannot be efficiently swapped. As a result, we recommend setting the supply caps equal to the total amount of USDT paired with USDe, effectively representing the available exit liquidity.

For USDe, we recommend setting its borrow cap in line with the Kink point on its interest rate curve. Given its limited use cases, we do not recommend enabling borrowing for sUSDe. Lastly, we advise aligning USDe’s interest rate curve with those of other stablecoins for consistency and risk parity.

Pricing

We recommend utilizing the Chainlink feeds: USDe/USD for USDe, and USDe/USD multiplied by sUSDe/USDe for sUSDe.

Specification

| Parameter | Value | Value |

|---|---|---|

| Asset | sUSDe | USDe |

| Chain | BNB Chain | BNB Chain |

| Pool | Core | Core |

| Collateral Factor | 75.00% | 75.00% |

| Supply Cap | 2,000,000 | 2,000,000 |

| Borrow Cap | - | 1,600,000 |

| Kink | - | 80% |

| Base | - | 0.0 |

| Multiplier | - | 0.075 |

| Jump Multiplier | - | 0.5 |

| Reserve Factor | - | 25.00% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0