Overview

Chaos Labs supports the listing of PT-SolvBTC.BBN in a new BTC-correlated isolated pool on BNB Chain. Our analysis and recommendations are provided below.

PT-SolvBTC.BBN

PT-SolvBTC.BBN is the Pendle principal token related to deposits of SolvBTC.BBN, itself representing deposits of SolvBTC staked in Babylon. SolvBTC is a BTC-pegged asset backed primarily by BTCB; it has previously been evaluated by Chaos Labs and listed on Venus. This ultimately results in four levels of smart contract risk: BTC wrapped to BTCB (or WBTC, cbBTC, etc.), then wrapped to SolvBTC, then staked as SolvBTC.BBN, then deposited in Pendle. While the risks of the first two steps have been evaluated previously and deemed acceptable, we more closely examine the latter two steps below.

SolvBTC.BBN

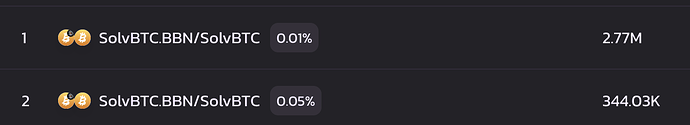

SolvBTC.BBN represents SolvBTC staked in the Babylon ecosystem, which uses Bitcoin to secure PoS networks. Deposits are incentivized with Babylon points, thus far it has attracted a TVL of $700M. Liquidity on BNB Chain is concentrated on two PancakeSwap pools, with $2.77M SolvBTC paired against $2.5M SolvBTC.BBN in the larger of the two.

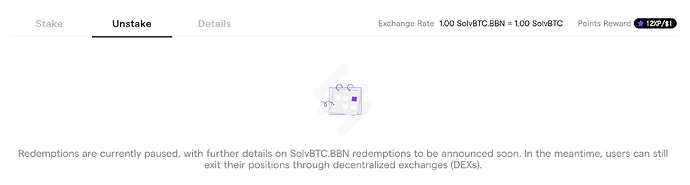

This liquidity is critical, as withdrawals of SolvBTC.BBN are currently paused, “with further details… to be announced soon.”

The lack of withdrawals means that the asset is relying on its DEX liquidity; with a BNB Chain market cap of $260M and just $3M in paired liquidity, it is possible that the market price of the SolvBTC.BBN could dislocate from SolvBTC, which could in turn create significant volatility in SolvBTC.BBN’s derivatives. However, it is likely that dislocations would largely be arbitraged away, less a discount for duration risk.

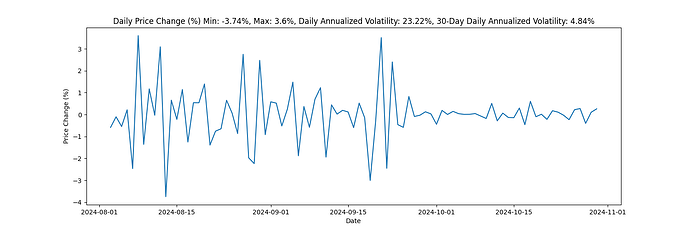

The asset has demonstrated high volatility relative to BTC, though this has reduced significantly in the past month, registering at 4.84%.

PT-SolvBTC.BBN

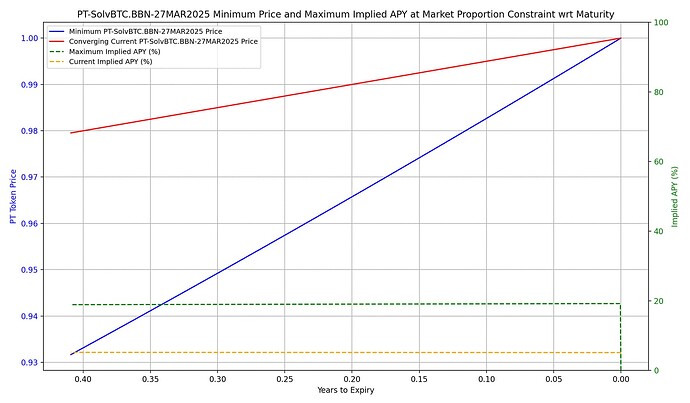

PT-SolvBTC.BBN (27MAR2025) is a token representing the principal of the underlying asset deposited into Pendle. At the current time of expiry, given by the market proportion constraint and the configured scalarRoot parameter, the maximum price drop for the PT token is 5% from its current implied value, which will continue to decrease as the PT token reaches maturity, implying that the market price is confined within a tight range.

Collateral Factor and Liquidation Incentive

Using our previous listing of PT-weETH as a guide, and augmenting for the additional volatility present in SolvBTC.BBN, we recommend setting the CF to 80%, the LT to 85%, and the Liquidation Incentive to 3%.

Supply Cap

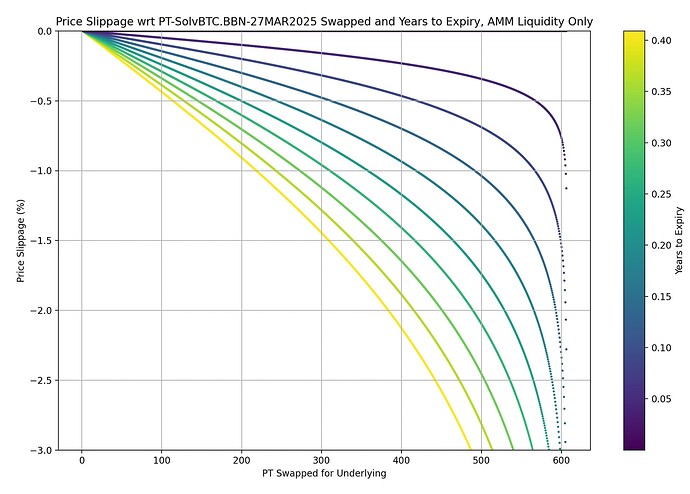

Pendle AMM Slippage

The below plot represents the amount of liquidity available under 3% slippage as the market approaches expiry, given the current liquidity distribution in the AMM. As the market matures and moves closer to expiry, the slippage associated with swapping PT becomes less extreme. This trend is especially pronounced for assets with lower scalarRoot values, i.e. a greater expected implied yield fluctuation, and they tend to have more variance in liquidity concentration. As a result, the quota limit relative to the pool size becomes quite substantial as expiry approaches, reflecting the heightened liquidity concentration.

Underlying Asset Liquidity

However, the underlying asset SolvBTC.BBN portrays much smaller on-chain liquidity, which is a necessity when unwrapping for the underlying during liquidation events and at expiry. Following Chaos Labs’ approach to initial supply caps for new assets and deployments, we propose setting initial supply caps at 2x the liquidity available under the Liquidation Penalty price impact, leading to a supply cap recommendation at 80 PT-SolvBTC.BBN.

Borrow Cap

Given the asset is set to expire, after which it will converge to the underlying at expiry, effectively transforming into an SolvBTC.BBN wrapper within the pool. This transition will necessitate manual withdrawals by PT token holders, with the underlying oracle quoting the price of SolvBTC.BBN.

Anticipating a surge in PT token withdrawals and BTC debt repayments post-expiration, we opt not to enable borrowing of the asset. This decision stems from the absence of a clear use case for borrowing, coupled with our expectation that users will withdraw PT tokens. Thus, we aim to mitigate potential tail risks associated with insufficient liquidity for withdrawals in case users borrow the asset.

Pricing

Given the lack of available withdrawals, we recommend pricing SolvBTC.BBN using a market oracle, augmented with the PT token TWAP oracle, configured to a 30 min time window.

BTCB IR Curve and Caps

We recommend setting the borrow APR at the Kink to 50 bps below the median implied APY for the asset since inception (7.47%). This leads to a target of 7% at the Kink, which we recommend setting to 80%, given that BTCB will not be used as a collateral asset in this pool. We recommend a borrow cap set at 2x the amount of BTCB that will be borrowable given PT-SolvBTC.BBN’s borrowing power, finding that BTCB’s caps will not materially change risk and higher caps will allow us to better facilitate market growth and potential new asset listings.

Recommendation

| Asset | PT-SolvBTC.BBN | BTCB |

|---|---|---|

| Chain | BNB Chain | BNB Chain |

| Pool | BTC Isolated Pool | BTC Isolated Pool |

| Collateral Factor | 80% | 0% |

| Liquidation Threshold | 85% | 0% |

| Liquidation Incentive | 3% | - |

| Supply Cap | 80 | 175 |

| Borrow Cap | - | 140 |

| Kink | - | 80% |

| Base | - | 0.0 |

| Multiplier | - | 0.0875 |

| Jump Multiplier | - | 2.0 |

| Reserve Factor | - | 20% |