Listing Frax Assets on Venus

Overview

Chaos Labs supports the listing of FRAX ecosystem-related assets in the Ethereum deployment. However, we do not recommend the integration of such assets within the BNB Chain market, due to the lack of liquidity and supply on BNB Chain. Following are our analysis and risk parameter recommendations for the initial listing.

Note: The following analysis is conducted solely from a market risk viewpoint, excluding considerations related to centralization and third-party risk. If the community aims to reduce exposure to sfrxETH, sFRAX or FRAX adopting more conservative supply and borrow caps should be considered.

frxETH and sfrxETH

Liquidity and Market Cap

frxETH

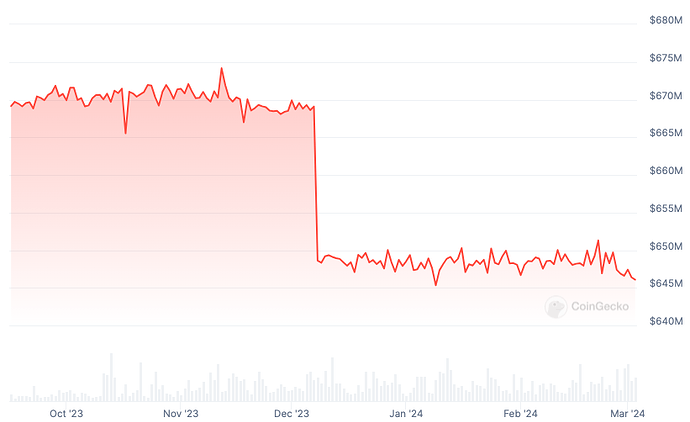

When analyzing market cap and trading volumes of assets for listing, we look at data from the past 180 days. The average market cap of frxETH over the past 180 days is ~$625M, and the average daily trading volume was $3.8M (CeFi & DeFi).

sfrxETH

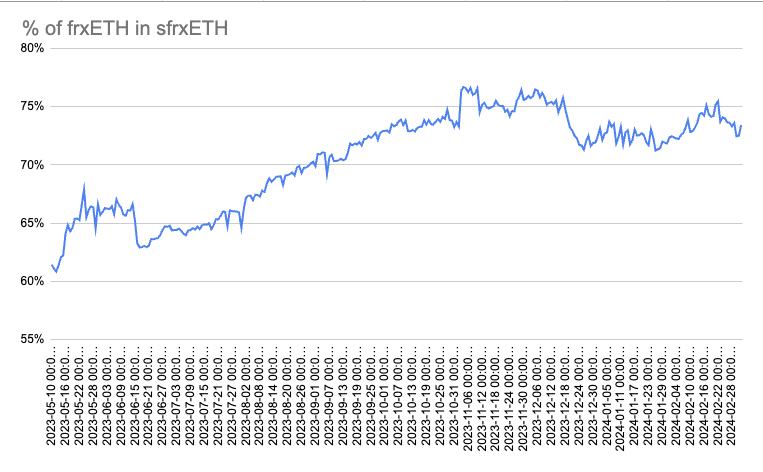

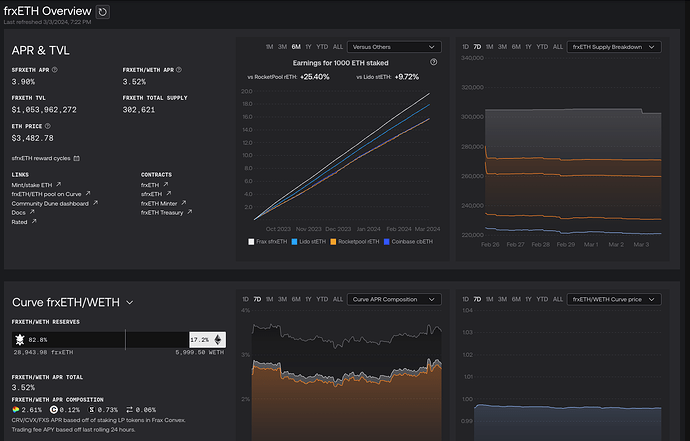

sfrxETH constitutes approximately 73% of all deposits within frxETH. The average market capitalization of sfrxETH over the past 180 days stands at approximately $460 million, with an average daily trading volume of $1M across DeFi platforms. Users who deposit into sfrxETH are entitled to all staking rewards generated by the Frax liquid staking protocol.

frxETH does not undergo explicit rebasing or generate staking yield, effectively relinquishing its share to sfrxETH depositors. However, frxETH holders are incentivized through Curve LP rewards, creating a dual-incentive structure. This structure results in high staking yields for the vault, while the rewards allocated to frxETH liquidity providers effectively mirror the yield generated by sfrxETH suppliers.

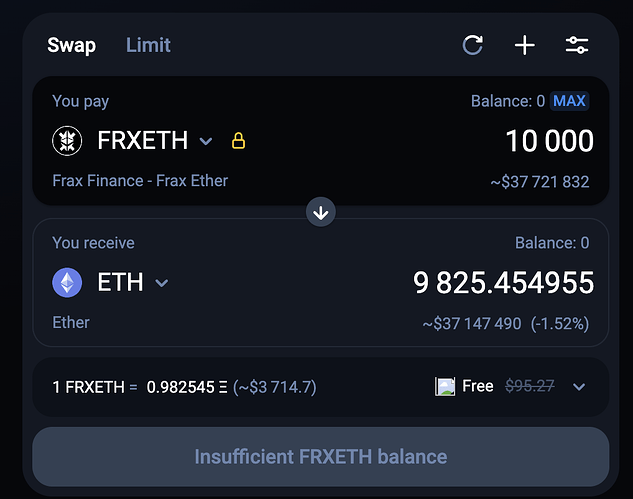

Listing frxETH on Venus will lead to minimal demand, as it doesn’t accrue staking yield whatsoever, and all frxETH yield is generated from Curve LPs or deposita into sfrxETH… Nevertheless, its liquidity can be leveraged within the context of sfrxETH supply cap parameters, allowing for a greater value. This is due to the ability to atomically withdraw sfrxETH for frxETH and swap frxETH for ETH during a liquidation event.

Volatility

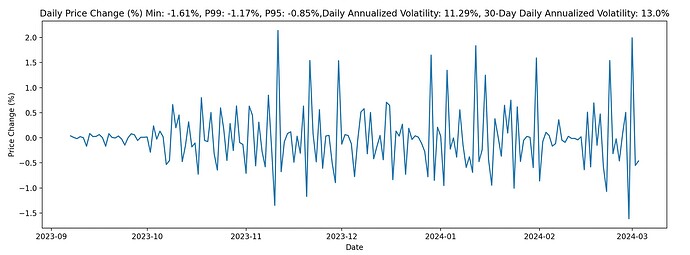

frxETH / ETH Volatility

Analyzing frxETH price volatility over the past, we observed daily annualized volatility of 11.29% and 30-day annualized volatility of 13%.

Collateral Factor

Considering the volatility and the correlation of sfrxETH to ETH, we recommend listing it in the ETH LST pool and setting the Collateral Factor to 90%, similar to the ETH and wstETH parameters.

Supply Cap, Borrow Cap, and Liquidation Bonus

Following Chaos Labs’ approach to initial supply caps, we propose setting the Supply Cap at 2x the liquidity available under the Liquidation Penalty price impact.

Given the concentrated liquidity of frxETH, we recommend a supply cap of 10,000 sfrxETH.

Based on our observations, the utilization rate for vault-standard LSTs has been low. Therefore, we have taken a conservative approach toward LSTs borrow caps of 1,000 sfrxETH. However, if there is a significant increase in demand and utilization, we will reassess the caps according to the utilization pattern.

Reserve Factor and IR Curve Parameters

For the Reserve Factor and Interest Rate curves, we recommend aligning the parameters with those of ETH on the Ethereum market to ensure consistency across similar assets on Venus.

sfrxETH Oracle Implementation:

We recommend utilizing the custom sfrxETH Oracle implementation as defined here. This is the current oracle utilized within FRAX-native lending markets, created by the frax team, which leverages an aggregate pricing approach through a combination of two discrete pricing mechanisms:

- sfrxETH/frxETH exchange rate, followed by a Uniswap V3 15 minute time-weighted average price (TWAP) of frxETH/FRAX and the Chainlink FRAX/USD Oracle.

- sfrxETH/frxETH exchange rate, followed by the exponential moving average (EMA) of the frxETH/ETH Curve Pool (with a current EMA time of 2 hours) and the Chainlink ETH/USD Oracle.

FRAX and sFRAX

FRAX

When analyzing market cap and trading volumes of assets for listing, we look at data from the past 180 days. The average market cap of FRAX over the past 180 days was ~$659M, and the average daily trading volume was ~$10M (CeFi & DeFi).

Collateral Factor

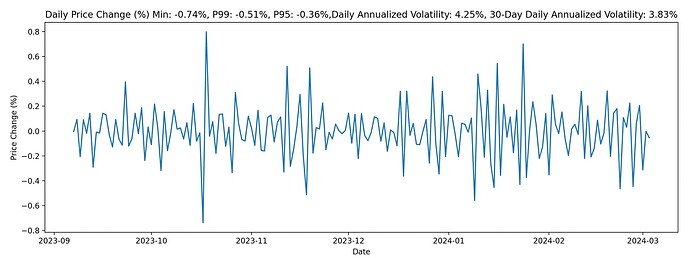

Analyzing FRAX price volatility over the past, we observed daily annualized volatility of 4.25% and 30-day annualized volatility of 3.83%.

Considering this volatility and the history of FRAX on other chains, we recommend a CF of 75%.

We recommend listing FRAX as borrowable as we do not observe a significant risk to the protocol by allowing the borrowing of FRAX, as long as it is bound by a well-defined cap.

sFRAX

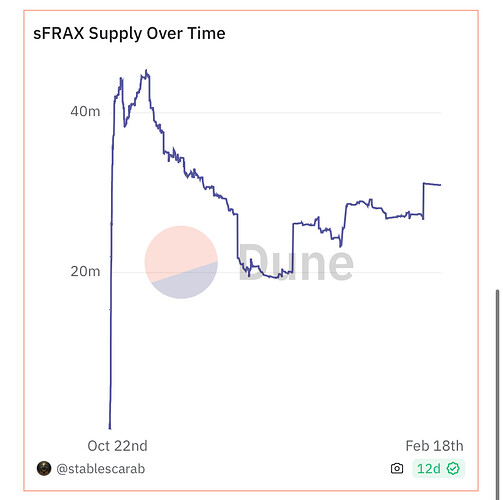

sFRAX represents a yield-bearing equivalent to FRAX and can be atomically withdrawn for FRAX at any point, leveraging its underlying liquidity. The total supply of sFRAX is 30 million. Therefore, we apply the same logic when defining parameters for FRAX as we do for sFRAX.

Supply Cap, Borrow Cap, and Liquidation Bonus

While Chaos Labs’ approach to initial supply caps is set such that the Supply Cap value is at 2x the liquidity available under the Liquidation Penalty price impact, given the relative lack of demand for FRAX in other money markets, we initially propose a more conservative supply cap approach for FRAX and sFRAX of 10M. Should demand scale, thereby leading to hitting the cap, we will reassess and parameterize accordingly.

FRAX Borrow Cap

We recommend FRAX borrow caps be set to 8M. The ensuing parameter changes will result in borrow cap values aligned with the Uoptimal threshold per the 10M supply cap value.

sFRAX Borrow Cap

Much like LSTs, the utilization rate for yield-accruing vault tokens like sFRAX has been low, given the additional borrowing cost on top. Therefore, we have taken a conservative approach toward the sFRAX borrow caps of 1M sFRAX. However, if there is a significant increase in demand and utilization, we will reassess the caps according to the utilization pattern.

Reserve Factor and IR Curve Parameters

For the Reserve Factor and Interest Rate curves, we recommend aligning the parameters with stablecoins on Venus.

sFRAX Oracle Implementation

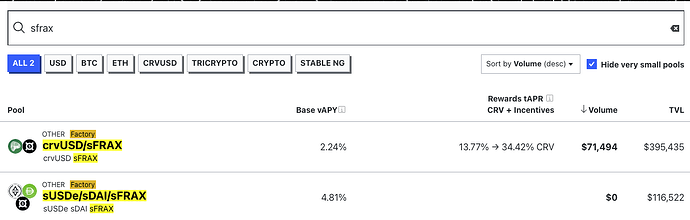

The underlying Oracle implementation should be structured in a way that the sFRAX/FRAX exchange rate and the FRAX/USD Chainlink oracle collectively serve as the aggregate pricing mechanism for the sFRAX market. This is because sFRAX liquidity is incredibly limited, at just 100K, while its underlying value is derived from traditional staked FRAX generating protocol revenue.

Binance Chain:

At present, we do not advise listing FRAX-centric assets on Binance Chain due to the absence of native-chain liquidity. In such a scenario where a liquidation event occurs in a FRAX asset, there may be difficulties in liquidating the position. We will reassess and parameterize accordingly once these assets gain liquidity on Binance Chain.

Recommendations

Following the above analysis, we recommend listing FRAX-ecosystem-related assets with the following parameter settings:

| Asset |

FRAX |

sFRAX |

sfrxETH |

| Pool |

Core Pool |

Core Pool |

LST Pool |

| Collateral Factor |

75% |

75% |

90% |

| Liquidation Threshold |

80% |

80% |

93% |

| Supply Cap |

10,000,000 |

10,000,000 |

10,000 |

| Borrow Cap |

8,000,000 |

1,000,000 |

1,000 |

| Kink |

80% |

80% |

40% |

| Base |

0% |

0% |

0% |

| Multiplier |

15% |

15% |

9% |

| Jump Multiplier |

250% |

250% |

300% |

| Reserve Factor |

10% |

10% |

20% |