Gauntlet Recommendations

In order to fully service Venus and the community, Gauntlet will be expanding our coverage beyond our original agreement to include risk parameter recommendations for isolated pools, effective immediately.

Summary

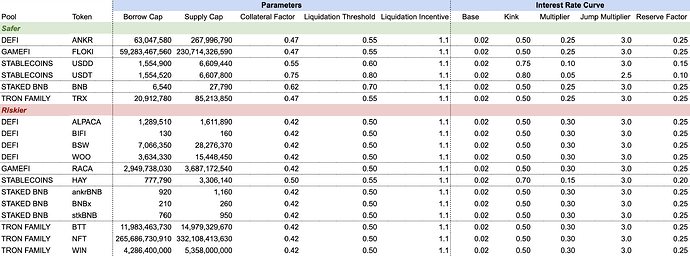

Gauntlet categorizes isolated pool assets into “safer” and “riskier” categories based on existing CEX + DEX market data. Within these categories, we provide a standardized, largely conservative set of parameter recommendations that differ only on the basis of whether that asset is a stablecoin, or whether that asset is already listed in Venus’s core lending pool.

Gauntlet will make recommendations per market for borrow cap, supply cap, collateral factor, and liquidation threshold. We recommend standardized liquidation incentive parameters (10%) for all markets to start. We will also make per-market recommendations for interest rate parameters, which include the interest rate curve’s base, multiplier, jump multiplier, kink, and reserve factor.

Risk Parameter Recommendations

As isolated pools go live on Venus, Gauntlet will analyze user data alongside market dynamics to update these initial parameters to best suit each pool and market within a given pool.

We note that while we currently provide a standard set of recommendations for USDD and USDT, which will be listed in all isolated pools, we will recommend different parameterizations for these assets per pool as user data accumulates and we make ongoing recommendations.