Summary

Add support for the SolvBTC market on Venus Core Pool

Background

About Solv Protocol

Solv Protocol is pioneering a Bitcoin Reserve through SolvBTC, aimed at unlocking the full potential of over $1 trillion in Bitcoin assets through a liquidity consensus infrastructure. By providing a fully transparent Proof-of-Reserve, having diverse reserve assets, and seamless integration with liquidity markets, Solv is creating a comprehensive gateway to BTCFi, and also paving the way for traditional funds to confidently enter the crypto world.

Backed by prominent investors such as Binance Labs, Blockchain Capital, Laser Digital, and others, Solv Protocol stands as a beacon of security and trust. Solv Protocol has undergone extensive security audits by leading firms, including Quantstamp, Certik, SlowMist, Salus, and SECBIT, ensuring the highest standards of safety.

About SolvBTC

SolvBTC, is a token representation of Bitcoin kept in Solv’s Bitcoin Reserves(the Initial Reserves includes BTCB & native BTC only), where it allows Bitcoin liquidity to seamlessly flow across various chains, breaking down inter-chain barriers and providing crucial liquidity infrastructure for the entire Bitcoin-powered finance (BTCFi) ecosystem.

Deployed on more than five major networks like Bitcoin mainnet, Ethereum mainnet, BNB Chain, SolvBTC is a key liquidity provider with over 18,000 BTC kept in our reserves. Our robust liquidity has attracted many key players in the DeFi world to partner and build using SolvBTC. Among them include Bitcoin Staking protocol Babylon, Synthetic Dollar Stablecoin Protocol Ethena, and many other projects.

SolvBTC on BNB Chain

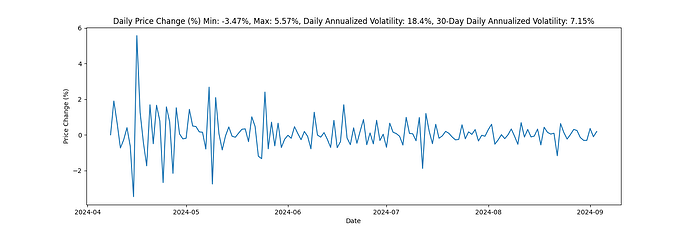

Since launching in April 2024, more than 10,000 SolvBTC have been minted from BTCB on the BNB Chain. As of July 25th, SolvBTC is redeemable for BTCB at a 1:1 ratio. We continue to see substantial growth potential of SolvBTC on the BNB Chain.

Our strong collaborations with major BNB Chain players, such as ListaDAO, Pancake, CakePie, Tranchess, Thena, DODO, and Binance Oracle, have positioned Solv as a top 5 protocol in the BNB Chain ecosystem, contributing significantly to our partners.

Benefits

Integrating SolvBTC as collateral on Venus Core Pool will offer several benefits:

-

Enhanced Liquidity

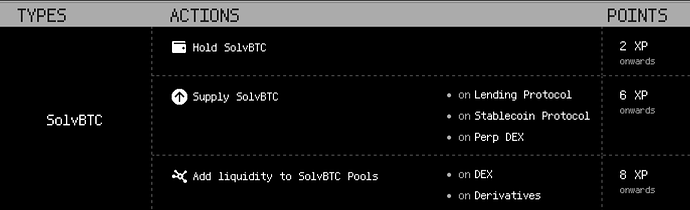

SolvBTC will boost Venus’s liquidity and trading volumes, due to the various yield opportunities built upon the SolvBTC ecosystem, including Solv XP, DeFi yields & also points farming on some of the most popular L2s. -

Increased Yield Opportunities:

With Venus supporting SolvBTC as collateral on the Core Pool, users can leverage their SolvBTC holdings to maximize returns from Venus’s lending and borrowing features, driving higher returns for BTCB lending. -

Innovative DeFi Strategies:

Support from Venus will foster the development of new DeFi strategies for BTCB and SolvBTC, increasing demand for both supplying and borrowing BTCB. Similar cases can already be seen on other L2s, where users lend their SolvBTC.BBN (LST built on top of SolvBTC), to borrow more SolvBTC to leverage farm Solv XP and other kind of yields. This resulted in higher protocol fees for those lending protocols due to higher borrowing rates. -

Solv Points Incentives

Lending SolvBTC - 10 XP/$1 per day, the highest we offer across multiple chains.

Community campaign to distribute more XP Boosting cards to Venus users.

Solv Points System Portal: https://app.solv.finance/points

Liquidity Page: Solv App – Decentralized Liquidity Infrastructure

These benefits are aligned with similar successful integrations on other lending protocols in the DeFi space, where SolvBTC has enabled users to enhance their yield opportunities and drive higher protocol fees.

Integrating SolvBTC into Venus’s Core Pool represents a strategic opportunity for both platforms. This partnership will enhance liquidity, attract new users, and drive innovative DeFi strategies within the BNB Chain ecosystem. By combining SolvBTC’s robust liquidity with Venus’s lending capabilities, we can foster significant growth and reinforce our leadership in the DeFi and BTC-Fi sectors.

Specifications

On BNB Chain

Dune Dashboard: https://dune.com/picnicmou/solvbtc-overview-bnb

Token Address: 0x4aae823a6a0b376de6a78e74ecc5b079d38cbcf7

Token Supply: 10,408 SolvBTC

Token Holders: 85,370

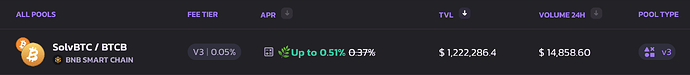

Liquidity on DEX’s: $11m+

Additional Information

Website: Solv App – Decentralized Liquidity Infrastructure

Github: solv-finance · GitHub

Twitter: x.com

Telegram: Telegram: Contact @SolvProtocol

Medium: https://solvprotocol.medium.com/