Summary

This proposal seeks to approve a time-sensitive listing of USDe and sUSDe in the Venus Core Pool on BNB. Ethena aims to use Venus as its main money market for its ongoing push onto BSC. Adding USDe and sUSDe to the market will improve options for Venus and BSC users, and will potentially bring increased borrow demand.

Context

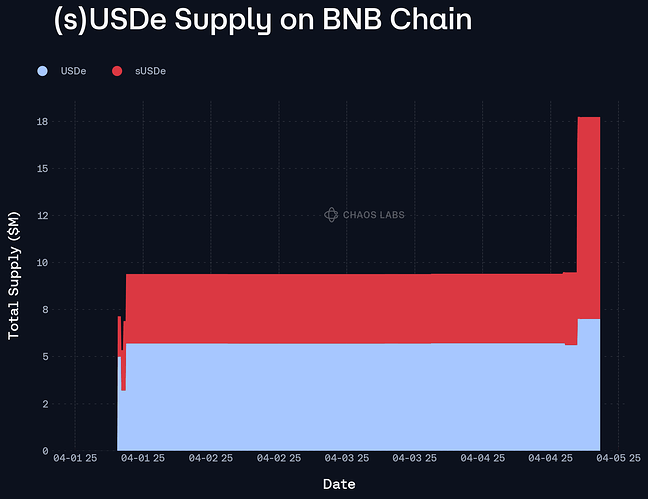

Ethena is undergoing an ongoing push of its core product line to BNB Chain.

USDe has grown to be one of the largest dollar-denominated assets in crypto, with over $5.3 billion in supply as of this protocol’s writing. USDe is crypto-collateralized with exogenous collateral, with transparency data found here. Since launch in early 2024, USDe has grown to be one of the most well-integrated assets in DeFi, with deep connectivity in apps like Pendle, Curve, Maker/Sky, Aave, and Morpho.

Ethena is looking to bring USDe to BNB Chain, along with sUSDe, the staked variant of USDe. Venus will be Ethena’s money market partner for the BNB Chain push.

Through its rewards program, Ethena will be providing points to users of USDe and sUSDe on Venus.

Details

Risk Parameters

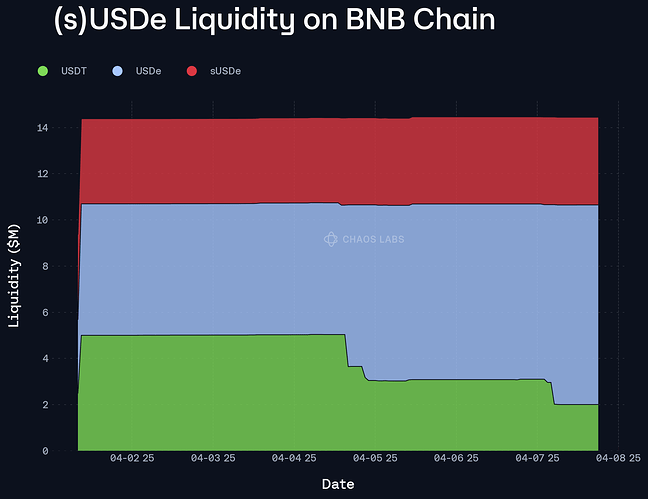

In collaboration with partners, over $5m each of sUSDe-USDe and USDe-USDT liquidity will be seeded against PancakeSwap v3 pools. The pools are already live, and can be found here: sUSDe-USDe and USDe-USDT.

Redstone will also be launching USDe and sUSDe price oracles shortly, and will be updated in this thread upon the point of their launch.

Due to the time sensitive nature of this deployment, Ethena is seeking the optimistic approval of these two assets with 0 borrow cap and 0% CF to ensure Venus protocol safety, with parameters on the borrow side to be determined by Chaos Labs without an additional VIP in the days after Ethena’s official rollout onto BNB Chain in the coming week.