I compare VAI investment to Bonds. You won’t get rich, correct, but richer. The risk/reward ratio is pretty good and since it’s a stablecoin (finally!) i’ve no fear to bet very big amounts. I wouldn’t do it on DOGE. Cashing-in like 10% or 20% on huge amounts with low risk is still welcome. I’m not a Sh*tcoin investor, i’ve rather a Fixed-Income profile.

They have $1.5 in one hot wallet and about $6 in the other, it has been like this for the last 3-4 days. I am a bit obsessed yes has been a nice trade when you could catch the arb you could make 1-2% easy, when the withdrawal was shut it was 7-8%.

Like @Jmn you might not get rich but richer, which is also my style swerve the shitcoins and get a nice 20% profit from VAI by cashing in on the miss pricing and kicking up a bit of stink so the peg get’s fixed.

My favourite trade before this was BUSD/DAI, very much a grind and hard work type of deal and not a get rich quick type of trade.

Not a get rich at all and bonds COST you money not make you money. There is an opportunity cost you are not considering. Maybe make 1% vs likely make 100%+…

How do bonds cost you money and not make you money?

My strategy is more about risk management and wealth preservation. Having a 10x is nice but watching your portfolio fall 90% is no fun.

Well, yes, same question as @Fat?

My Bond portfolio yields in the 10% YTM, so I actually do earn money, even inflation and trading fees deduced. Maybe he was talking about Sovereign Bonds, which, inflation deduced, yield negative, correct. But not, I’m not crazy enough to compare a VAI to a T-Bond. It was about High-yield and Frontier bonds. The good ones, not those from Trump.

You’re right, I’m not, but on purpose. I do not trust the magic of “Had I 100K invested just before Musk tweeted something about Doge, i’d get rich”.

This is Casino. You win, win, and one day lose everything. If keeping liquidity to jump into a bubble and get-rich-quick was automatic, we’d all be rich. Maybe you did it, and inflated your portfolio by 1000% in one day while it takes me one year to do 10%. Happy you, but I see it as winning at the lottery. What you are not considering is all those who lost by investing in volatile coins, and the risk.

Me neither, unless your betting on deflation and expecting bond prices to go higher (i.e. rates lower) there is no reason to trade them, let alone hold them too maturity.

If you think bonds are not worth investing in…

" At 61, Gundlach proved his worth as and investment savvy and could outperform even Warren Buffett by the end of his life."

“Gundlach made his fortune by navigating the bonds market instead of stocks”

The return on bonds are minuscule and dont keep up with inflation. That’s how.

You guys are the only ones I have seen bragging about making money by stock piling and hodling VAI. That should tell you something…

I totally disagree with your opinion that Ill have to soon buy 1 VAI for $5 in order to repay my debt. But even if you were slightly right and I had to spend $2 for each VAI I believe crypto will be more than a 2x so it would still make more sense to borrow VAI and buy crypto.

Right, on this, I disagree.

Not that crypto won’t be 2x, but that concept of believe. I do believe nothing, I do maths and as @Fat explained, the VAI now has a pressure to push it toward 1+ (not two, not five, it was a joke, I think). So I bought tons of discounted VAI and waited for it to go to 1+, and here we are.

As strange as it look, I’m not really a crypto investor. I have zero position in non-stable coin (counting VAI as stable). For such a profile, VAI happens to be excellent, it has both vol opportunities and relative safety. Like a DAI on steroids.

For a risk-appetite crypto trader, sure VAI is lame, but on the other side, low-risk, it’s pretty good.

Yep the $5 thing is not serious, I think you might see a flash crash to that level but as for sustaining it that’s something else.

Binance won’t let me put orders in more than 20% below the current market price and liquidity is quite thin, Otherwise I would like to step some orders down to provide a floor.

Thinking crypto is guaranteed to double in a short time frame makes me very nervous. Especially considering we’ve already had a huge run up.

Honest question @JimK have you been through a bear market before?

Depends on which bonds, high yield is around 9-10% and your thinking of holding them to maturity, if the US does taper and then has to role it back due to weakening economic data you could make some big money on TLT calls.

Assuming $1.30 is theoretical max for VAI price, there’re only 70K remaining on Binance, and 80K in total (including stupid orders at $5). Arb no longer possible.

The momentum has a mind of it’s own.

I would add more Busd as collateral rather than selling it for Vai if I wanted a certain coin back.

Binance has nearly 1m in their hot wallets. 338k in Hot wallet 6 and 630k in hot wallet 7 and probably some more on user wallets.

Correct, one good million available for withdrawals. The issue now is the Bid on Binance: it’s just gone. A few thousands under $1.15, there’s nothing more to do there. On the other side the liquidity on-chain got big with Dino.

DSG has just been listed on coin market cap.

They have a V1 and V2 but the contracts are the same lol. Have they just cloned pancake swap?

I took a look, and the change is subtle but real. Mostly param adjutments and gas optimization, as documented. And it hasn’t been Audited by Certik yet AFAIK. A typo in an update of otherwise Audited code is exactly what killed Uranium Finance.

And they do typos…

“Donte” instead of “Donate”.

The basic features like Liquidity and Stake look good, but those NFT and other complex tokenomics should be re-audited asap.

It’s not like PancakeV1 and V2, which were different pairs. Here the pair is the same, the Staking has changed to support more NFT tokenomics.

Suspicious Dino Arbi-bot

This recently created wallet has been topped-up with 5000 BUSD plus 2000 VAI.

Then it ping-ponged both sides, losing the fees each time, until it ran out of VAI. Then the BUSD went away.

What the h*ll is that? A buggy bot or some artificial volume pumping for Dino?

Update: See explanation below.

If it walks like a duck and quacks like a duck.

Wash trading to generate volume not sure I understand it, maybe they want to show up in the top gas guzzlers.

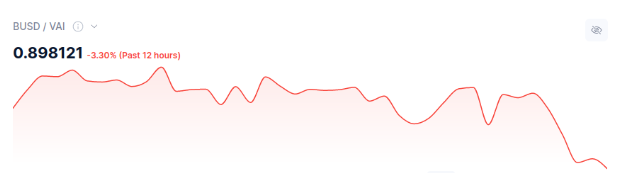

Binance order book is also breaking through $0.9

I really don’t get the point of the BUSD<->VAI pingpong. I understood the odd technique of liquidators to repeat the same tx to flood the block, but this one, i’m thinking about it for hours and still can’t get the point. Any idea?

I’m wondering how far VAI will go, after all, $1.10 is actually off-peg too.

Indeed…

I got it, finally. That’s due to the Mining Rewards (à la Biswap). By swapping a lot and a lot, you can end with many more rewards than the initial amount.

Unlike Biswap, the rewards are sticky, once you enabled then, so you continuously get rewards until you harvest them.

Well spotted! would not have guessed that.

Trade Mining Rewards: 25,156.11 %

- After the withdrawal of your rewards, you will lose the transaction mining weight