This proposal is co-authored by Pendle Finance and Solv Finance.

Rationale

BTCfi narrative is gaining healthy traction over the past month with successful introduction of various BTC LST protocols such as SolvBTC. According to IntoTheBlock’s Bitcoin in DeFi dashboard, ~1% of total BTC supply is currently circulating in DeFi. This signals rising interests in BTCfi, thereby presenting an opportunity for leading money markets like Venus to participate in this vertical through an Isolated Pool.

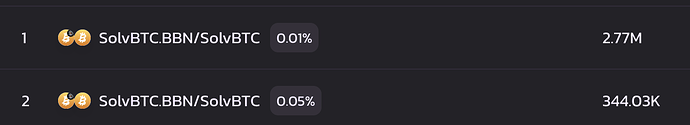

We believe PT-SolvBTC.BBN is the best suited asset as the first collateral of this newly created Isolated Pool as SolvBTC.BBN has proven traction on the BNB chain. SolvBTC.BBN represents SolvBTC staked in Babylon. Currently, there’s total supply of 3687 SolvBTC.BBN (approximately $245m liquidity) on the BNB chain.

In addition to above, this proposal is built upon previous success of adding Pendle’s PT-weETH into Liquid Staked ETH Isolated Pool on Ethereum which currently contributes ~$5m liquidity to Venus. Similarly, through supporting Pendle’s BTC Principal Tokens (PT) as collateral, Venus Protocol can capture borrowing demand from this rising BTCfi narrative.

Proposal Summary

- Create new Pendle PT-BTCfi Isolated Pool with PT-SolvBTC.BBN as its first collateral on BNB chain

- Delegate full discretion for Venus’s risk managers to decide risk parameters such as collateral factors and appropriate supply cap for PT-SolvBTC.BBN

- A separate proposal will be submitted to seek Venus DAO approval in the future if there’s suitable collateral to add into this Isolated Pool

Motivation

-

Venus currently has massive idle BTCB liquidity in its Core Pool. Total supply is ~$640m while utilisation is only 10%. Creating a separate Isolated Pool for BTCB depositors will enable higher deposit APYs and generate higher borrowing revenue for Venus.

-

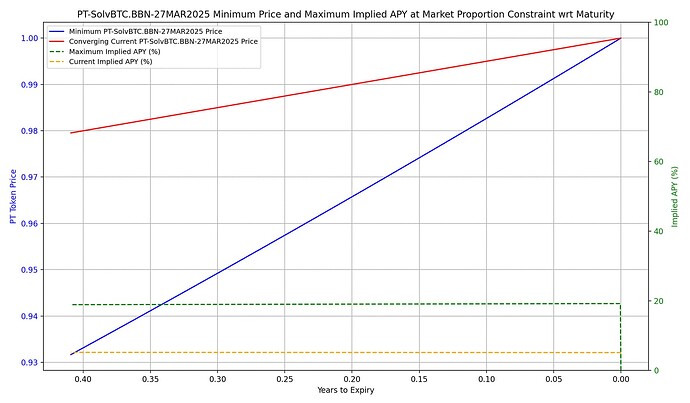

The newly launched PT-SolvBTC.BBN market on Pendle has seen positive traction, successfully accruing ~$50m of TVL within a month with PT Fixed APY hovering around ~6%. The difference between PT’s Fixed APY and current BTCB borrowing APY of ~1% indicates there’s substantial margin for users to profitably leverage loop PT-SolvBTC.BBN through Venus.

-

Venus DAO has recently passed VIP to add SolvBTC as collateral to Core Pool. This is a vote of confidence for SolvBTC as collateral asset and this proposal seeks to build on Solv team’s proposal and introduce PT-SolvBTC.BBN (which is an LST of SolvBTC deposited into Babylon) as collateral in the newly created Isolated Pool. (https://app.venus.io/#/governance/proposal/387?chainId=56)

What is Pendle

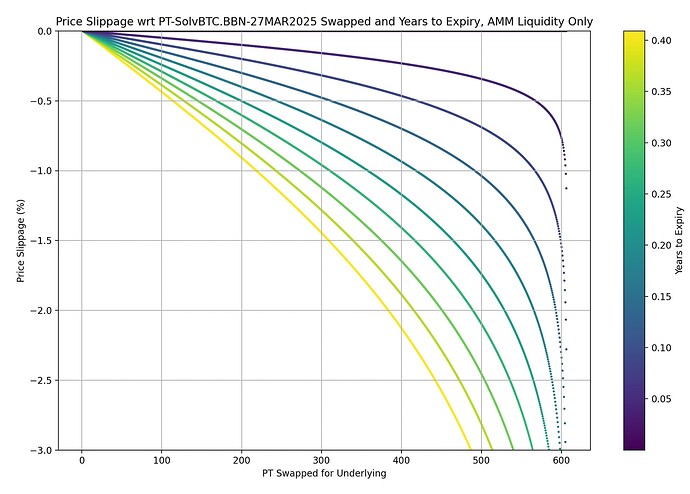

The Pendle protocol enables permissionless tokenization and trading of yield. Pendle allows anyone to purchase assets at a discount, obtain fixed yield, or long DeFi yield. The protocol enables this by taking yield-bearing tokens and then splitting them into their principal and yield components, PT (principal token) and YT (yield token) respectively, which allows them to be traded via Pendle’s AMM.

Pendle brings the TradFi interest derivative market into DeFi. In traditional finance, interest rate swaps are the biggest market in the world at >$500T. PT is the equivalent of zero-coupon bonds while YT is the equivalent of coupon payments. Pendle is positioning itself to become a core infrastructure for on-chain yield trading.

Principal Tokens Mechanics

PT is a non-rebasing token. PT represents the principal portion of the underlying asset and can be redeemed 1:1 for the underlying asset at maturity. Since the yield component (staking/restaking rewards and points accrual) has been separated, PT can be acquired at a discount compared to the underlying asset. The value of PT will approach and ultimately match the value of the underlying asset on maturity.

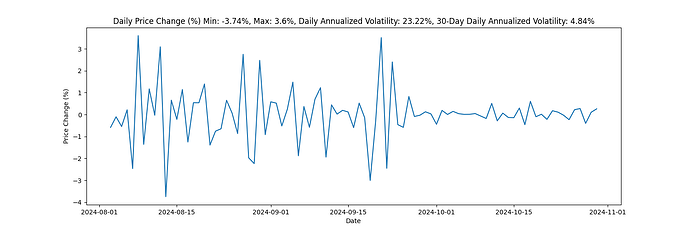

Due to its mechanics, the value of PT is tightly correlated with the value of its underlying asset. At maturity, the price of 1 PT is equivalent to 1 underlying asset.

Details on how PT is minted can be found here: https://docs.pendle.finance/ProtocolMechanics/YieldTokenization/SY

Details of PT Oracle can be found here:

https://docs.pendle.finance/Developers/Oracles/IntroductionOfPtOracle

Details of using PT as collateral in Money Markets can be found here:

Security and Audit

Pendle smart contracts have been audited by Spearbit, Chain Security, Ackee, Dedaub, Dingbats, and some of the top wardens from Code4rena. All of Pendle’s smart contracts are open source.

The complete list of audit reports can be found on our Github repo:

https://github.com/pendle-finance/pendle-core-v2-public/tree/main/audits

Other References

Money markets such as Morpho, Silo, Dolomite and Timeswap have already supported various Pendle PT tokens as collateral. Collectively, there’s more than $170m worth of Pendle’s PT tokens deployed as collateral across these money markets.

Additional Information

PT-SolvBTC.BBN Token Address: 0x541b5eeac7d4434c8f87e2d32019d67611179606

Website: https://app.pendle.finance/trade/markets

Github: https://github.com/pendle-finance/pendle-core-v2-public

Twitter: https://x.com/pendle_fi