Overview

Chaos Labs supports listing SolvBTC on Venus Protocol’s BNB Chain deployment as part of the Core pool. Below is our analysis and initial risk parameter recommendation.

BNB Chain Liquidity

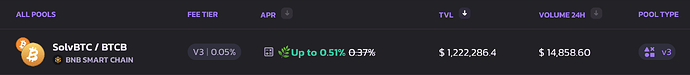

The current supply of SolvBTC on BNB Chain is 11,500, with 89K holders and 767K transfers. Its DEX liquidity is primarily paired against BTCB, with its most liquid pair on Dodo V2 and the second most liquid on PancakeSwap V3.

Dodo

PancakeSwap

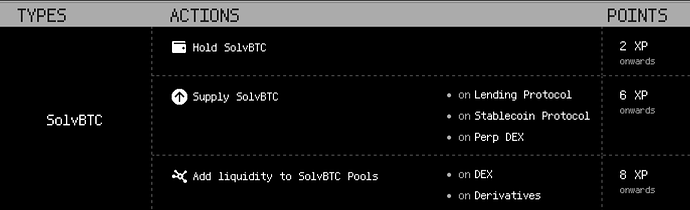

Currently, holding, supplying, and LPing SolvBTC is incentivized with points, adding a speculative element to SolvBTC’s on-chain supply and liquidity.

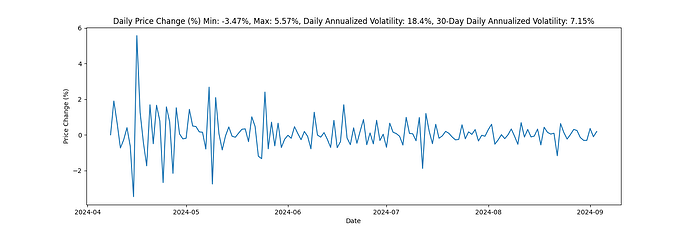

SolvBTC Volatility

Relative to BTC, SolvBTC has relatively low volatility, indicating strong peg volatility. Additionally, its volatility has improved in recent weeks, with a 30-day annualized volatility of 7.15%, compared to 18.4% since March.

Collateral Factor

Given the asset’s volatility relative to BTC, we recommend setting the CF slightly lower than that of BTCB.

Interest Rate Curve

We recommend aligning the IR curve with similar assets on the Venus protocol.

Supply and Borrow Cap

We recommend setting the supply cap at 2x the liquidity available under the Liquidation Incentive. Using this methodology, we recommend an initial supply cap of 100 SolvBTC and setting the borrow cap at 55% of the supply cap.

Pricing SolvBTC

Given SolvBTC’s limited price history, we recommend using the asset’s market price.

Recommendation

| Asset | SolvBTC |

|---|---|

| Chain | BNB Chain |

| Pool | Core |

| Collateral Factor | 75% |

| Liquidation Incentive | 10% |

| Supply Cap | 100 |

| Borrow Cap | 55 |

| Kink | 50% |

| Base | 0 |

| Multiplier | 0.09 |

| Jump Multiplier | 2.0 |

| Reserve Factor | 20% |