Overview

Chaos Labs supports the listing of sUSDe, PT-sUSDe-27MAR2025 and PT-USDe-27MAR2025 on Venus’ Ethereum deployment through an isolated pool. Below is our analysis and initial risk parameter recommendations.

Technical Overview

Pendle Finance utilizes a three-token system to represent each asset on the platform. Standardized Yield (SY) tokens serve as a unified interface for all yield-bearing assets. These SY tokens can be decomposed into Principal Tokens (PT) and Yield Tokens (YT). Principal Tokens (PT) represent the principal portion of the asset and are redeemable at a 1:1 ratio upon maturity, offering a fixed return to holders. Yield Tokens (YT), on the other hand, embody the yield portion of the asset. Holding YT entitles users to receive the accrued yield from the underlying asset until it reaches maturity.

PT-USDe is Pendle Finance’s principal token for USDe, and PT-sUSDe is Pendle Finance’s principal token for sUSDe. As we discussed above, PT tokens represent a claim on the principal component of the asset with a specific maturity date, which, in this case, is March 27, 2025. At maturity, PT-sUSDe can be redeemed 1:1 for sUSDe, allowing users to lock in a fixed yield until this date; PT-USDe can be redeemed 1:1 for USDe. The value of the PT tokens converges towards the underlying over time, reflecting the fixed yield accrued.

The underlying assets are sUSDe and USDe. sUSDe is the staked version of USDe, a synthetic stablecoin pegged to the U.S. dollar, developed by Ethena. USDe maintains its peg through a delta-neutral strategy, which involves balancing long and short positions to minimize exposure to market volatility. This ensures that fluctuations in the value of the collateral are offset by corresponding changes in the value of the hedge, effectively preserving the stability of USDe at its 1:1 peg to the dollar. By staking USDe within Ethena, users receive sUSDe, which accrues yield from Ethereum staking rewards and funding rate income generated by Ethena’s derivatives market hedging. sUSDe has a 7-day withdrawal period, during which users must wait to convert it back to USDe. To ensure stability, especially during periods of high market volatility, the system relies on DEX liquidity to facilitate smooth conversions and maintain user confidence

Liquidity

Given the reliance of PT-sUSDe and PT-USDe on their underlying assets, sUSDe and USDe, analyzing liquidity under extreme market conditions requires evaluating the entire process to ensure that PT-sUSDe and PT-USDe can be smoothly converted into safer assets. Specifically, during periods of high market volatility, PT-sUSDe and PT-USDe, combined with their respective YTs, would be used to redeem underlying tokens via the Pendle AMM, and subsequently swapped into safer assets on DEXs.

Each Pendle asset and its corresponding maturity date has a dedicated AMM pool composed of PTs and SYs. The AMM employs a dynamic pricing formula that accounts for the increasing value of PTs as they approach maturity. Specifically, through the scalarRoot, the AMM incorporates time decay and yield expectations into its pricing model, ensuring that the PT’s price upon maturity reflects both the passage of time and market expectations. As the asset nears expiration, the liquidity range becomes more concentrated around implied yield. This happens because uncertainty around the asset’s value diminishes, narrowing the price range and enhancing capital efficiency.

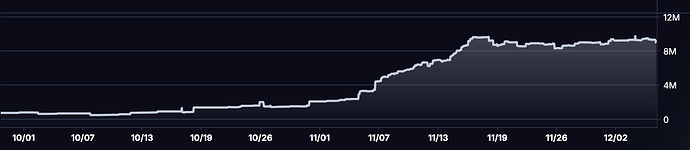

The TVL of PT-USDe surged by 322% in November 2024, rising from $2.8 million to $8.79 million.

PT-USDe-27MAR2025 Pendle AMM TVL

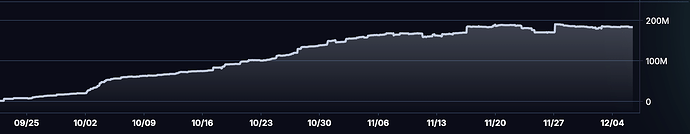

PT-sUSDe-27MAR2025 Pendle AMM TVL

Underlying Volatility

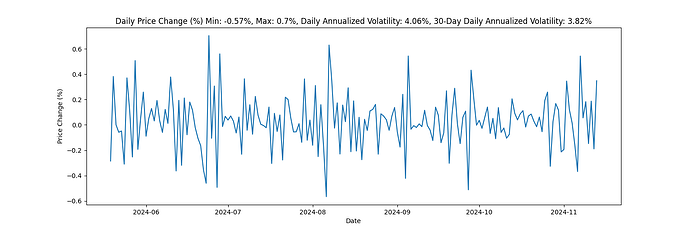

The underlying asset of PT-USDe, USDe, has exhibited somewhat elevated volatility for a stablecoin pegged to USD, with a Daily Annualized Volatility of 3.82% over the past 30 days and 4.06% over the past 180 days. The largest price drop during this period was 0.57%.

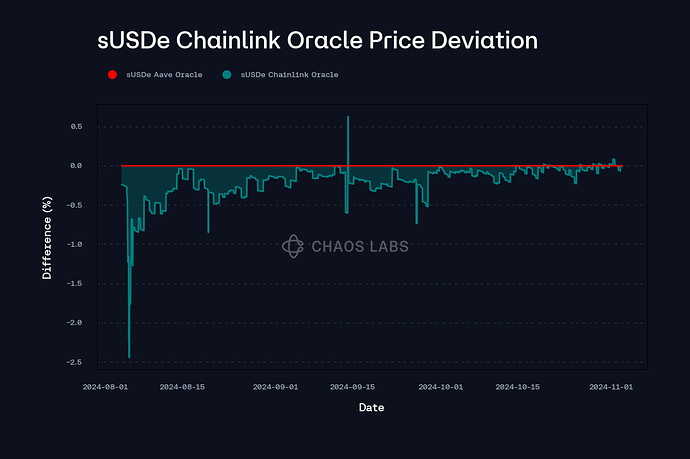

sUSDe has also previously deviated from its oracle price by 2.5%, which could impact liquidations of sUSDe’s PT token. With this in mind, applying the Pendle TWAP oracle will require us to incorporate additional volatility considerations when setting the initial listing parameters.

PT Token Volatility

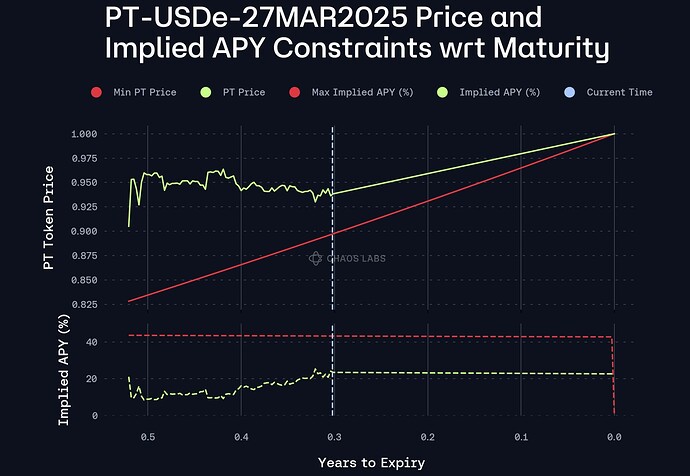

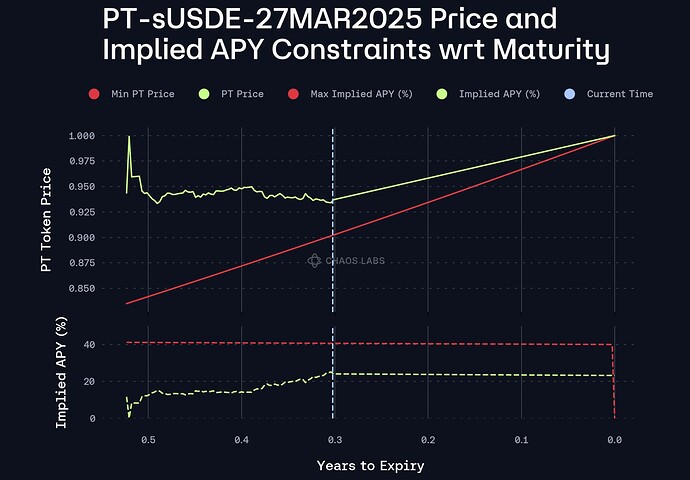

It is possible to infer the minimum PT token price from the parameters set on Pendle; the PT token converges to 1 as it approaches maturity. This allows us to set collateral parameters in a manner that significantly limits the risk of liquidation. As shown in the chart below, the minimum price of the PT token remains closely aligned with its actual price, indicating a degree of stability. The volatility of the PT token decreases over time because of reduced uncertainty, resulting in significantly lower volatility compared to the current stage.

Isolated Pool

Based on observations from previous PT listings, it is highly likely that the top use case for these markets will be looping the tokens with a stablecoin to boost yield. By creating an Isolated Pool devoted entirely to this use case, we are able to recommend more aggressive collateral parameters compared to listing the assets in the Core Pool, where liquidations would be more likely because of available borrowing of uncorrelated assets.

In our proposed setup, we recommend listing the assets alongside borrow-only (to prevent USDC-USDC looping) USDC. It may be prudent to incentivize this market, though the IR curve described below should properly reward USDC suppliers in this market.

Oracle Configuration and Associated Pricing Risks

sUSDe

Given the structure of the oracle chosen for sUSDe, the asset differs from others, like LSTs, in terms of how price deviations affect liquidation risk. In LSTs, deviations in market price do not typically trigger liquidations thanks to the debt being denominated in the same asset as the oracle market price. For example, in the case of wstETH, the oracle reflects the ratio of wstETH/stETH multiplied by WETH/USD. Given the predominant WETH debt, the only variance in the oracle setup that could lead to liquidation is the exchange rate of wstETH/stETH decreasing. This setup means that market price deviations don’t impact the collateral’s valuation relative to the debt, avoiding unnecessary liquidations.

In contrast, sUSDe’s oracle is structured as sUSDe/USDe multiplied by USDe/USDC. When the market price of USDe declines, it directly impacts the sUSDe oracle price, increasing the likelihood of liquidations. Additionally, sUSDe has a 7-day unlock period, during which deviations between its sUSDe/USDe market price and sUSDe/USDe exchange rate can occur. If USDe deviates from USDC and sUSDe deviates from USDe, liquidations may be triggered when the asset has already moved beyond profitable liquidation levels.

PT Tokens

Given the additional volatility that the PT token can incur compared to the underlying asset, we recommend pricing PT-sUSDe using a calculated oracle that combines the sUSDe rate with Pendle’s internal PT-sUSDe/sUSDe TWAP oracle configured with a 30-minute time window. The oracle will be structured with two elements:

- PT-sUSDe/sUSDe market rate using Pendle’s 30-minute TWAP

- USDe/USD market rate using Chainlink oracle

For PT-USDe, we recommend the same setup.

For PT-sUSDe, this setup includes the risks associated with the sUSDe oracle, particularly the potential discrepancies between the market sUSDe/USDe rate and the exchange rate. Deviations between the two can cause liquidations to be triggered under unfavorable conditions if the market price of sUSDe diverges from the oracle price, especially during periods of volatility or liquidity constraints. However, our proposed parameters have taken into account historical depegs, attempting to mitigate this possibility.

Additionally, the 30-minute TWAP for the Pendle market rate for both means that the oracle may not promptly reflect rapid market changes, increasing the risk that liquidations are executed when the actual market price has deviated further than the oracle indicates.

Finally, the market proportion constraint can be hit during a depegging event or the repricing of implied yields. In this, PT token liquidations would process, while fixing the PT token price with respect to the maximum implied yield and time until maturity. However, the PT token would still converge to 1:1 with the underlying at maturity, meaning debt interest accrual would generally lead to the CF of each position decreasing over time from the PT component of the oracle. With the debt asset being correlated, under the assumption that the price stays at the minimum and no liquidations can happen until maturity, the underlying asset price must revert to a value whereby the CF of each position would not cause bad debt.

LTV, LT, and Liquidation Bonus

Considering the use of a comprehensive aggregation to price the Pendle market rate, a conservative Liquidation Bonus is necessary to ensure that, during any price deviation, the discrepancy between the TWAP and the market price does not erode liquidators’ profitability.

Specifically, we suggest a Liquidation Incentive of 4% for the pool, with CF and LT of 90% and 92% for sUSDe, 86% and 88% for PT-USDe, and 85% and 87% for sUSDe to account for the additional components in the Oracle.

Supply Caps

Pendle AMM Slippage

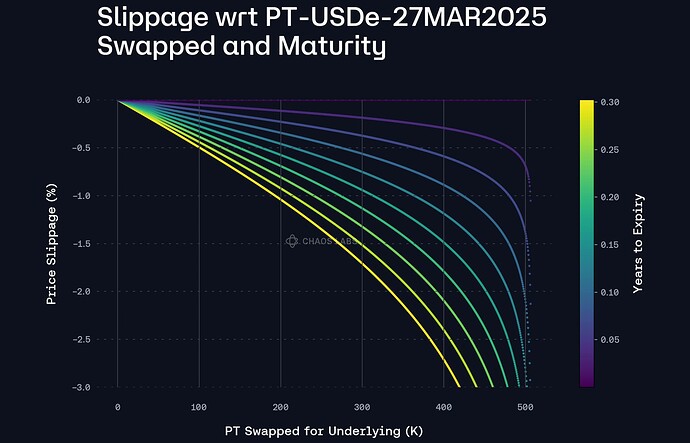

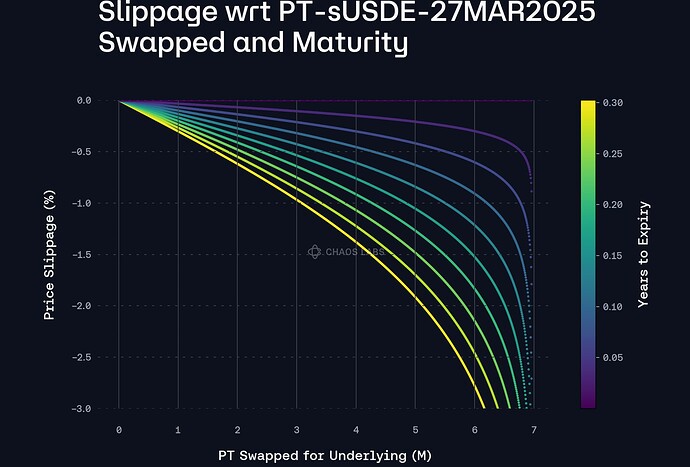

The plots below represent the amount of liquidity available under 3% slippage for both PT assets as the market approaches expiry with the current liquidity distribution in Pendle’s AMM. As the market matures and moves closer to expiry, the slippage associated with swapping reduces, especially for assets with lower scalarRoot values (greater expected implied yield fluctuation), which tend to have more variance in liquidity concentration. As a result, the quota limit relative to the pool size becomes much larger as expiry approaches and liquidity concentrates.

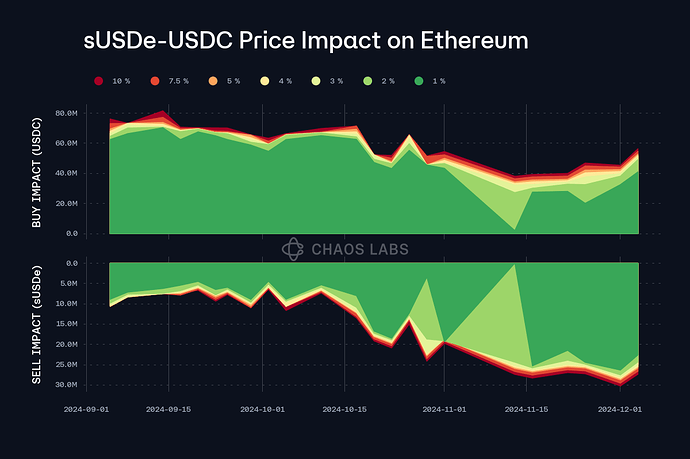

sUSDe

The following step in the liquidation process considers the sUSDe historical liquidity and price impact. Recently, it has grown to withstand a selling pressure of 25,000,000 sUSDe before incurring a significant price impact. Given the deep liquidity of the sUSDe/USDC pool, the liquidity on the Pendle AMM for PT-sUSDe/USDe becomes the main limiting factor for the asset.

Based on these plots and utilizing 2x the liquidity available below 3% price slippage at the current time to expiry, we are able to recommend a starting cap of 850K PT-USDe and 12M PT-sUSDe, alongside 50M for sUSDe, noting that the underlying asset liquidity is sufficient to support these caps. We note that we are using 3% as a conservative measure (rather than the 4% Liquidation Incentive) upon initial listing, and we are prepared to facilitate cap increases following observation of the market and utilization of our risk simulations.

Borrow Cap and IR Curve

The PT tokens will expire, converging to the underlying and effectively transforming into a sUSDe or USDe wrapper within their pools. Anticipating a surge in PT token withdrawals and stablecoin debt repayments post-expiration, we opt not to enable borrowing of the PT tokens. This decision is further bolstered by the fact that there is no clear use case for borrowing these assets.

For USDC, we are able to set its Kink at 92% because it will not be used as collateral, reducing the need for a buffer. Having observed surging stablecoin interest rates on other markets that have introduced sUSDe leverage, as well as the implied APY in the PT markets, we propose setting the rate at the Kink to 15%, with a JumpMultiplier aligned with other stablecoins. This IR curve will make the strategy profitable while also properly compensating USDC suppliers. We recommend setting its borrow cap according to the maximum combined borrowing power of the two PT tokens at full utilization.

Specification

| Parameter | Value | Value | Value | Value |

|---|---|---|---|---|

| Asset | PT-USDe-27MAR2025 | PT-sUSDe-27MAR2025 | sUSDe | USDC |

| Collateral | Yes | Yes | Yes | No |

| Borrowable | No | No | No | Yes |

| Supply Cap | 850,000 | 12,000,000 | 50,000,000 | 50,000,000 |

| Borrow Cap | - | - | - | 46,000,000 |

| Collateral Factor | 86% | 85% | 90% | - |

| Liquidation Threshold | 88% | 87% | 92% | - |

| Liquidation Incentive | 4.0% | 4.0% | 4.0% | - |

| protocolSeizeShareMantissa | 0.4% | 0.4% | 1% | - |

| Kink | - | - | - | 92% |

| Base | - | - | - | 0.0% |

| Multiplier | - | - | - | 0.16304 |

| JumpMultiplier | - | - | - | 2.5 |

| Reserve Factor | - | - | - | 10% |

| Address | 0x8a47b431a7d947c6a3ed6e42d501803615a97eaa | 0xe00bd3df25fb187d6abbb620b3dfd19839947b81 | 0x9D39A5DE30e57443BfF2A8307A4256c8797A3497 | 0xA0b86991c6218b36c1d19D4a2e9Eb0cE3606eB48 |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0